Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

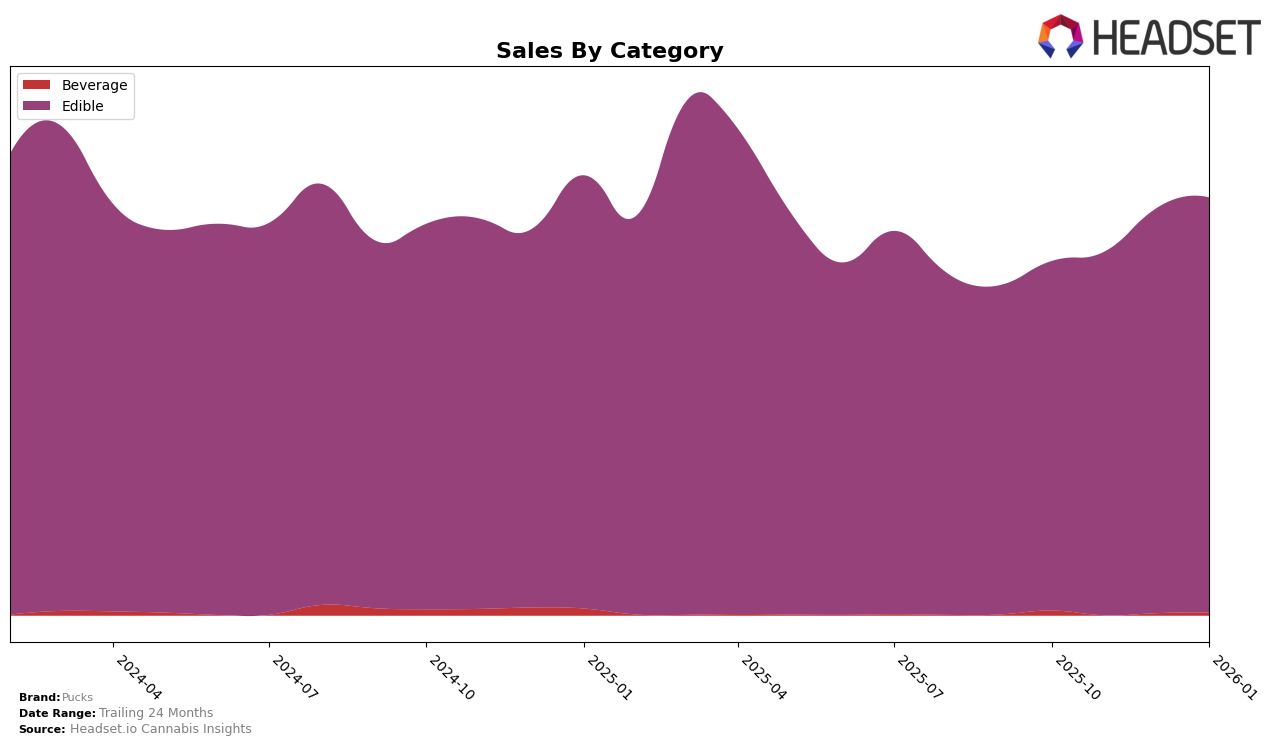

Pucks has shown consistent performance in the Arizona edible market over the last few months. The brand maintained a steady presence, holding the 22nd position in October and November 2025, briefly climbing to the 21st spot in December 2025 before returning to 22nd in January 2026. This stability is noteworthy, especially considering the competitive nature of the edible category. The gradual increase in sales from $80,162 in October to $95,210 in January indicates a positive trend, suggesting that Pucks is gaining traction among consumers in Arizona.

However, it's important to note that Pucks was not ranked among the top 30 brands in any other state or province for the edible category during this period. This absence from other markets could be seen as a limitation in their current market reach. The brand's focus and performance in Arizona suggest a targeted strategy, but there may be opportunities for expansion or increased visibility in other regions. The lack of ranking in additional states could be an area for potential growth, as expanding their footprint could diversify their market presence and potentially enhance overall brand performance.

Competitive Landscape

In the competitive landscape of the edible category in Arizona, Pucks has shown a consistent presence, albeit with challenges in climbing the ranks. Over the past few months, Pucks has maintained a steady position, ranking 22nd in October and November 2025, improving slightly to 21st in December 2025, before returning to 22nd in January 2026. This stability indicates a loyal customer base, but also highlights the need for strategic initiatives to boost its market position. Notably, Mellow Vibes (formerly Head Trip) consistently outperformed Pucks, maintaining a solid 18th rank until slipping to 21st in January 2026, suggesting a potential opportunity for Pucks to capitalize on any market shifts. Meanwhile, Sublime demonstrated upward momentum, moving from 21st to 19th, which could pose a competitive threat if Pucks does not innovate or enhance its offerings. Additionally, Kushy Punch re-entered the top 20 in January 2026, indicating a resurgence that Pucks must be wary of. Overall, while Pucks has shown resilience, the brand must strategize to improve its rank and sales amidst dynamic market movements.

Notable Products

In January 2026, the top-performing product for Pucks was Watermelon Gummies 10-Pack (100mg), which claimed the number one rank, maintaining strong sales with a figure of 1204 units. This product improved from its second position in December 2025. Hybrid Blue Raspberry Gummies 10-Pack (100mg) slipped to the second position despite consistently holding the top spot from October through December 2025. Taffy Banana Dream Candy 10-Pack (100mg) secured the third rank, showing a notable comeback after not being ranked in December. Meanwhile, Watermelon Sorbet Taffy 10-Pack (100mg) consistently held the fourth position, demonstrating stable performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.