Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

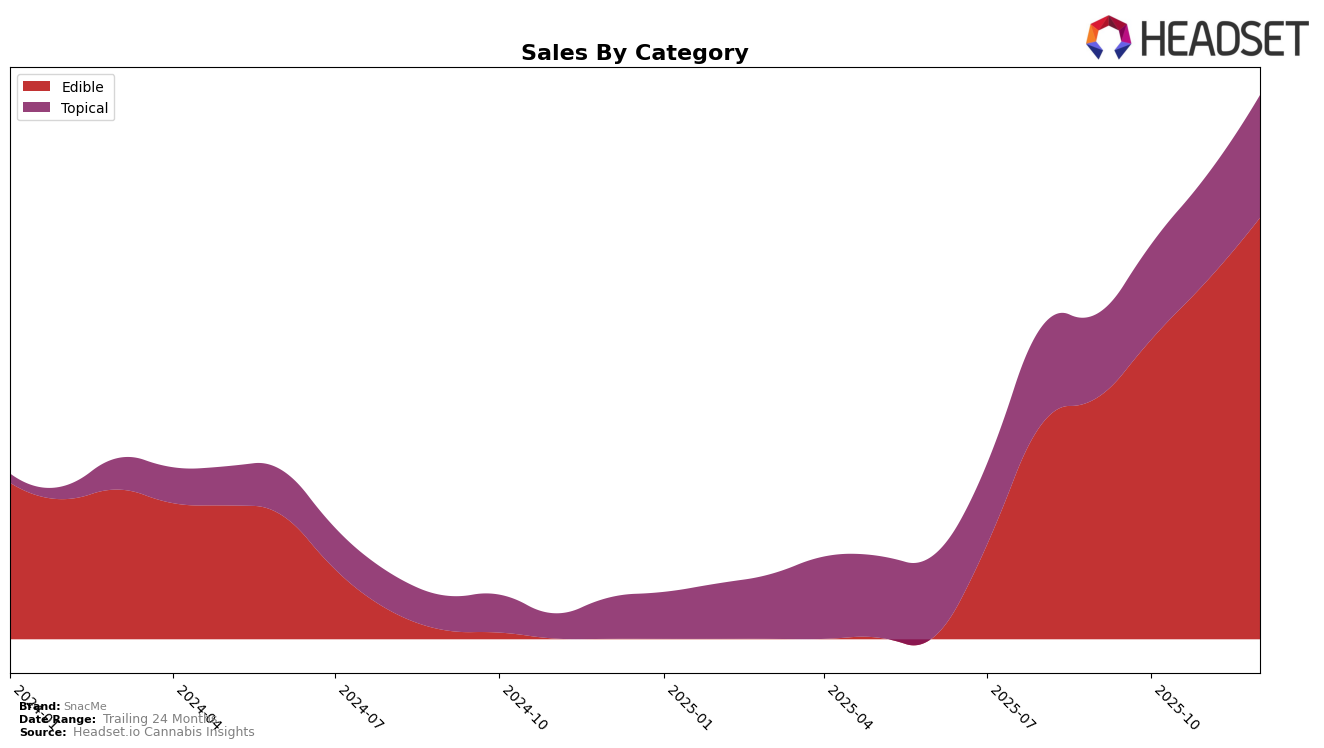

SnacMe's performance in the Washington market showcases a mixed trajectory across different product categories. In the Edible category, SnacMe maintained a consistent ranking of 25th place from September to November 2025, before slipping to 26th in December. This slight dip in ranking contrasts with the steady increase in sales during this period, indicating a competitive market where even sales growth doesn't guarantee a rise in rank. The consistent presence in the top 30, however, suggests a stable foothold in the Edibles market, though there's room for improvement to climb higher in the rankings.

In contrast, SnacMe's performance in the Topical category in Washington demonstrates a more favorable trend. Starting at 6th place in September, the brand managed to climb to 5th in October and maintained this position through November before dropping back to 6th in December. This fluctuation, despite an upward trend in sales, highlights the dynamic nature of the Topical category. The ability to maintain a top 10 position consistently is a positive indicator of SnacMe's strong brand presence and potential growth in this segment, although the slight drop in December suggests there is still competition that could impact future standings.

Competitive Landscape

In the Washington edible cannabis market, SnacMe has demonstrated a steady upward trajectory in sales, although its rank has slightly declined from 25th to 26th place by December 2025. This is noteworthy considering competitors like Kelly's Sweet Hash Edibles have made significant rank improvements, climbing from 32nd to 24th, with a substantial increase in sales. Meanwhile, Goodiez Gummies maintained a higher rank than SnacMe throughout the period, despite fluctuating sales. SnacMe's consistent sales growth, from 39,660 in September to 69,186 in December, suggests a robust market presence, even as Hi-Burst and Koko Gemz remain lower in rank and sales. This indicates that while SnacMe's rank slightly dipped, its sales momentum positions it well against competitors, highlighting potential for further market penetration and brand strengthening.

Notable Products

In December 2025, Blue Watermelon Gummy Bombs 10-Pack (100mg) emerged as the top-performing product for SnacMe, maintaining its leading position from October and experiencing a significant sales increase to 2036 units. Candy Apple Gummy Bombs 10-Pack (100mg) followed closely, securing the second rank, having swapped positions with Blue Watermelon from November. Strawberry Guava Gummy Bombs 10-Pack (100mg) consistently held the third rank throughout the last four months. Huckleberry Gummy Bombs 10-Pack (100mg) improved to fourth place from fifth in November, showing steady growth in sales. Meanwhile, Dragon Berry Gummy Bombs 10-Pack (100mg) remained in fifth place, having briefly climbed to fourth in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.