Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

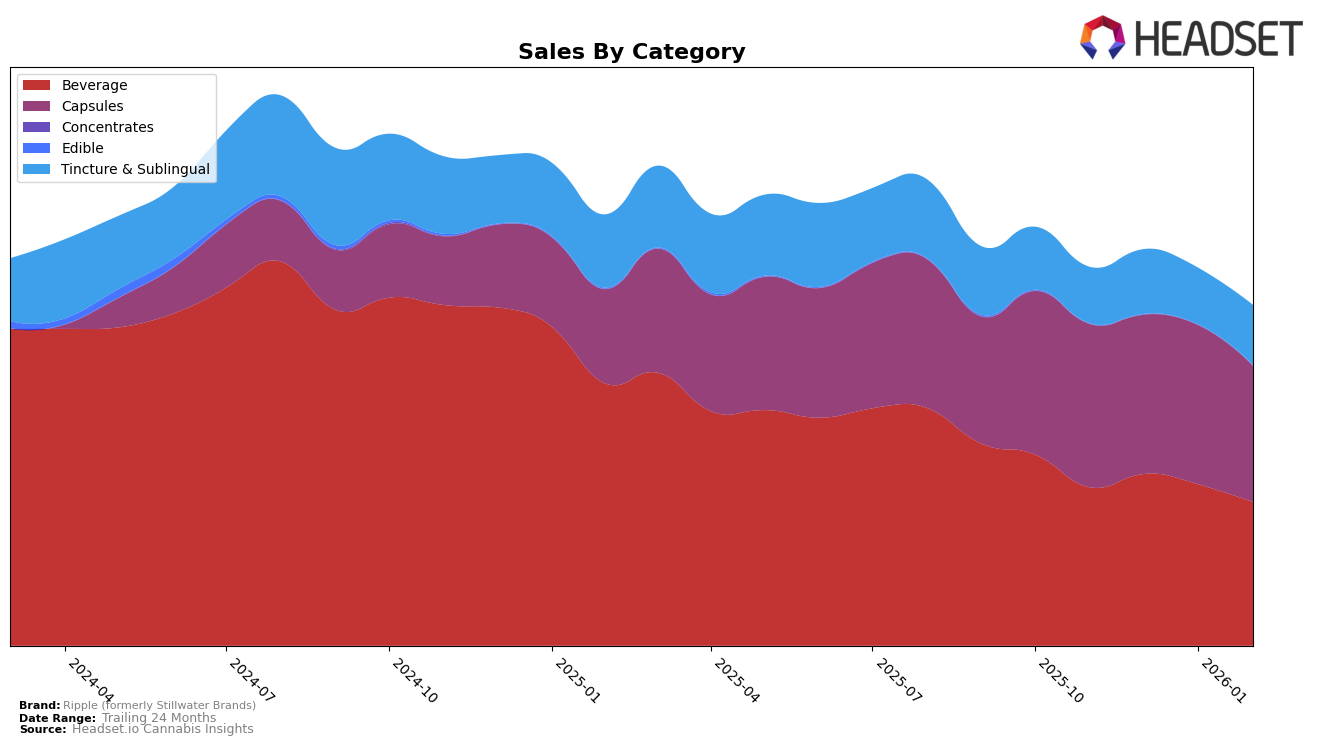

Ripple (formerly Stillwater Brands) has demonstrated a strong presence in the Colorado market, particularly within the Beverage and Capsules categories. In the Beverage category, Ripple maintained a steady rank of 2nd place from November 2025 through January 2026, before slipping to 3rd in February 2026. This slight drop in rank may indicate increased competition or a seasonal shift in consumer preferences. Meanwhile, in the Capsules category, Ripple has consistently held the top spot, showcasing its dominance and consumer loyalty in this segment. The brand's ability to maintain its leadership position in Capsules suggests a robust product offering that resonates well with Colorado consumers.

In the Tincture & Sublingual category, Ripple has also secured the number one rank consistently across the same period, reinforcing its strong foothold in the Colorado market. Despite facing potential challenges such as market saturation or evolving consumer trends, Ripple's unwavering performance in this category highlights its strategic focus and product quality. Notably, the absence of Ripple from the top 30 brands in other states and categories could be seen as a limitation in their market expansion strategy, or it might reflect a targeted approach to dominate specific niches within Colorado. This strategic positioning in select categories and markets might be integral to Ripple's overall brand strategy, focusing on depth rather than breadth.

Competitive Landscape

In the competitive landscape of the beverage category in Colorado, Ripple (formerly Stillwater Brands) has maintained a strong position, consistently ranking second from November 2025 through January 2026, before slipping to third in February 2026. This shift in rank highlights the competitive pressure from brands like Journeyman, which climbed from third to second place in February 2026, indicating a significant upward trend in their sales. Meanwhile, Keef Cola has consistently held the top spot, showcasing its dominance in the market. Ripple's sales have shown a slight decline from January to February 2026, which may have contributed to its drop in rank. This competitive environment underscores the need for Ripple to innovate and strategize effectively to reclaim its position and drive sales growth in the rapidly evolving Colorado beverage market.

Notable Products

For February 2026, Ripple (formerly Stillwater Brands) maintained its position with Pure Fast-Acting Dissolvable Powder 10-Pack (100mg) as the top-performing product in the Beverage category, consistently holding the number one rank since November 2025, with sales reaching 5215 units. QuickStick - Blue Raspberry Dissolvable Powder 10-Pack (100mg) in the Tincture & Sublingual category climbed to the second rank, improving from its third position in January 2026. Riplets - CBD/CBN/CBC/THC 6:1:1:2 Deep Sleep Capsules 20-Pack (300mg CBD, 50mg CBN, 100mg CBC, 100mg THC) experienced a drop to third place, a position it previously held in December 2025. Riplets - CBD/CBG/THCV/THC 4:4:1:2 Max Revive Tablets 20-Pack (200mg CBD, 200mg CBG, 50mg THCV, 100mg THC) re-entered the rankings at fourth place, maintaining its initial position from November 2025. QuickStick - Watermelon Dissolvable Powder 10-Pack (100mg) remained steady in fifth place throughout the observed months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.