Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

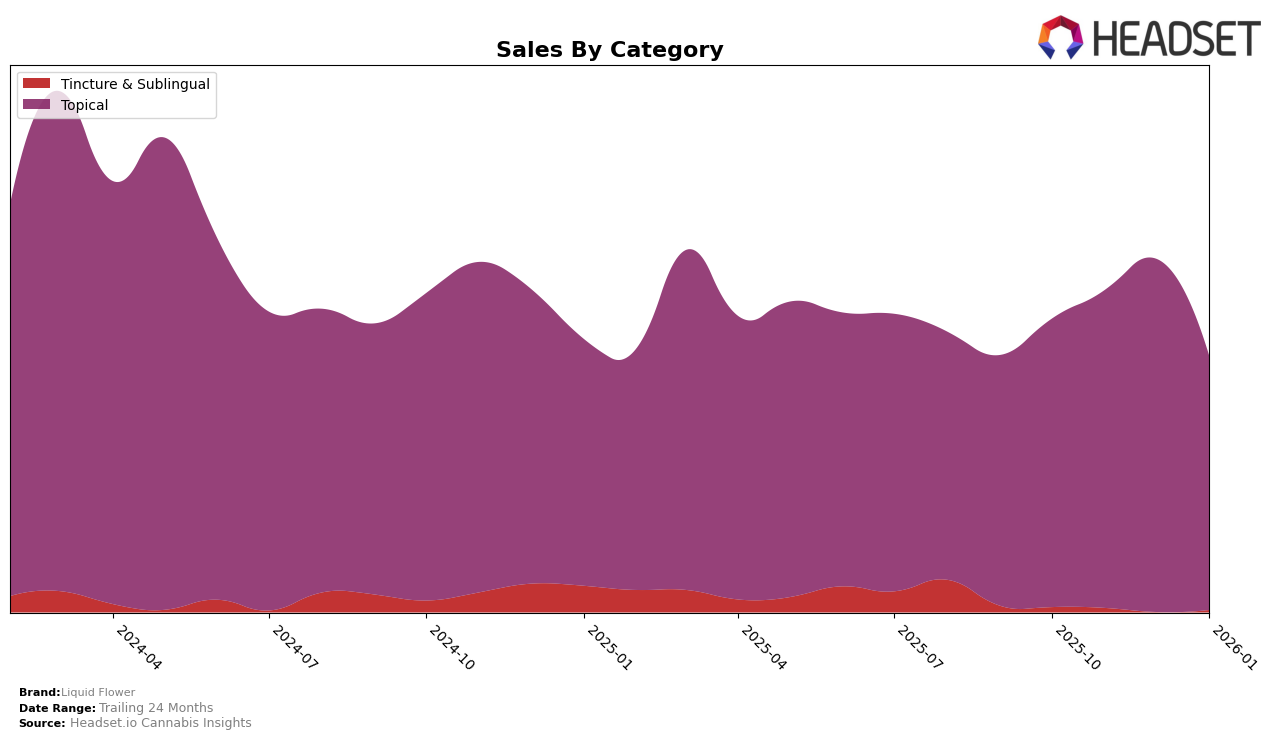

Liquid Flower has shown notable performance in the Topical category across various states, with a consistent presence in the California market. In California, Liquid Flower maintained a strong ranking, starting at 6th place in October 2025 and remaining there into November. By December, the brand improved its position to 4th place, indicating a positive reception and increased consumer interest. However, by January 2026, the brand's ranking slipped back to 6th, suggesting a potential seasonal fluctuation or increased competition. Despite this slight dip, the brand's ability to remain within the top 10 highlights its resilience and popularity in the California market.

Interestingly, Liquid Flower's presence in other states and categories is not mentioned, implying that the brand did not make it into the top 30 in those markets. This could be seen as a challenge for the brand to expand its reach and improve its performance outside of California. The sales figures in California show a peak in December, with sales reaching over $51,000, before decreasing in January. This trend suggests that while the brand is strong in its home state, there is room for growth and strategic expansion into other markets. For a deeper dive into how Liquid Flower can leverage its current standing to explore new opportunities, further analysis would be required.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, Liquid Flower has experienced notable fluctuations in its ranking and sales over the past few months. As of January 2026, Liquid Flower holds the 6th position, a slight decline from its peak at 4th place in December 2025. This fluctuation is significant when compared to competitors like Sweet ReLeaf (CA), which consistently maintained a top 5 position, and Carter's Aromatherapy Designs (C.A.D.), which also showed strong performance by holding steady in the top 5. Despite these changes, Liquid Flower's sales trajectory showed a positive trend in December 2025, indicating a potential for recovery and growth. However, maintaining this momentum is crucial as competitors like Care By Design and Autumn Brands remain consistent in their rankings, posing a continuous challenge in the market.

Notable Products

In January 2026, Liquid Flower's top-performing product was the Deep Relief Balm, which maintained its first-place ranking from October and November 2025, after briefly dropping to second place in December. This product achieved a sales figure of 253 units. The Deep Relief Stick, which had climbed to the top spot in December, ranked second in January, showing a slight decline in sales. The Deep Relief Topical consistently held the third position throughout the months from October 2025 to January 2026. Notably, the CBD/CBC/THC Mineral Bath Soak +Lavender & Chamomile moved up from fifth place in December to fourth in January, matching the rank of the Deep Muscle Relief & Detox Mineral Bath Soak, which has remained steady in fourth place since November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.