Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

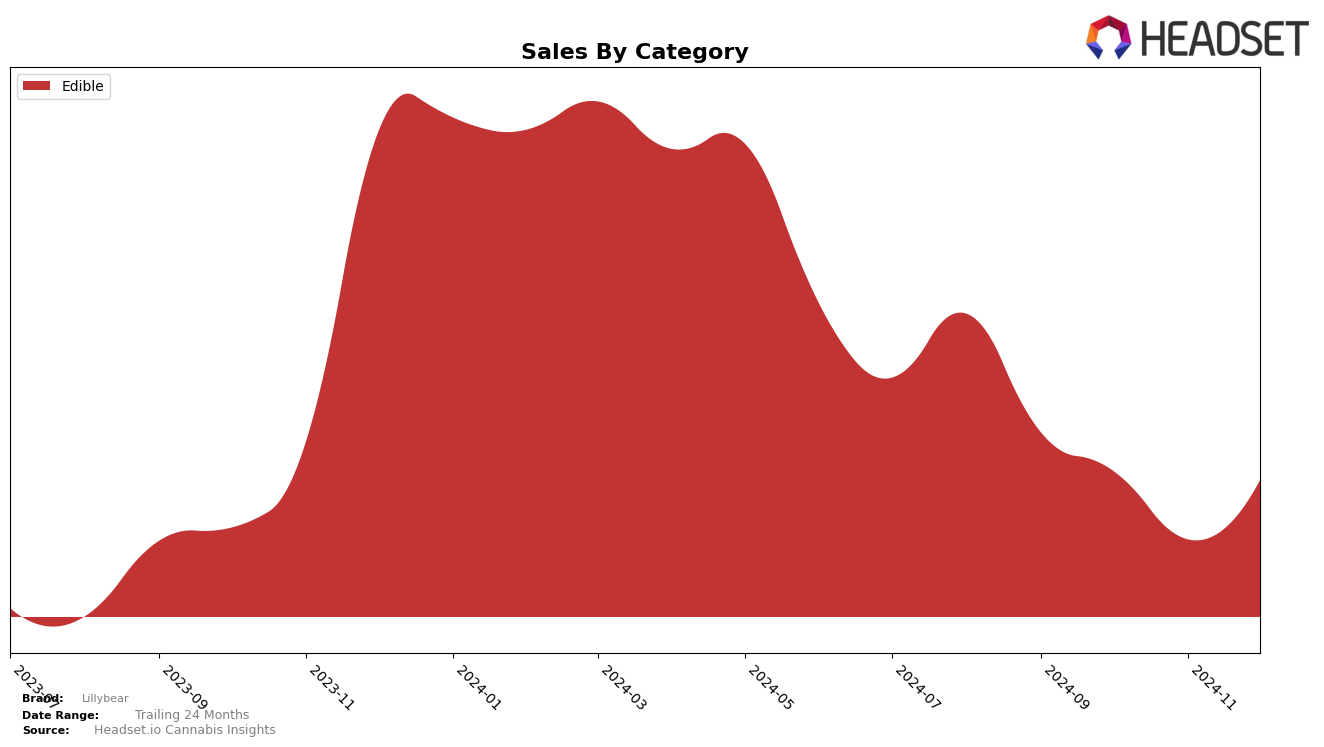

Lillybear has shown fluctuating performance across different categories and states over the last few months. In the Edible category within Maryland, the brand has had an inconsistent ranking, starting at 29th in September 2024, dropping to 30th in October, slipping out of the top 30 in November, and then climbing back to 30th by December. This movement indicates a struggle to maintain a stable position within the competitive landscape of Maryland's edible market. The sales figures reflect this volatility, with a notable dip in November before a recovery in December. Such trends suggest that while Lillybear is managing to stay relevant, there is room for improvement in maintaining a consistent market presence.

The absence of rankings in November for the Edible category in Maryland highlights a critical challenge for Lillybear; dropping out of the top 30 could indicate either a decline in consumer interest or increased competition. This is a significant point for stakeholders to consider, as maintaining visibility in the top rankings is crucial for brand recognition and sales growth. The brand's performance in December, however, suggests a potential rebound, which could be a positive sign heading into the new year. Observing how Lillybear navigates these challenges and opportunities in the coming months will be essential for understanding its long-term trajectory in the market.

```Competitive Landscape

In the Maryland edible cannabis market, Lillybear has faced significant competition, impacting its rank and sales trajectory over the last few months of 2024. Notably, Lillybear's rank fluctuated from 29th in September to 30th in October, dropped to 35th in November, and then improved slightly back to 30th in December. This volatility is contrasted by competitors like Select, which maintained a strong presence, consistently ranking 8th in October, and Grass, which showed a positive trend by climbing from 35th in October to 28th in December. Additionally, Oria displayed a stable performance, hovering around the low 30s throughout the period. Lillybear's sales mirrored its rank instability, experiencing a notable decline from September to November before a slight recovery in December. The brand's challenges in maintaining a competitive edge highlight the dynamic nature of the Maryland edible market, emphasizing the need for strategic adjustments to reclaim and sustain higher market positions.

Notable Products

In December 2024, Lillybear's top-performing product was the Strawberry Freeze Dried Astro Bites 10-Pack (100mg), which rose to the number one spot with impressive sales of 459 units. This product had consistently improved its rank over the months, moving from fourth in September and October to second in November before claiming the top position. The Milk Chocolate Hazelnut Coffee Creamer 10-Pack (100mg) followed closely as the second-best seller, maintaining a strong presence in the top ranks throughout the last few months. Notably, the Vanilla Bean White Chocolate Coffee Creamer 10-Pack (100mg) held steady at the fourth position in December, showing slight fluctuations in its monthly rankings. The Neapolitan Freeze Dried Astro Bites 10-Pack (100mg) re-entered the top five in December, despite being absent from the top ranks in November, highlighting a recovery in its sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.