Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

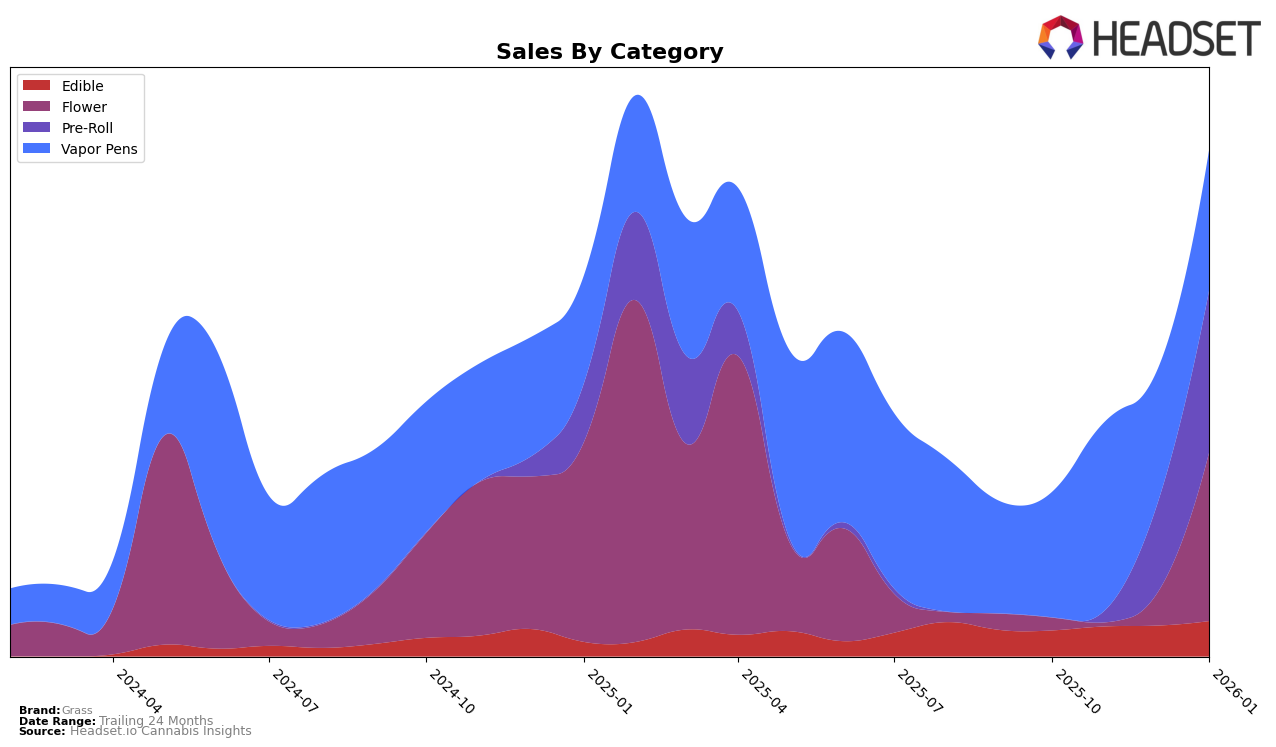

In the state of Maryland, Grass has shown noteworthy progress in several product categories from October 2025 to January 2026. In the Edible category, Grass has consistently improved its ranking, moving from 28th in October to 26th by January, indicating a steady growth in popularity. Their sales figures in this category also reflect an upward trend, with a notable increase from October to January. Meanwhile, in the Flower category, Grass made a significant leap from being unranked in November to 31st by January, suggesting a resurgence or successful new strategy in this segment. However, the initial absence from the top 30 in November could point to challenges that were overcome in subsequent months.

The Pre-Roll category in Maryland has seen a remarkable climb for Grass, with the brand jumping from 47th in November to 15th by January. This rapid ascent highlights a strong consumer response or effective marketing efforts. On the other hand, the Vapor Pens category shows a more fluctuating performance, with Grass peaking at 19th in November before settling at 21st in January. This suggests some volatility or competitive pressure in this segment. Notably, the sales figures in the Vapor Pens category remained relatively stable, indicating a consistent consumer base despite the ranking shifts. These movements across categories and rankings provide a glimpse into Grass's strategic positioning and consumer engagement in the Maryland market.

Competitive Landscape

In the Maryland flower category, Grass has demonstrated a notable upward trajectory in its market presence, particularly evident in its rank progression from October 2025 to January 2026. Initially ranked at 55th in October, Grass was absent from the top 20 in November, but made a significant leap to 48th in December and further improved to 31st by January. This upward trend in rank coincides with a substantial increase in sales, suggesting a successful market penetration strategy. In contrast, competitors like Old Pal and (the) Essence experienced fluctuations, with Old Pal dropping from 22nd to 30th and (the) Essence declining from 19th to 36th over the same period. Meanwhile, 1937 showed a promising rise in January, moving from 41st to 29th. These dynamics highlight Grass's potential to capitalize on its recent momentum, positioning itself as a formidable player in the Maryland flower market.

Notable Products

In January 2026, the top-performing product from Grass was the Strawberry Snoball Pre-Roll 2-Pack (1g), which climbed to the number one rank with a notable sales figure of 7108. Apollo 22 Pre-Roll 5-Pack (2.5g) secured the second position, making its debut in the rankings. Cambridge Valley OG Pre-Roll 5-Pack (2.5g) followed closely in third place, also newly ranked. Baltimore Crush Gummies 10-Pack (100mg) maintained a consistent performance, ranking fourth, a slight improvement from its fifth position in December 2025. The Strawberry Snoball Pre-Roll 5-Pack (2.5g) entered the list at fifth place, completing the lineup of top products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.