Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

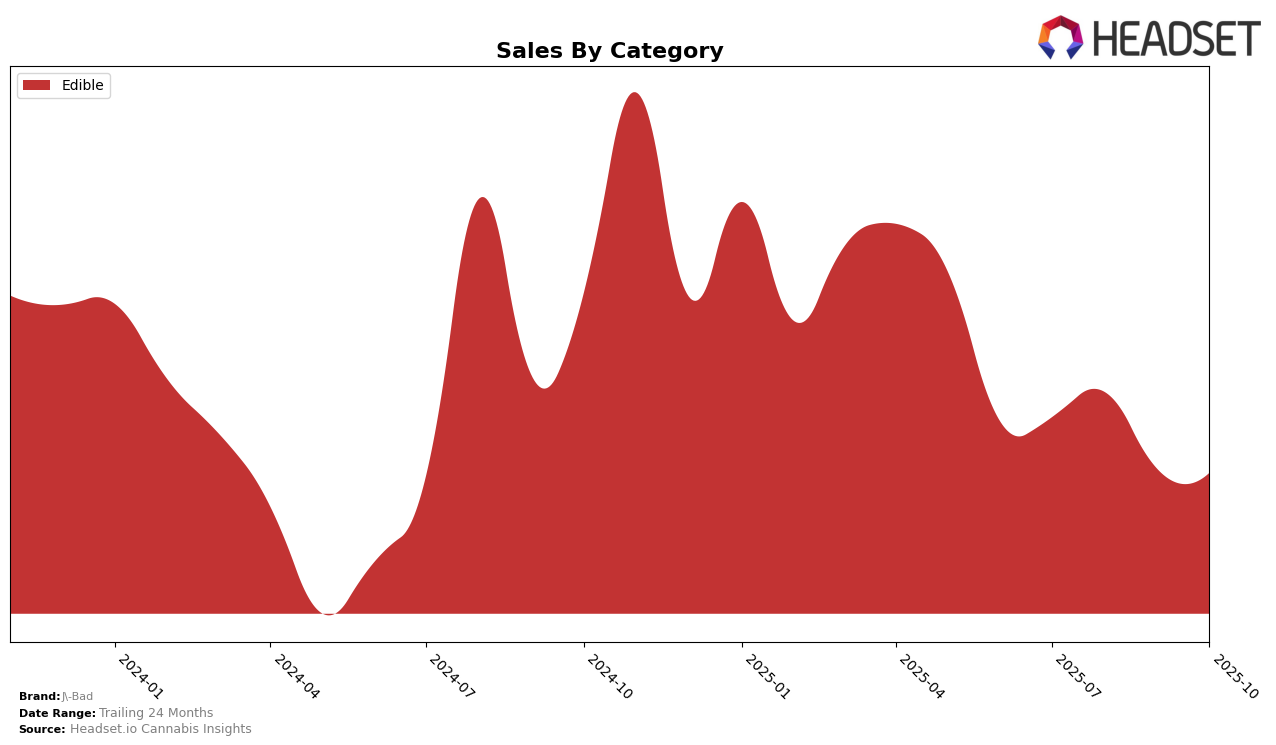

J-Bad has shown interesting performance trends across different states and categories in recent months. In Ohio, J-Bad's presence in the Edible category has been somewhat volatile. The brand managed to secure a spot in the top 30 rankings for July and August, but slipped out of the top 30 in September, only to regain its position at 30th in October. This fluctuation suggests that while J-Bad is holding its ground, there is room for improvement in maintaining a consistent ranking. The sales figures reflect a slight decline from August to October, which might have contributed to the brand's fluctuating rank in the market.

When analyzing J-Bad's performance, it's crucial to note the competitive nature of the Edible category in Ohio. While the brand's recovery to the 30th position in October indicates resilience, the absence from the top 30 in September highlights the challenges faced by J-Bad in maintaining its market presence. This inconsistency could point to seasonal variations or shifts in consumer preferences that the brand needs to address. Observing how J-Bad navigates these challenges in the coming months will be key to understanding its long-term viability and growth potential in Ohio's competitive cannabis market.

