Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

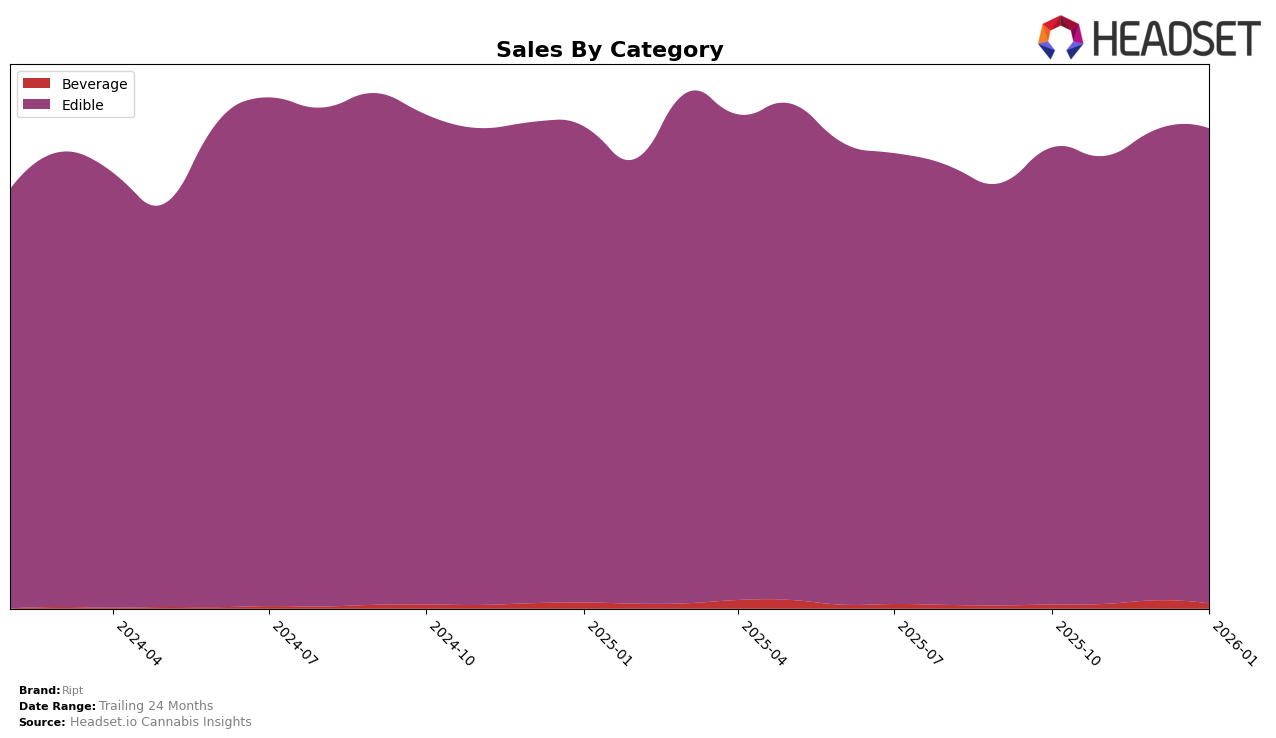

Ript has shown consistent performance in the beverage category within Colorado, maintaining a rank of 4th in both October and November 2025, and slightly dropping to 5th in December 2025 and January 2026. This minor fluctuation in ranking is accompanied by a notable increase in sales from November to December, suggesting a strong consumer response during the holiday season. However, the slight decline in January sales indicates a potential seasonal dip or increased competition. The stability in rankings highlights Ript's strong presence in the beverage market, although the brand's absence from the top 30 in other states suggests room for geographic expansion.

In the edible category, Ript has maintained a consistent 4th place ranking from October 2025 through January 2026 in Colorado. This stability in ranking is supported by a steady increase in sales, particularly from December to January, which could indicate effective marketing strategies or product improvements. The absence of rankings in other states or provinces suggests that while Ript is a strong contender in Colorado, it may not have the same level of brand recognition or market penetration elsewhere. This could present both a challenge and an opportunity for Ript to explore new markets and diversify its geographic presence.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Ript consistently held the 4th rank from October 2025 to January 2026, showcasing a stable position amidst its competitors. Despite this steadiness, Ript faces significant competition from brands like Wana, which maintained a strong lead at the 2nd rank throughout the same period. Meanwhile, Dialed In Gummies also consistently ranked above Ript at 3rd place, indicating a competitive edge in sales performance. Ript's sales figures, although stable, were notably lower than these top competitors, suggesting potential areas for growth and market share expansion. Brands like Good Tide and TasteBudz (CO) remained consistently behind Ript, indicating a solid middle-ground positioning for Ript in this competitive market.

Notable Products

In January 2026, Ript's top-performing product was Blazed Blue Raz Gummies 10-Pack (100mg) in the Edible category, maintaining its first-place ranking from the previous months with sales reaching 28,039 units. Faded Fruit Punch Gummies 10-Pack (100mg) also held steady at second place with a consistent upward trend in sales over the months. Sour Smashed Watermelon Gummies 10-Pack (100mg) continued in third place, showing a notable increase in sales compared to December 2025. Baked Apple Gummies 10-Pack (100mg) remained in fourth place, experiencing a slight dip in sales from the previous month. Pucked Up Peach Gummies 10-Pack (100mg) held its position at fifth, with sales figures indicating a minor decrease from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.