Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

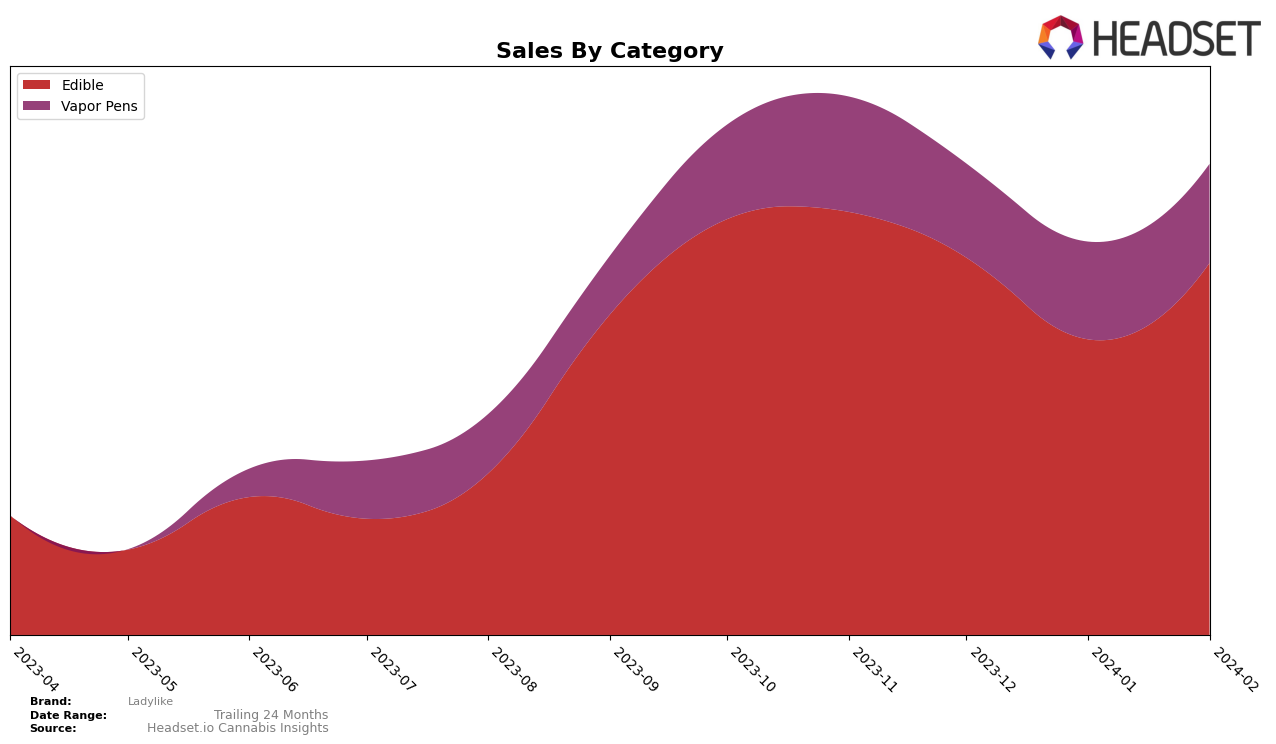

In the competitive cannabis market of Arizona, Ladylike has shown a notable presence in the Edibles category, maintaining its position within the top 30 brands for the months of November and December 2023, with rankings of 26th in both months. However, the brand experienced a slight dip in January 2024, falling just outside the top 30 to rank 31st, before making a comeback in February to rank 29th. This fluctuation indicates a resilient performance amidst tough competition, although the drop in January suggests there's room for improvement. Sales figures reveal a decline from November 2023's $51,707 to January 2024's $36,117, followed by a partial recovery in February 2024 to $45,456, highlighting the brand's capability to regain its footing in the market.

Conversely, Ladylike's journey in the Vapor Pens category tells a different story. Here, the brand struggled to break into the top 50, with its rankings hovering in the 50s and 60s over the four-month period. Starting at 60th in November 2023 and peaking at 50th in January 2024 before slipping back to 57th in February, these rankings indicate a more challenging landscape for Ladylike within this category. Despite these struggles, the slight improvement in January 2024 suggests potential for growth, although the brand's performance remains inconsistent. Sales in this category also saw a fluctuation, with a low in December 2023 at $11,470 and a slight increase thereafter, underscoring the unpredictable nature of the Vapor Pens market for Ladylike in Arizona.

Competitive Landscape

In the competitive landscape of the edible category in Arizona, Ladylike has experienced fluctuations in its market position, indicating a dynamic and challenging environment. Despite a promising start in November 2023, where it ranked 26th, Ladylike saw a slight dip in December, maintaining the same rank but with reduced sales, followed by a further drop to the 31st position in January 2024, indicating a struggle to keep up with competitors. However, a slight recovery was observed in February 2024, improving to the 29th rank. Notably, competitors such as Pucks and Mind Ryte have shown more stability and even improvement in their rankings and sales over the same period, suggesting they are effectively capitalizing on market opportunities that Ladylike might be missing. Specifically, Pucks maintained a stronger presence in the top 30, while Mind Ryte demonstrated significant improvement, moving up in the rankings. This competitive analysis underscores the importance of strategic adjustments for Ladylike to enhance its market position and sales trajectory amidst a fiercely competitive edible market in Arizona.

Notable Products

In February 2024, Ladylike's top-performing product was the Balance CBD:THC 1:1:1:1 Strawberry Grapefruit Gummies 10-Pack (100mg), leading the sales chart with 1537 units sold. Following closely in second place was the Lively - CBD/THC/CBC 2:2:1 Raspberry Lemon Gummies 20-Pack (100mg CBD, 100mg THC, 50mg CBC), marking a notable climb from its previous fourth position in January. The Dreamer - CBD:THC:CBN 2:2:1 Cranberry Blood Orange Gummies 10-Pack (100mg CBD, 100mg THC, 50mg CBN) secured the third spot, despite leading the sales in January, indicating a shift in consumer preference. The CBD/THC 1:1 Peppermint Mints 10-Pack (50mg CBD, 50mg THC) remained consistent, occupying the fourth position for the second consecutive month. Interestingly, the CBD/CBG/THC/CBC Balance 1:1:1:1 Distillate Pod (1g) made it into the top five, a significant leap from not being ranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.