Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

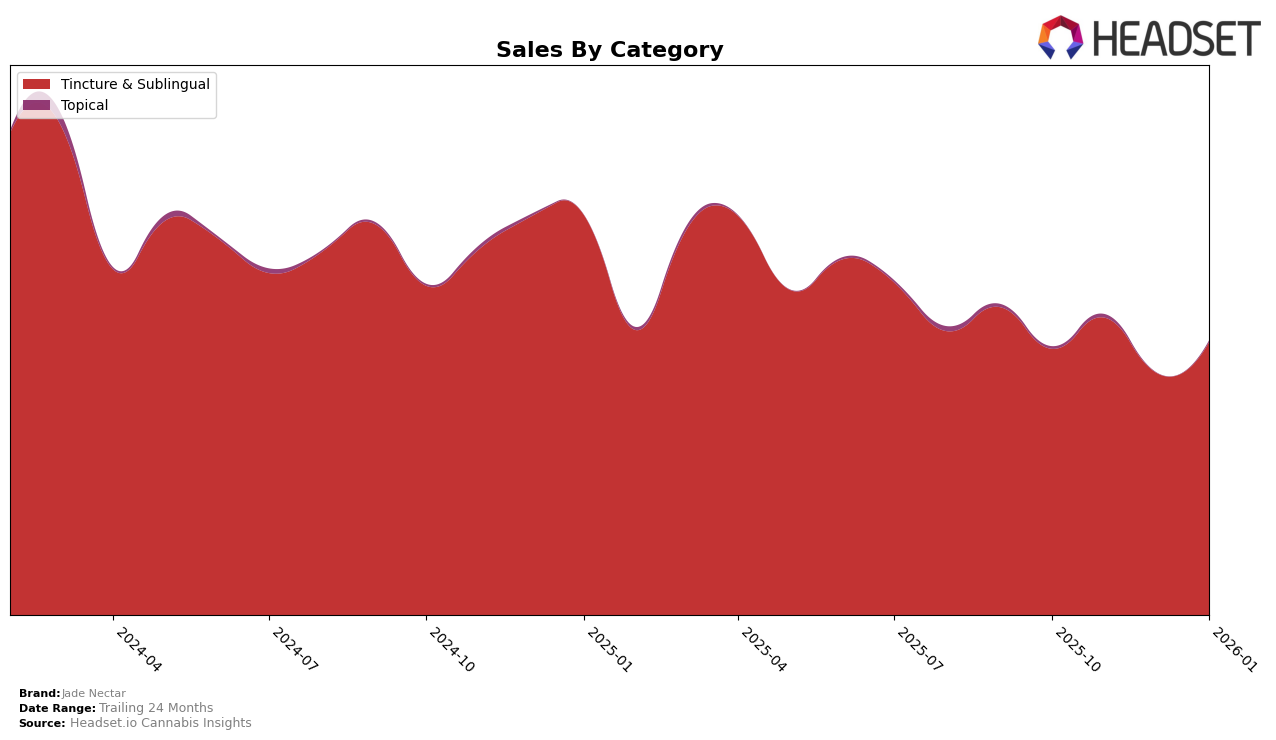

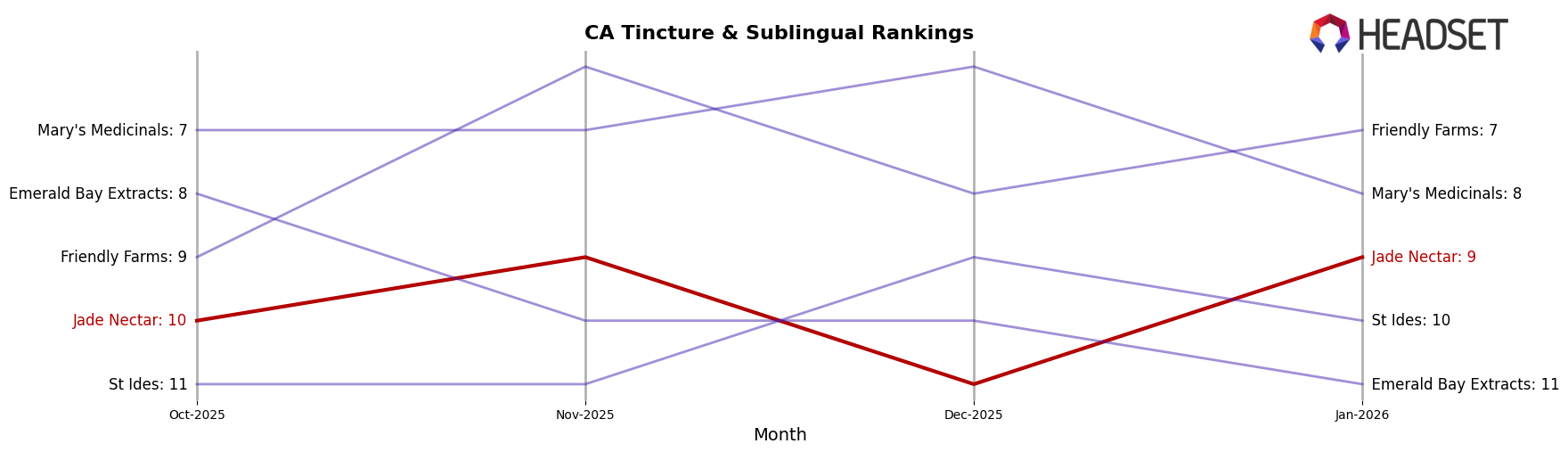

Jade Nectar has shown a consistent performance in the California market within the Tincture & Sublingual category. Over the four-month period from October 2025 to January 2026, Jade Nectar maintained a steady presence, ranking within the top 15 brands each month. Notably, the brand improved its position from 10th in October to 9th in November, although it briefly slipped to 11th in December before regaining the 9th spot in January. This fluctuation indicates a relatively stable demand for Jade Nectar's products in California, with a slight dip during the holiday season. The brand's sales figures reflect this trend, with a peak in November, suggesting a successful marketing or promotional strategy during that month.

While Jade Nectar has secured a solid position in the California market, its absence from the top 30 rankings in other states or provinces could be seen as a potential area for growth or concern. The data does not indicate presence in any other regions, which might suggest that Jade Nectar is either focusing its efforts solely on California or has yet to penetrate other markets effectively. This could be an opportunity for the brand to explore expansion strategies or to strengthen its distribution channels outside of California. Understanding the dynamics of other markets and consumer preferences could be key to Jade Nectar's future growth and diversification across different states and categories.

Competitive Landscape

