Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

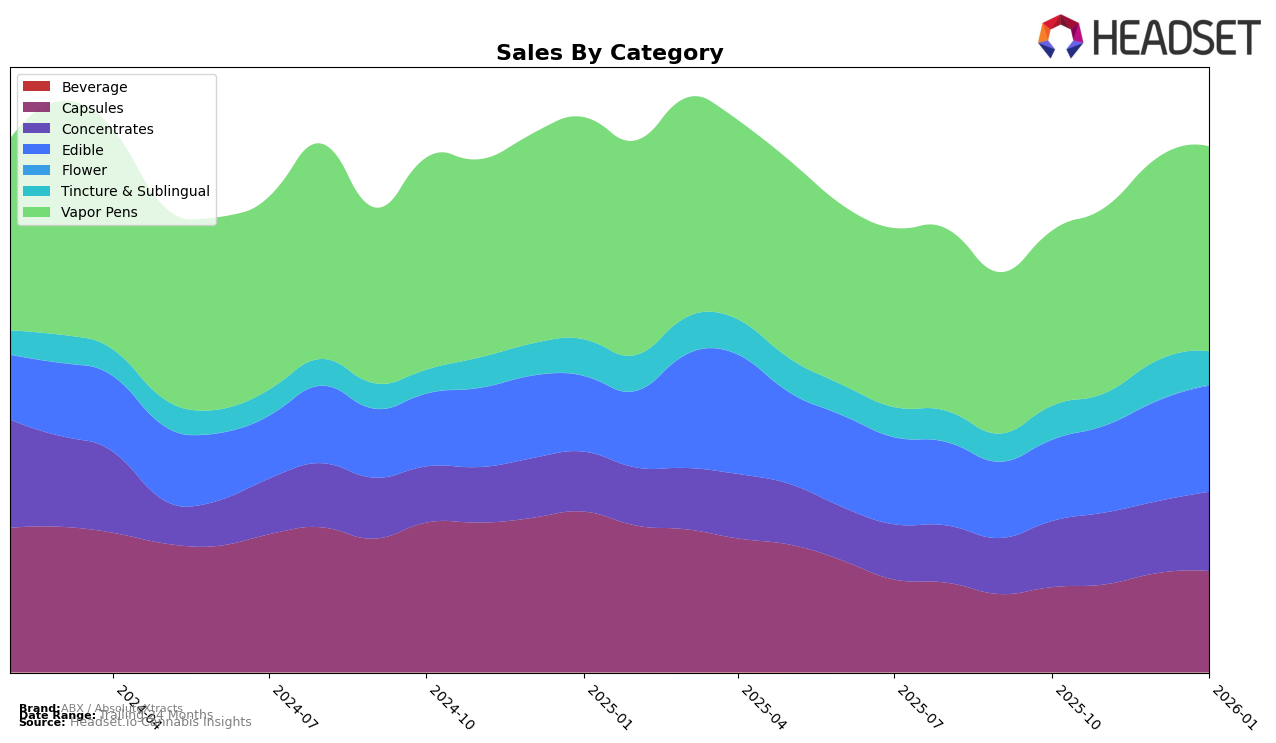

ABX / AbsoluteXtracts has demonstrated a consistent presence in the California market across several product categories. Notably, the brand maintained a solid third-place ranking in the Capsules category from October 2025 through January 2026, with sales showing a positive upward trend during this period. In the Concentrates category, ABX / AbsoluteXtracts improved its position slightly, moving from tenth to ninth place by January 2026, indicating a competitive edge in this segment. Conversely, their performance in the Tincture & Sublingual category remained stable, holding the fifth position consistently, suggesting a steady demand for their products in this category.

In the Edible category, ABX / AbsoluteXtracts showed a notable improvement, climbing from the 16th position in October 2025 to 13th by January 2026, reflecting growing consumer interest and possibly effective product innovation or marketing strategies. The Vapor Pens category also exhibited positive movement, with the brand advancing from 24th to 19th place over the same period. However, it's important to note that ABX / AbsoluteXtracts did not make it into the top 30 rankings in several other states and categories, indicating potential areas for growth or increased competition outside of California.

Competitive Landscape

In the competitive landscape of vapor pens in California, ABX / AbsoluteXtracts has demonstrated a steady improvement in rank from October 2025 to January 2026, moving from 24th to 19th position. This upward trajectory indicates a positive reception and increasing market penetration, contrasting with brands like Flavorade, which experienced a decline from 18th to 21st within the same period. Despite being outperformed by competitors such as Gelato and UP!, which consistently ranked higher, ABX / AbsoluteXtracts has shown resilience and growth, particularly notable in its sales figures which have steadily increased month over month. This suggests a strengthening brand presence and consumer loyalty, positioning ABX / AbsoluteXtracts as a formidable contender in the California vapor pen market.

Notable Products

In January 2026, the top-performing product from ABX / AbsoluteXtracts was the Sleepytime- THC/CBN 2:1 Elderberry Gummies 20-Pack, maintaining its position as the number one ranked product since October 2025, with sales of 9215 units. The Sleepy Time - THC/CBN 2:1 Grape Gummies 20-Pack rose to the second position, surpassing the CBN/THC 2:5 Blueberry Lavender Sleepy Time Gummies, which moved to third place. A new entry, the Forbidden Fruit Terp Chews 20-Pack, debuted at the fourth spot, indicating a strong market entry. Meanwhile, the Maui Wowie Terp Chews remained consistent in the fifth position, showing stable performance over the months. These rankings reflect a strong consumer preference for sleep aid gummies, particularly those with a THC/CBN blend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.