Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

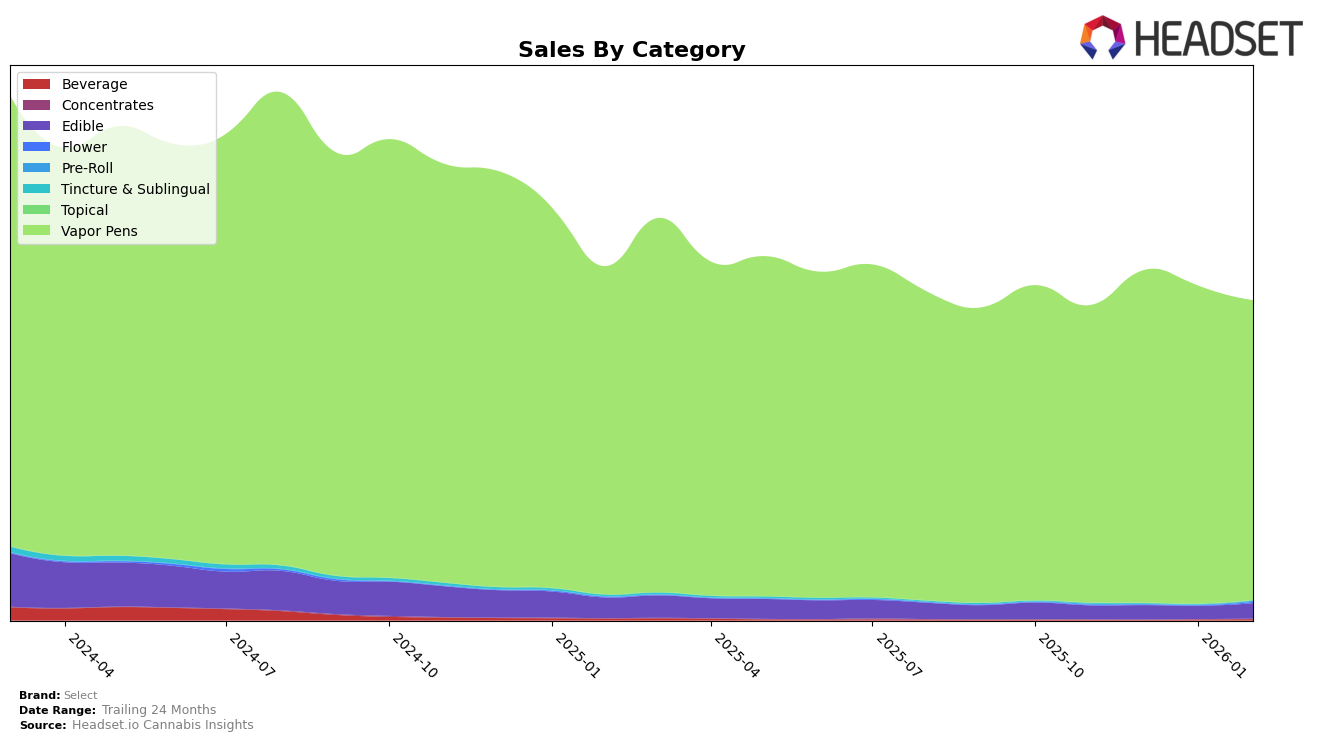

Select has shown a notable performance in the Vapor Pens category across various states. In Arizona, Select maintained a strong presence, consistently holding the second position in January and February 2026, reflecting a positive upward trend from the previous months. Meanwhile, in Connecticut, Select achieved the top rank in January 2026, a significant improvement from the fourth position in November 2025, indicating a growing preference for their products in this market. However, in Missouri, Select's presence was less prominent, with the brand not appearing in the top 30 rankings for January and February 2026, suggesting potential challenges in gaining traction in this market.

In Maryland, Select consistently maintained the number one position throughout the observed months, demonstrating a strong foothold in the Vapor Pens category. Conversely, in New Jersey, the brand experienced a decline, dropping from fifth in January 2026 to ninth in February 2026, which might indicate increased competition or changing consumer preferences. Notably, in Ohio, Select's rank fell from fourth in November 2025 to ninth in February 2026, suggesting a need for strategic adjustments to regain their previous standing in the market. These movements highlight the dynamic nature of the cannabis market and the varying consumer preferences across different states.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Select has demonstrated a strong upward trajectory in recent months. While consistently maintaining a third-place rank in November and December 2025, Select advanced to the second position in January and February 2026, overtaking Dime Industries. This shift indicates a positive trend in Select's market performance, suggesting effective strategies in capturing consumer interest and increasing sales. Despite Mfused holding the top position consistently, Select's steady sales growth and improved ranking highlight its potential to challenge the market leader. Meanwhile, Timeless has shown fluctuations, maintaining a lower rank, which further emphasizes Select's competitive edge in this category.

Notable Products

In February 2026, Select's top-performing product was Guava Melon Infused Pre-Roll (1g) from the Pre-Roll category, maintaining its first-place ranking with notable sales of 17,601 units. Essentials Briq - Pineapple Express BDT Distillate Disposable (2g) from the Vapor Pens category held the second position, a slight drop from its first-place ranking in January 2026. Elite Briq - Blue Dream BDT Distillate Disposable (2g), also from Vapor Pens, slipped to third place after leading in December 2025. Essentials Briq - Clementine BDT Distillate Disposable (2g) emerged in fourth place, showing consistent performance since its entry in January 2026. Lastly, Essentials BRIQ - Mo Wowie BDT Distillate Disposable (2g) rounded out the top five, maintaining a stable ranking since December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.