Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

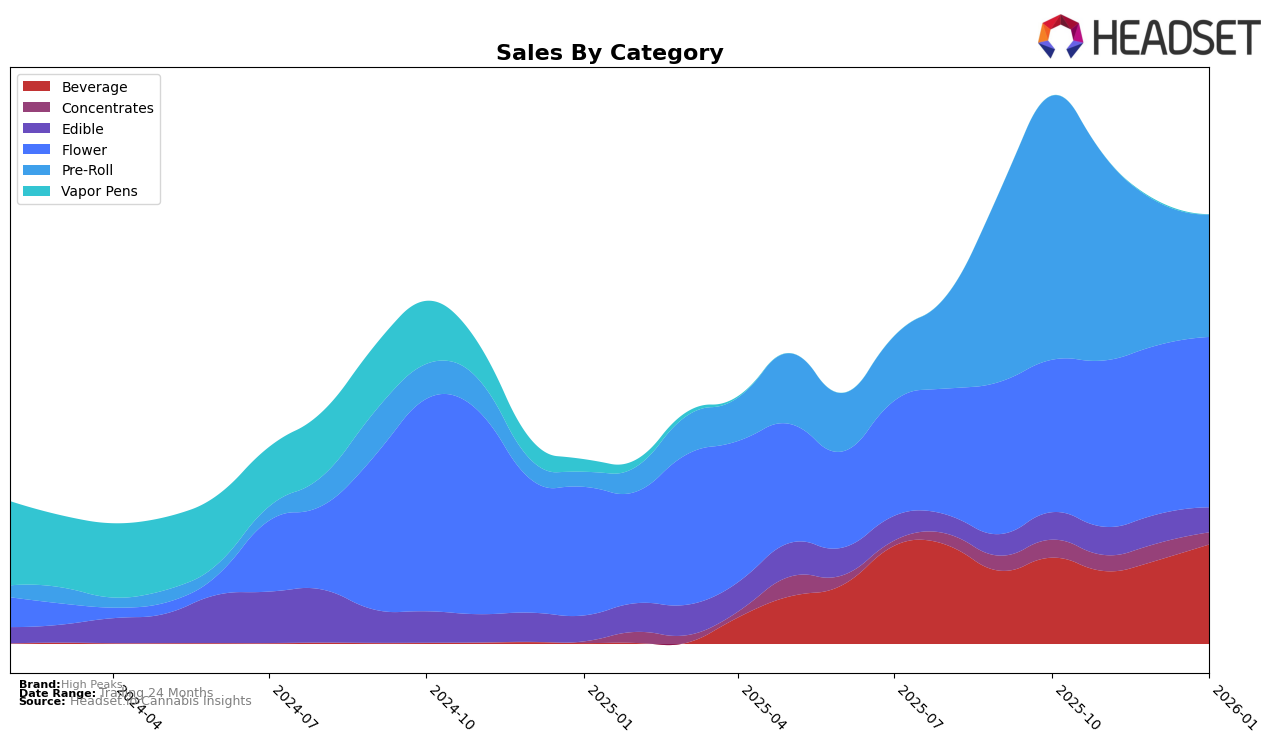

High Peaks has demonstrated notable performance in the New York market, particularly in the Beverage category where it consistently ranks within the top five. From October 2025 to January 2026, the brand maintained a strong presence, oscillating between the fourth and fifth positions. This stability is indicative of a solid consumer base and effective market strategies in this segment. On the other hand, High Peaks' performance in the Concentrates category has been less consistent. The brand fell out of the top 30 in November 2025 and January 2026, highlighting potential challenges or increased competition in this area. This variability suggests that while High Peaks has strengths, there are also opportunities for growth and improvement in certain categories.

In the Edible category, High Peaks has struggled to break into the top 30, with rankings hovering in the 40s over the observed months. This trend indicates potential market saturation or a need for differentiation in their product offerings. Meanwhile, in the Flower category, the brand showed a slight upward trajectory, improving from 58th to 55th before settling back to 58th. Pre-Rolls, however, present a more complex picture; despite starting at a strong 25th position in October 2025, the brand experienced a decline, dropping to 41st by January 2026. This decline might suggest shifting consumer preferences or the emergence of new competitors. Overall, High Peaks' performance across categories in New York reflects both its established strengths and areas where strategic adjustments could enhance its competitive edge.

Competitive Landscape

In the competitive landscape of the New York Flower category, High Peaks has shown a steady performance, maintaining a rank in the mid to high 50s over the last few months. Despite not breaking into the top 50, High Peaks has demonstrated a consistent upward trend in sales, culminating in a slight increase from October 2025 to January 2026. In contrast, Lobo and House of Sacci have experienced fluctuations in their ranks, with Lobo dropping from 45th to 56th and House of Sacci remaining relatively stable but outside the top 50. Meanwhile, urbanXtracts has shown significant improvement, climbing from 76th to 59th, potentially posing a future threat to High Peaks if this trend continues. Golden Garden has seen a decline in rank, suggesting a decrease in competitive pressure from this brand. Overall, High Peaks' consistent sales growth amidst fluctuating competitor ranks highlights its resilience and potential for future advancement in the market.

Notable Products

In January 2026, the top-performing product for High Peaks was the CBD/THC 1:1 Sparkling Strawberry Lemonade (5mg CBD, 5mg THC, 12oz) in the Beverage category, which rose to the number one rank with sales of 7688 units. The CBD/THC 1:2 Frescanna Ruby Grapefruit Sparking Drink (5mg CBD, 10mg THC, 12oz) also saw a notable increase, climbing to the second position. Previously holding the top rank from October to December 2025, the CBD/THC 1:2 Sparkling Strawberry Lemonade (5mg CBD, 10mg THC, 12oz) fell to third place in January 2026. The CBD/THC 1:2 Cherry Cola (5mg CBD, 10mg THC, 12oz), a newer entry, improved its ranking from fifth to fourth. Additionally, the CandyLand Kush Pre-Roll 2-Pack (1.5g) entered the top five for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.