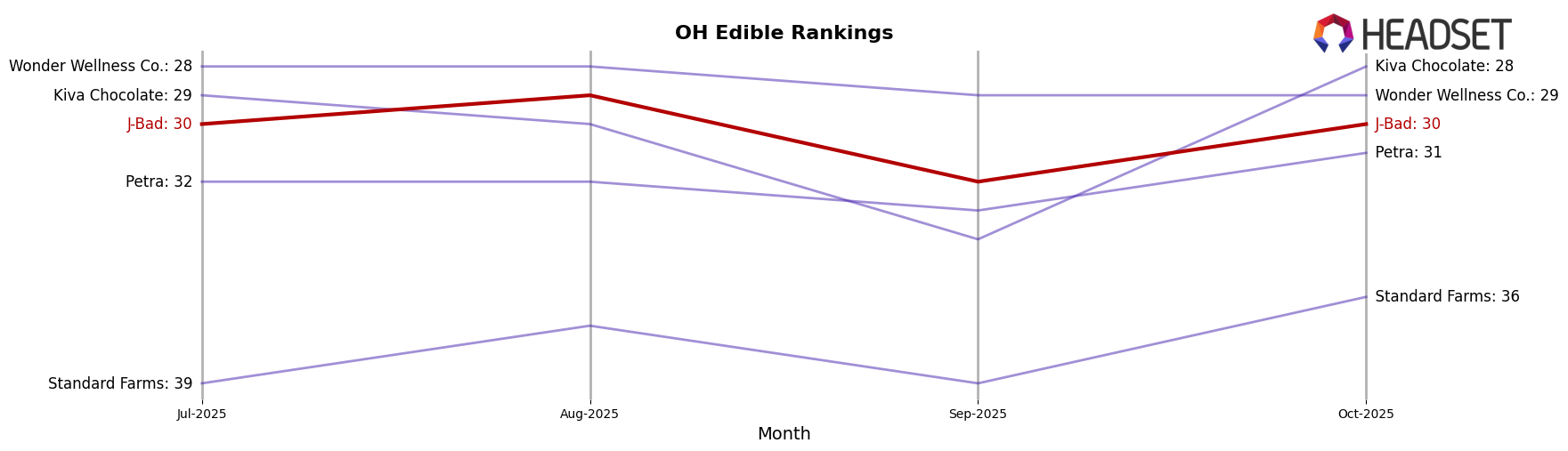

Competitive Landscape

In the competitive landscape of the Edible category in Ohio, J-Bad has shown a relatively stable performance over the months from July to October 2025. J-Bad's rank fluctuated slightly, moving from 30th in July to 29th in August, then dropping to 32nd in September before recovering to 30th in October. This indicates a consistent presence in the top 30, although not without challenges. Notably, Wonder Wellness Co. maintained a steadier rank, consistently outperforming J-Bad by holding the 28th or 29th position throughout this period. Meanwhile, Kiva Chocolate and Petra also demonstrated competitive pressure, with Kiva Chocolate improving its rank to 28th in October, surpassing J-Bad. Despite these challenges, J-Bad's sales figures show resilience, suggesting potential for strategic adjustments to regain higher rankings and increase market share in the Ohio edible market.

Notable Products

In October 2025, the top-performing product from J-Bad was Sour Blue Razz Gummies 4-Pack (100mg) in the Edible category, maintaining its position as the number one ranked product from the previous month, with sales of 276 units. Green Apple Sour Gummies 4-Pack (100mg) followed closely in second place, improving from a third-place ranking in September. The Green Apple Sour Gummies 4-Pack (440mg) secured the third position, moving up from fourth place, while Sour Peach Gummies 16-Pack (440mg) dropped to fourth. Notably, Strawberry Gummies 4-Pack (110mg) entered the rankings for the first time in fifth place. These shifts in rankings highlight a competitive landscape among J-Bad's Edible products, with slight fluctuations observed month over month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.