Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

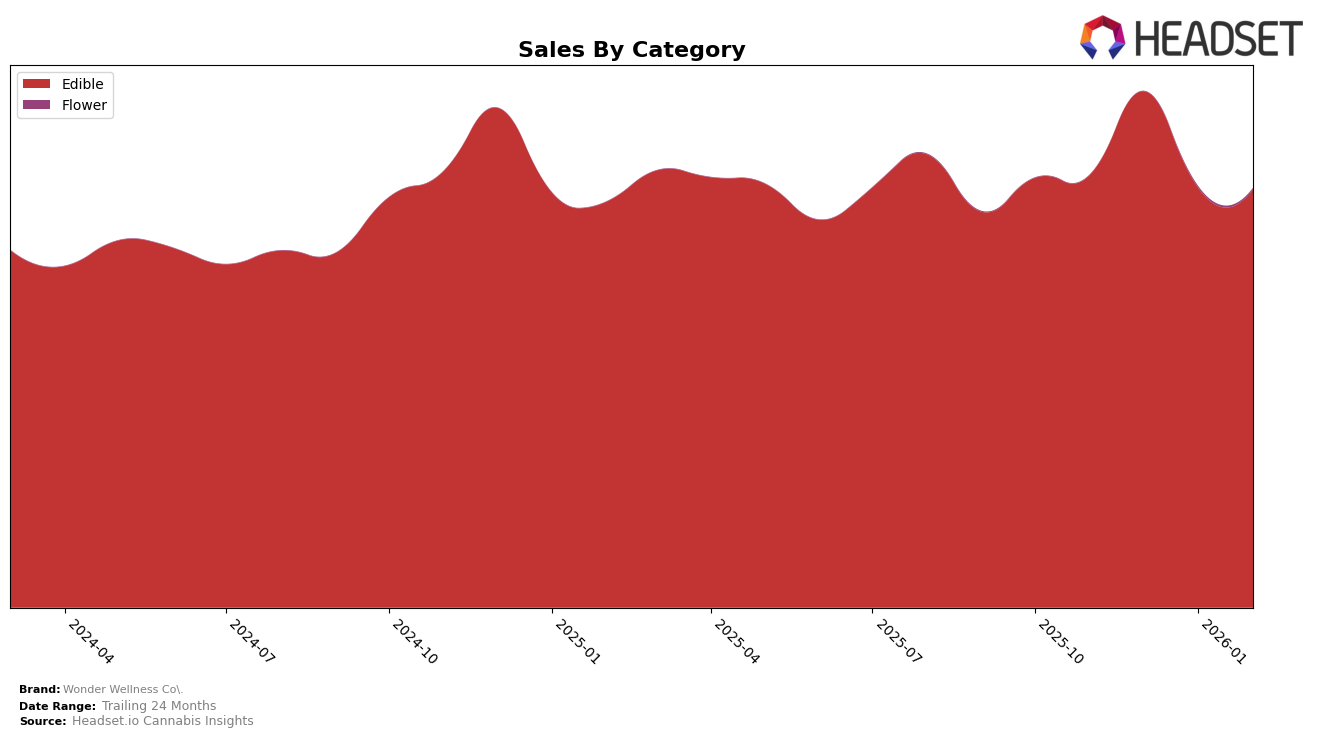

Wonder Wellness Co. has shown varying performance across different states and categories, with notable rankings in the Edible category. In Illinois, the brand maintained a strong presence, consistently ranking within the top 10 over the past four months. Despite a slight dip in January 2026, where they fell to the 8th position, they quickly rebounded to 5th place by February 2026. This recovery suggests a resilient brand strategy in Illinois, likely supported by a loyal customer base. On the other hand, in Michigan, Wonder Wellness Co. struggled to break into the top 30, with rankings fluctuating between 34th and 46th place, indicating a competitive market environment or potential challenges in brand penetration.

In Ohio, Wonder Wellness Co. managed to secure a consistent presence within the top 30, maintaining a steady 28th rank in three out of the four months. This stability, despite not being in the top tier, suggests a steady consumer demand that could be leveraged for gradual growth. The brand's sales figures in Ohio, while modest, reflect a consistent demand pattern, which might serve as a foundation for future strategic initiatives. The varied performance across states highlights the importance of localized strategies to cater to distinct market dynamics, which could be pivotal for Wonder Wellness Co.'s future growth trajectory across different regions.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Illinois, Wonder Wellness Co. has shown notable fluctuations in its rank and sales performance. From November 2025 to February 2026, Wonder Wellness Co. experienced a dip in rank from 6th to 8th in January, before improving to 5th in February. This recovery indicates a resilience in market positioning despite competitive pressures. In contrast, Incredibles consistently maintained a top position, ranking 1st or 2nd throughout the period, which suggests a strong brand presence and customer loyalty. Meanwhile, Lost Farm closely competed with Wonder Wellness Co., holding a steady 5th rank until February when it slipped to 6th, allowing Wonder Wellness Co. to surpass it. Additionally, Gron / Grön maintained a stable 4th position, indicating steady sales performance. This competitive environment highlights the dynamic nature of the market, where Wonder Wellness Co. must continue to innovate and engage consumers to improve its standing against strong competitors.

Notable Products

In February 2026, the top-performing product from Wonder Wellness Co. was the Sleep - THC/CBD/CBN 1:1:1 Plum & Chamomile Gummies 20-Pack, maintaining its number one rank consistently since November 2025, though its sales slightly decreased to 9026 units. Following closely, the Laugh - Tumeric x Tangerine Gummies 20-Pack held the second position with steady rankings over the months, albeit experiencing a gradual decline in sales. The Relax - CBD/THC 2:1 Blueberry & Lemon Balm Gummies 20-Pack remained in third place, with its sales figures also showing a downward trend. The Focus - CBG/THC 1:1 Prickly Pear Gummies 20-Pack consistently retained the fourth spot, with a similar sales pattern as the other top products. Finally, the Laugh - Tumeric x Tangerine Mints 40-Pack completed the top five, maintaining its rank without any changes across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.