Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

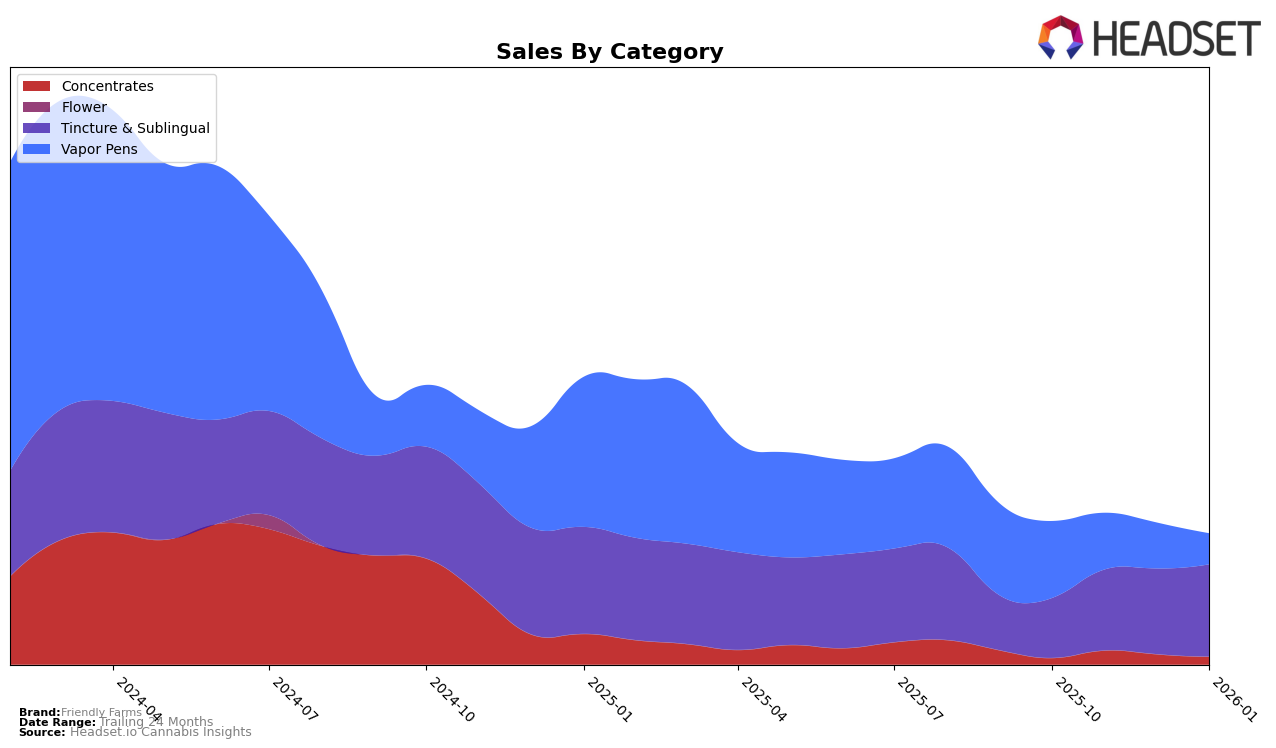

Friendly Farms has exhibited a varied performance across different product categories in California. In the Tincture & Sublingual category, they maintained a strong presence, consistently ranking within the top 10 over the past few months, peaking at 6th place in November 2025. This suggests a robust consumer demand and possibly a strong brand reputation within this category. However, in the Concentrates category, Friendly Farms did not make it into the top 30 brands for the months analyzed, indicating potential challenges in capturing market share or consumer preference in this segment. This absence from the top ranks could be seen as a strategic area for improvement or innovation.

In the Vapor Pens category, Friendly Farms experienced a downward trend, starting from a rank of 71 in October 2025 and eventually dropping out of the top 100 by December 2025. This decline might reflect increased competition or shifts in consumer preferences away from their offerings. The notable decrease in sales from October to December 2025 supports this observation, pointing to possible issues that need to be addressed to regain market position. The fluctuating performance across these categories highlights the dynamic nature of the cannabis market in California, suggesting that brands like Friendly Farms must continuously adapt to stay competitive.

