Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

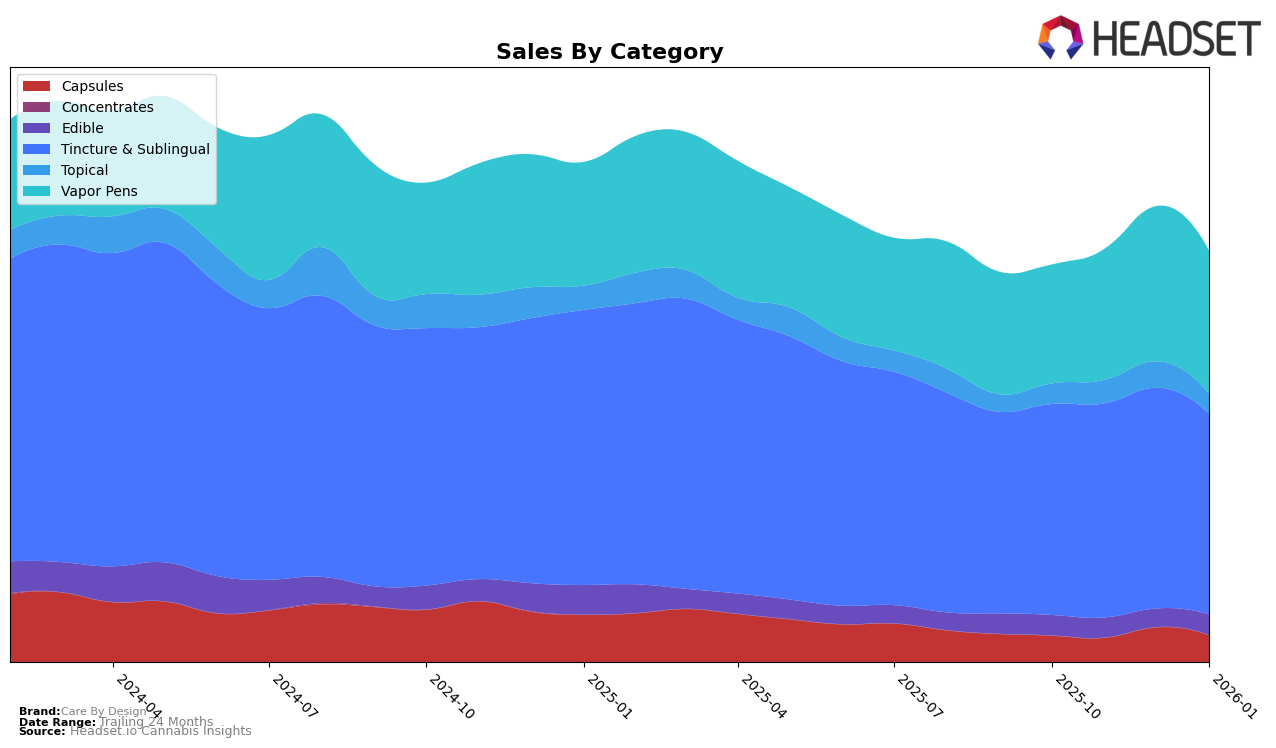

Care By Design has shown notable performance across various product categories in California. In the Tincture & Sublingual category, the brand has consistently maintained a strong position, holding the third rank from October 2025 through January 2026. This stability suggests a well-established presence and consumer loyalty in this category. On the other hand, their performance in the Capsules category has seen some fluctuations, with a slight improvement from the 14th to the 12th rank over the same period, indicating a positive trend. However, the brand's absence from the top 30 in the Edible category during this period highlights a potential area for growth or reevaluation of strategy.

In the Vapor Pens category, Care By Design has demonstrated a steady climb, moving from the 63rd rank in October 2025 to the 54th by January 2026, suggesting increasing consumer interest or effective marketing strategies. Meanwhile, the Topical category has shown consistency, with the brand maintaining the 7th position throughout the four-month period. This consistency could imply a stable market demand or a strong product offering in this segment. Despite the absence of top rankings in some categories, Care By Design's overall performance in California indicates a solid foothold in key areas, with room for growth and potential expansion in others.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Care By Design consistently held the third rank from October 2025 to January 2026. This stable position highlights its strong market presence, although it trails behind Papa & Barkley and Yummi Karma, which maintained the first and second ranks, respectively, during the same period. Notably, Papa & Barkley leads the market with a significant sales advantage, while Yummi Karma also outpaces Care By Design in sales. Despite this, Care By Design's sales figures show a consistent performance, with a slight dip in January 2026, suggesting a need for strategic initiatives to close the gap with its higher-ranked competitors. Meanwhile, VET CBD and ABX / AbsoluteXtracts remain steady at the fourth and fifth ranks, respectively, indicating a competitive but stable market environment.

Notable Products

In January 2026, the top-performing product from Care By Design was the CBD/THC 1:1 MAX Peppermint Full Spectrum Tincture, maintaining its number one rank consistently from October 2025 through January 2026, with a sales figure of 1866. The CBD/THC 1:1 Raspberry Gummies 20-Pack moved up to the second rank, showing a strong performance with a notable increase in sales from December 2025. The CBD/THC 4:1 Medium THC Full Spectrum Cartridge dropped to third place, despite being the second-ranked product for the previous three months. The CBD/THC 1:1 Higher THC Full Spectrum Cartridge held a steady position in the top five, ranking fourth in January. Additionally, the CBD/THC 18:1 Lower THC Full Spectrum Cartridge entered the rankings in fifth place, marking its first appearance in the dataset.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.