Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

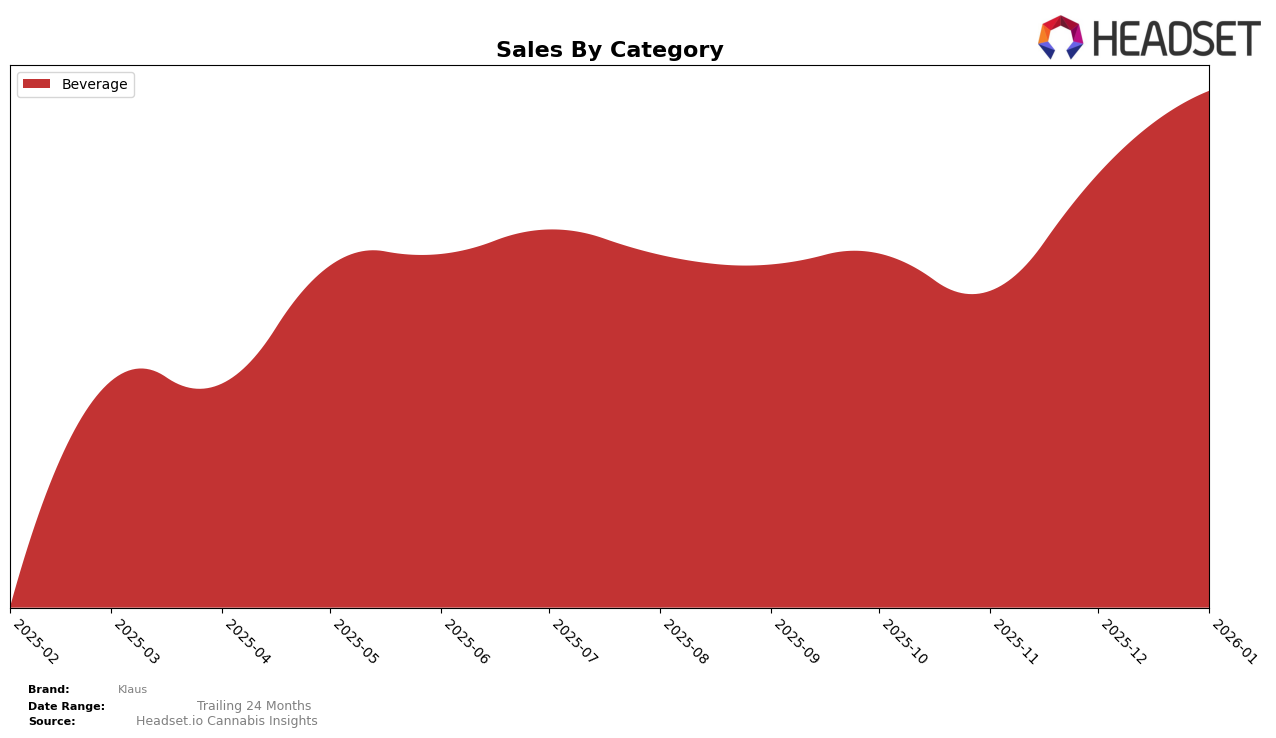

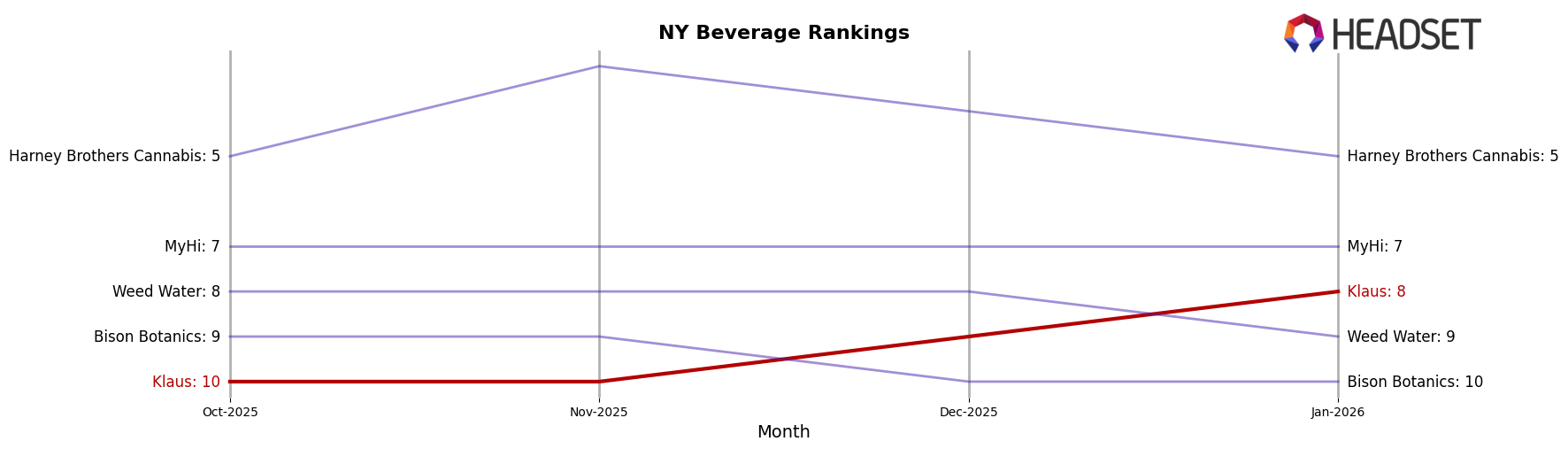

Klaus has shown a consistent upward trajectory in the Beverage category within New York. Starting from a rank of 10 in October 2025, the brand improved its position to rank 8 by January 2026. This movement indicates a strengthening presence in the market, as their ranking improved steadily over the months. The sales figures reflect this positive trend, with a notable increase from October to January, suggesting that Klaus is gaining consumer traction in the state. The brand's ability to climb the ranks in a competitive category highlights its growing appeal and market penetration.

Across other states or categories, Klaus's performance is not detailed, indicating that it may not have reached the top 30 rankings elsewhere during this period. This absence could be interpreted as a potential area for growth or a challenge to overcome in expanding its footprint beyond New York. Understanding the dynamics in these other markets could provide insights into opportunities for Klaus to replicate its success in New York. The brand's focus on the Beverage category in New York appears to be a strategic decision that has paid off, and examining this approach could offer valuable lessons for its expansion strategy.

```Competitive Landscape

