Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

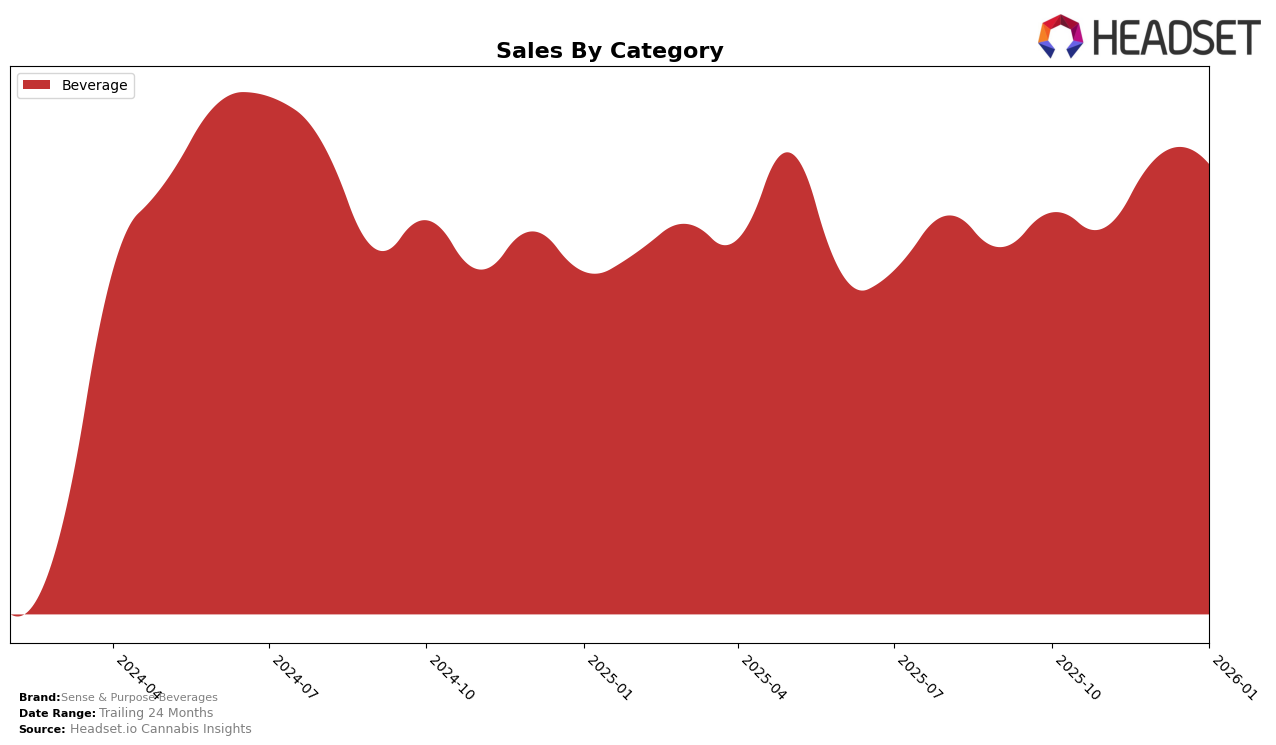

Sense & Purpose Beverages has shown a consistent presence in the Alberta beverage category, maintaining a steady rank of 8th place from October through December 2025, before improving to 7th in January 2026. This upward movement in January suggests a positive reception of their products, possibly due to seasonal demand or successful marketing strategies. The brand's stability in the top 10 highlights its strong foothold in this market, although the slight drop in sales from December to January indicates potential challenges in sustaining momentum.

In Ontario, Sense & Purpose Beverages has made notable progress, climbing from 19th to 15th place between October 2025 and January 2026. This improvement is particularly significant given the competitive nature of Ontario's market. The brand's ability to break into the top 15 suggests a growing consumer base and effective market penetration strategies. However, it's important to note that the brand was not ranked in the top 30 in some other states and categories during this period, indicating areas where they may need to focus on improving their market presence.

Competitive Landscape

In the competitive landscape of cannabis beverages in Alberta, Sense & Purpose Beverages has shown a steady presence, maintaining a consistent rank of 8th from October to December 2025, before climbing to 7th in January 2026. This upward movement indicates a positive trend, especially when compared to Collective Project, which slipped from 6th to 8th place over the same period. Despite Bubble Kush consistently holding the 5th position, Sense & Purpose Beverages has managed to close the sales gap, particularly in December 2025, when its sales surged significantly. Meanwhile, Mary Jones remains a formidable competitor, consistently ranking 4th with significantly higher sales. However, the consistent performance and recent rank improvement of Sense & Purpose Beverages suggest a growing market presence and potential for further advancement in Alberta's cannabis beverage sector.

Notable Products

In January 2026, the top-performing product from Sense & Purpose Beverages was Relax- CBD/THC 1:1 Grapefruit Yuzu Sparkling Water & Juice, maintaining its rank from December 2025 with notable sales of 4,597 units. Recharge - CBD/THC 1:1 Orange, Pineapple & Passionfruit Sparkling Water and Juice held the second position, consistent with its rank in December. Refocus - CBD/THC 10:1 Green Tea Lemonade Ginger Sparkling Beverage remained steady in third place, showing a positive sales trajectory from previous months. Notably, Relax experienced a drop in sales compared to December, while Refocus saw a significant increase. These rankings reflect a stable consumer preference for these top beverages over the last few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.