Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

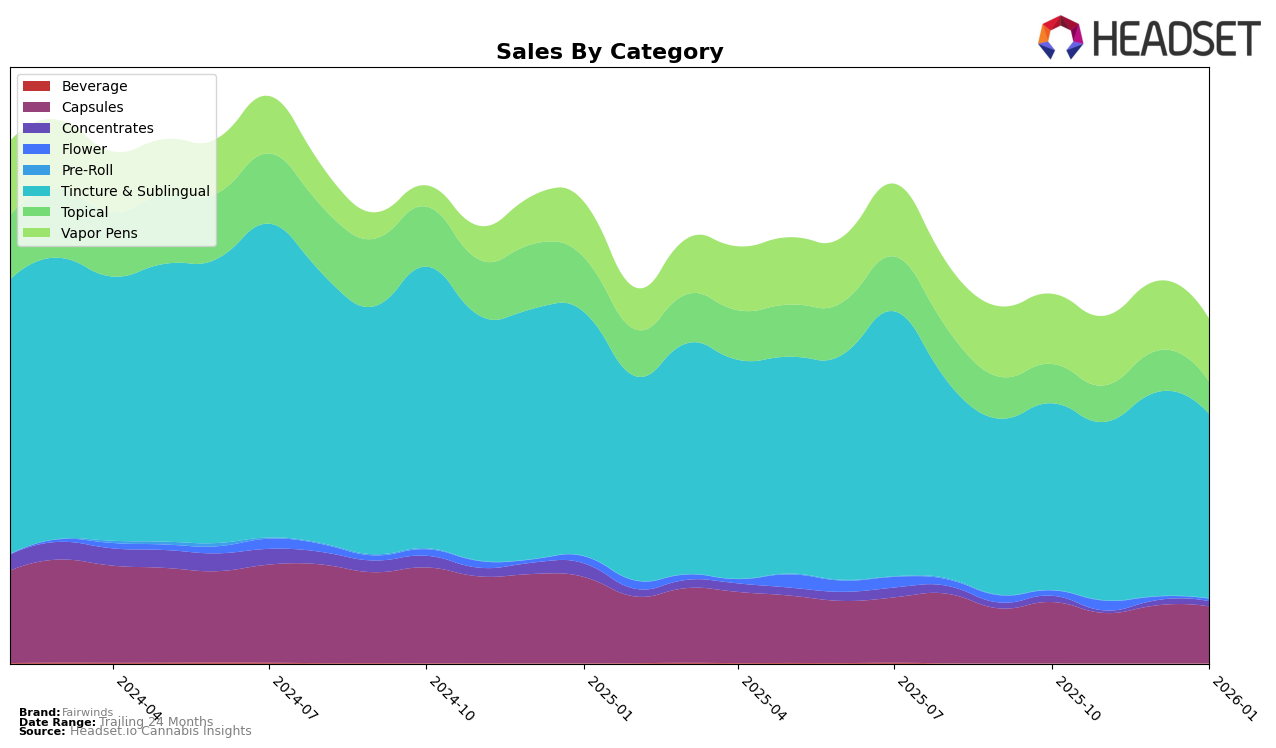

Fairwinds has shown remarkable consistency in the Washington market, particularly in the Capsules and Tincture & Sublingual categories, where they have maintained a steady second-place ranking from October 2025 through January 2026. This stability indicates a strong consumer base and effective product offerings within these categories. However, the Vapor Pens category presents a different story, as Fairwinds has not broken into the top 30, with rankings hovering around the 80s. This suggests a potential area for growth or reevaluation of their strategy in this segment.

In the Topical category, Fairwinds holds a consistent fourth-place position in Washington, indicating a solid foothold but also room for improvement to climb higher in the rankings. The sales figures for this category showed some fluctuation, particularly a notable drop in January 2026, which could be attributed to seasonal factors or increased competition. Overall, while Fairwinds demonstrates strong performance in certain categories, there are areas where they could enhance their market presence and competitive edge.

Competitive Landscape

In the Washington Tincture & Sublingual category, Fairwinds consistently held the second rank from October 2025 to January 2026, demonstrating a stable position in the market. Despite this consistency, Fairwinds trails behind Green Revolution, which maintains the top rank with slightly higher sales figures each month. Fairwinds' sales showed a notable increase in December 2025, but this was not enough to surpass Green Revolution. Meanwhile, HiKu and Ceres remained steady at third and fourth ranks, respectively, with significantly lower sales figures compared to Fairwinds. This competitive landscape highlights Fairwinds' strong market presence but also underscores the challenge of overtaking the leading brand, Green Revolution, in this category.

Notable Products

In January 2026, Fairwinds maintained its top position with the CBD/THC 5:1 Companion Savory Bacon 64x Tincture in the Tincture & Sublingual category, achieving sales of 1160 units. The CBD/CBN/THC 5:5:1 Deep Sleep Tincture also held steady at the second rank, showing a notable increase in sales from December to January. The CBD/THC 5:1 Companion Savory Bacon 32x Tincture continued its consistent performance, securing the third rank for four consecutive months. The CBD/CBG/THC FECO High Potency 20-Pack made a strong comeback in January, reclaiming its fourth position after not being ranked in November and December. Lastly, the CBD/THC/CBN 10:2:10 Deeper Sleep Plus CBN Capsule maintained its fifth position, demonstrating stable sales throughout the winter months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.