Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

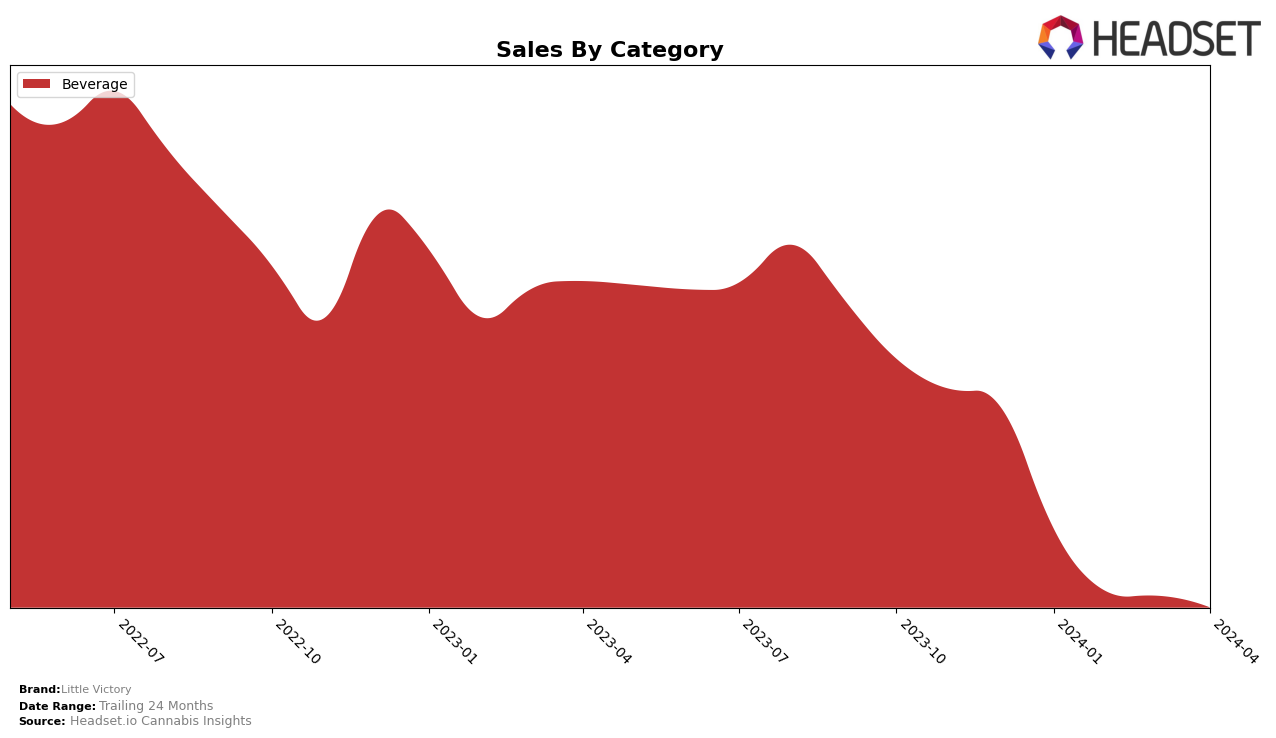

In the competitive cannabis market of Ontario, Little Victory has made a notable appearance within the Beverage category. Starting the year with a ranking of 28th in January 2024, the brand demonstrated its presence among the top 30 cannabis beverage brands, showcasing its initial success with sales amounting to $14,552. However, the absence of rank in the subsequent months up to April 2024 highlights a significant challenge for Little Victory. This drop-off from the ranking list suggests a potential decline in the brand's market penetration or consumer preference within the Ontario market during this period. Such a performance trajectory invites speculation on the brand's strategies and market activities following their initial visibility.

The fluctuation in ranking for Little Victory across the first quarter of 2024 underscores the volatile nature of the cannabis beverage market in Ontario. While the initial ranking in January indicates a strong start to the year, the lack of presence in the top 30 brands from February to April may point towards several factors, including increased competition, changes in consumer trends, or possibly inventory and distribution challenges. This performance is particularly important for stakeholders looking to understand market dynamics and for Little Victory to reassess its market strategies. The brand's journey through these months could serve as a valuable case study on the importance of maintaining momentum and adapting to market demands in the fast-evolving cannabis industry.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Little Victory has faced notable challenges in maintaining its position within the top ranks. As of January 2024, Little Victory was not within the top 20 brands, indicating a competitive setback in a rapidly evolving market. Competitors such as Proper Cannabis Company and Sense & Purpose Beverages have shown a dynamic presence in the rankings from February to April 2024. Proper Cannabis Company, entering the rankings in March and slightly improving by April, alongside Sense & Purpose Beverages making its appearance in April, both indicate a shifting preference among consumers. Although Little Victory had a head start in January with sales, the subsequent months saw it overtaken by these emerging competitors, highlighting the importance of innovation and market responsiveness. This trend suggests that Little Victory needs to reassess its market strategies to regain its competitive edge in Ontario's beverage category.

Notable Products

In April 2024, Little Victory's top-performing product was the CBD;THC 1:1 Peach Sparkling Drink (2.5mg CBD, 2.5mg THC, 355ml), maintaining its number one rank from the previous two months with sales figures reaching 317 units. Following closely behind, the CBD/THC 1:1 Blood Orange Sparkling Beverage (2.5mg CBD, 2.5mg THC, 355 ml) secured the second spot, a position it held consistently since February, showcasing a slight decrease in sales to 299 units. The CBD/THC 1:1 Dark Cherry Sparkling Beverage (2.5mg CBD, 2.5mg THC, 355ml) came in third, dropping one rank from March, with a notable decrease in sales to 173 units. Interestingly, the CBD/THC 1:1 Lime Celtzer (2.5mg CBD, 2.5mg THC, 355ml) and the CBD:THC 1:1 Mixer Celtzer Pack 4-Pack (10mg CBD, 10mg THC) both ranked fourth, with the former making its first appearance in the rankings since January. These rankings indicate a stable consumer preference within the beverage category for Little Victory, with minor shifts in product popularity over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.