Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

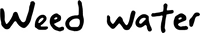

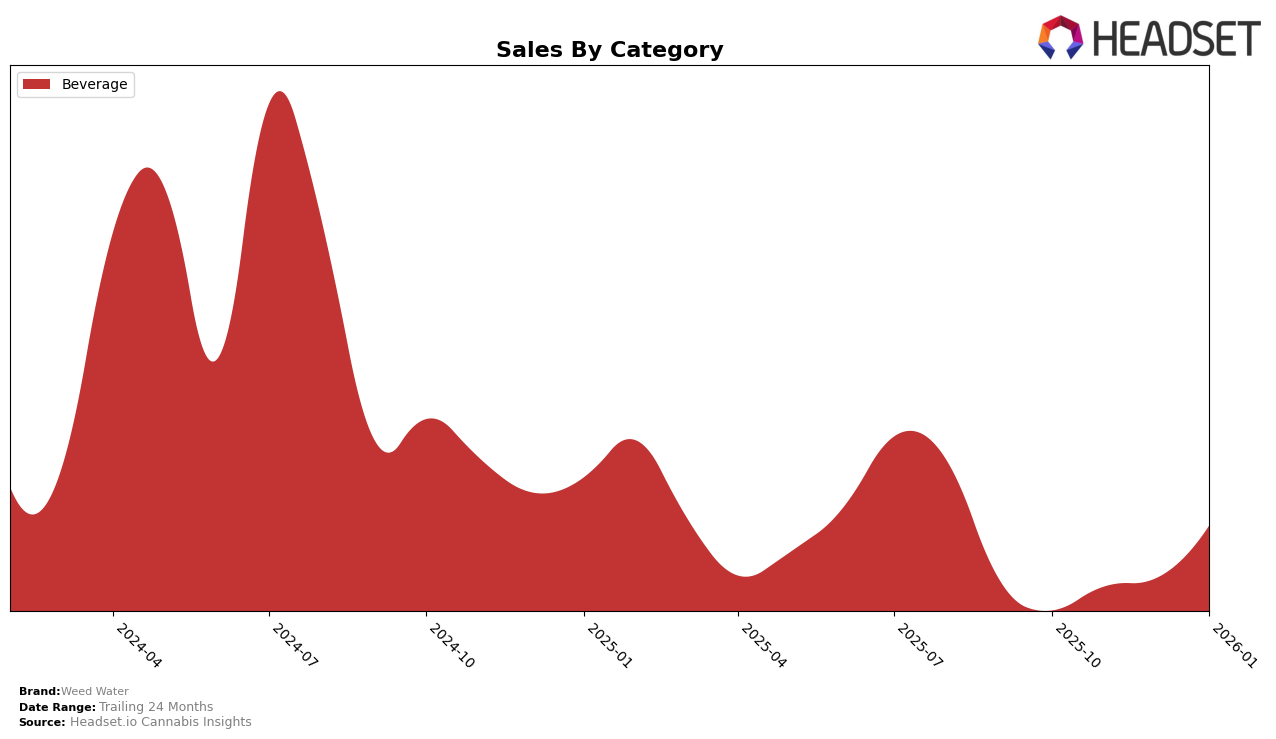

The performance of Weed Water in the Beverage category across various states has shown some interesting trends. In New York, Weed Water consistently maintained a strong presence, ranking 8th from October to December 2025 before slipping slightly to 9th in January 2026. This slight dip in ranking, despite a steady increase in sales from $23,978 in October to $29,827 in January, suggests a competitive market where other brands might be gaining traction. The consistent ranking in the top 10 highlights Weed Water's strong foothold in the New York beverage market, but the drop to 9th place could indicate the need for strategic adjustments to regain or improve its position.

Interestingly, the absence of Weed Water from the top 30 rankings in other states or provinces suggests either a lack of presence or insufficient market penetration in those areas. This could be seen as a potential area for growth if the brand decides to expand its reach beyond New York. The data indicates that while Weed Water has a solid standing in New York, its limited visibility in other markets may present both a challenge and an opportunity for future growth. Understanding the dynamics in other states could be crucial for Weed Water to replicate its success in New York and enhance its overall brand presence.

Competitive Landscape

In the competitive landscape of the beverage category in New York, Weed Water has shown a consistent presence, maintaining a rank of 8th from October to December 2025, before slipping to 9th in January 2026. This slight decline in rank coincides with an increase in sales from $26,203 in December 2025 to $29,827 in January 2026, suggesting that while sales are growing, competitors are also gaining traction. Notably, Klaus improved its rank from 10th in October to 8th by January, surpassing Weed Water, which may indicate a stronger growth trajectory. Meanwhile, MyHi consistently held the 7th position, and Bison Botanics remained stable at 9th and 10th, respectively, suggesting that Weed Water faces stiff competition in maintaining its market position. This analysis highlights the dynamic nature of the market, where even as sales increase, competitive positioning can fluctuate, emphasizing the need for strategic marketing efforts to bolster Weed Water's rank and visibility.

Notable Products

In January 2026, the top-performing product from Weed Water was the CBG/THC 1:1 Yuzu Peach Deez Sparkling Water, maintaining its first-place rank from the previous months with sales reaching 3685 units. The CBD/THC 1:1 Berry Rntz Sparkling Water also held steady at the second position, showing a notable increase in sales to 3189 units. The CBD/THC 1:1 Berry Rntz Sparkling Water 4-Pack improved to the third rank from fourth in December, with sales figures rising to 75 units. The CBD/THC 1:5 Gelato 41 Water, which had been ranked fifth in October, did not have available data for January. Meanwhile, the CBD/THC 1:5 Pineapple Express Water was absent from the rankings in January, after being ranked fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.