Competitive Landscape

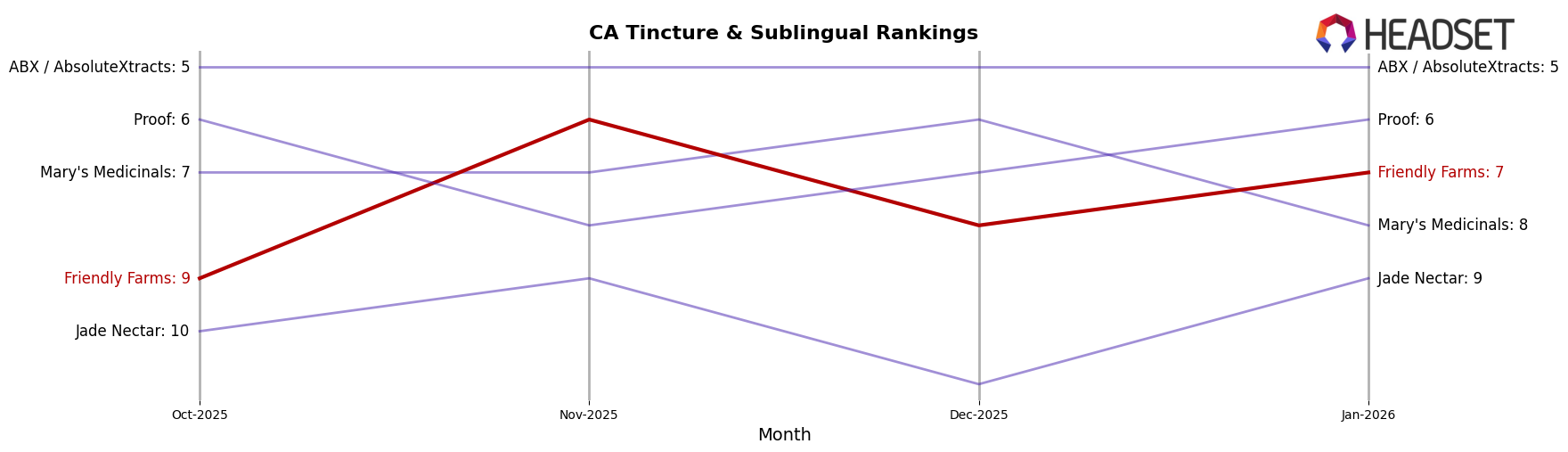

In the competitive landscape of the Tincture & Sublingual category in California, Friendly Farms has shown a dynamic performance from October 2025 to January 2026. Starting at the 9th position in October, Friendly Farms climbed to 6th in November, indicating a significant improvement in market presence. However, the brand experienced a slight dip to 8th in December before stabilizing at 7th in January. This fluctuation suggests a competitive tussle with brands like Proof, which moved from 6th to 8th and back to 6th during the same period. Notably, ABX / AbsoluteXtracts maintained a steady 5th rank, highlighting a consistent market dominance. Meanwhile, Mary's Medicinals showed a similar pattern of rank fluctuation, ending at 8th in January. Despite these challenges, Friendly Farms' sales trajectory is on an upward trend, closing January with a notable increase, suggesting potential for further rank improvement if this momentum continues.

Notable Products

In January 2026, Friendly Farms' top-performing product was God's Gift Full Spectrum Tincture, which climbed to the number one spot with sales reaching 811 units. Blue Dream Full Spectrum Tincture, previously ranked first in November and December 2025, slipped to second place, indicating a slight decrease in its dominance. Jack Herer Full Spectrum Tincture maintained its third-place position from December 2025 to January 2026, showing consistent performance. Maui Wowie Full Spectrum Tincture improved its rank from fifth in November to fourth in January, suggesting a positive trend in sales. Meanwhile, Slurricane Full Spectrum Tincture entered the top five for the first time in January 2026, indicating growing consumer interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.