In the competitive landscape of the California Tincture & Sublingual category, Jade Nectar has experienced fluctuating rankings over the past few months, highlighting both challenges and opportunities in its market positioning. From October 2025 to January 2026, Jade Nectar's rank varied from 10th to 9th, with a dip to 11th in December 2025. This fluctuation is notable when compared to competitors like Mary's Medicinals, which consistently maintained a higher rank, peaking at 6th in December, and Friendly Farms, which showed a strong upward trend, moving from 9th to 7th. Despite these challenges, Jade Nectar's sales figures indicate resilience, with a notable recovery in January 2026, suggesting potential for strategic growth. Meanwhile, St Ides and Emerald Bay Extracts also present competitive pressures, with St Ides overtaking Jade Nectar in December. These dynamics underscore the importance for Jade Nectar to leverage advanced data insights to enhance its competitive strategy and capitalize on market opportunities.

Notable Products

In January 2026, the top-performing product from Jade Nectar was the Indica Tincture (450mg), which ascended to the number one rank from its consistent third place in the previous months, achieving sales of 591 units. The Indica Sativa High Potency Blend Tincture (1000mg THC, 30ml) maintained its second-place position, showcasing stable performance. The Sativa Tincture Drops (1000mg THC, 30ml) made a notable comeback, climbing to third place from fifth, with a significant increase in sales. Meanwhile, the CBD/THC 30:1 CBD Drops (900mg CBD, 30mg THC, 30ml), which had been the top product for three months, dropped to fourth place. Lastly, the CBD/THC 10:1 Sleep Time Gentle Rest Tincture (300mg CBD, 33mg THC, 30ml) held steady in fifth place, showing a slight improvement in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.