In the competitive landscape of the beverage category in New York, Klaus has shown a promising upward trajectory in its rankings from October 2025 to January 2026. Initially ranked 10th, Klaus improved its position to 8th by January 2026, indicating a positive trend in consumer preference and market penetration. This rise in rank is complemented by a steady increase in sales, suggesting effective marketing strategies and growing brand recognition. In contrast, Bison Botanics experienced a slight decline, dropping from 9th to 10th, while Weed Water maintained a relatively stable position, only slipping from 8th to 9th. Meanwhile, Harney Brothers Cannabis consistently outperformed Klaus, holding a top 5 position throughout the period, which underscores the competitive challenge Klaus faces in climbing further up the ranks. The data suggests that while Klaus is making significant strides, it must continue to innovate and differentiate itself to compete with top-tier brands like Harney Brothers Cannabis.

Notable Products

In January 2026, the top-performing product from Klaus was the Mezzrole Mocktail (10mg THC, 12oz, 355ml) in the Beverage category, achieving the number one rank with sales of 2009 units. The 1851 Zombie Mocktail (10mg THC, 12oz, 355ml) followed closely behind, maintaining its second-place position from the previous month. The Bosphorus Mocktail (10mg THC, 12oz, 355ml), which had been the top seller in December 2025, slipped to third place in January. Notably, the Pineapple Express Bosphorus (10mg THC, 12oz, 355ml) remained steady in fourth place, showing consistent performance since its introduction in November. These changes reflect a dynamic shift in consumer preferences, particularly favoring the Mezzrole Mocktail's surge in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.