Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

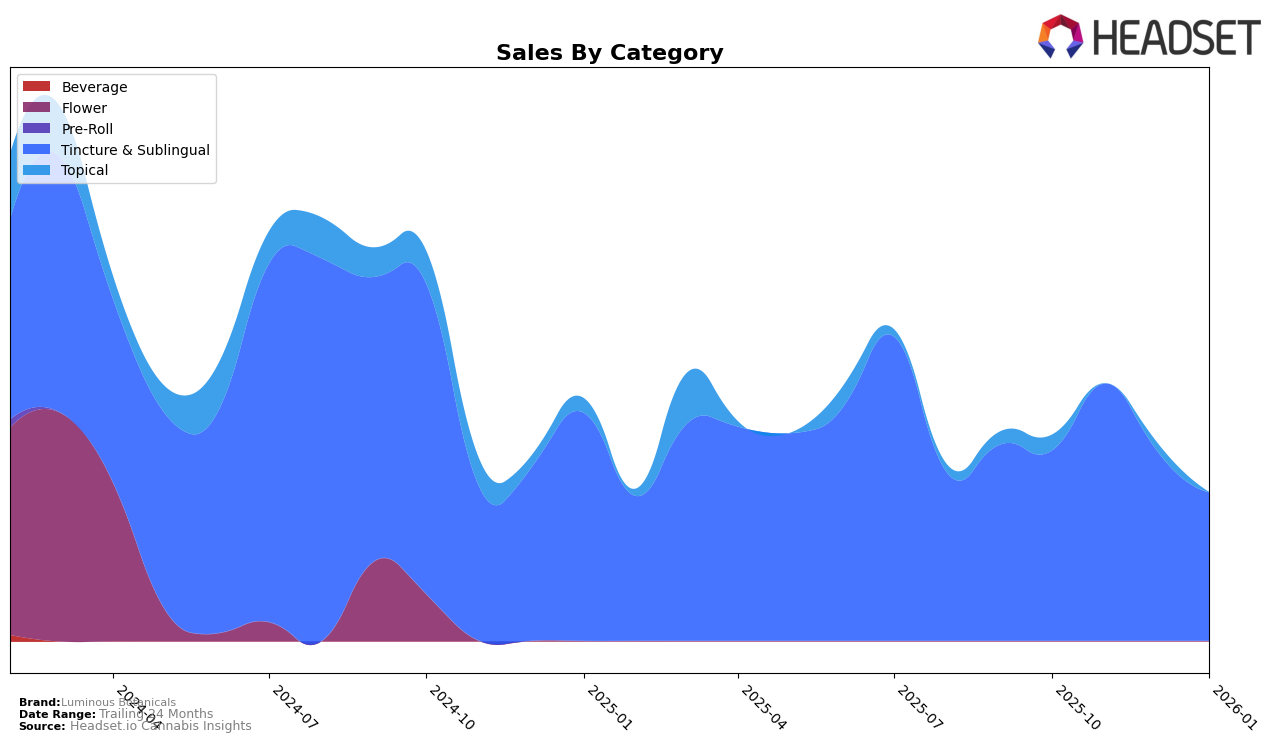

Luminous Botanicals has shown fluctuating performance in the Tincture & Sublingual category in Oregon over the last few months. In October 2025, the brand was ranked 13th, and it improved to 11th in November 2025, indicating a positive trend. However, by December 2025, the brand slipped back to 14th place, showing some volatility in its market position. Notably, Luminous Botanicals did not make it into the top 30 rankings in January 2026, which could be a cause for concern as it suggests a significant drop in visibility and possibly sales within the category during that month.

The sales figures for Luminous Botanicals in Oregon reflect these ranking changes, with a peak in November 2025, suggesting a strong marketing push or seasonal demand. However, the subsequent decline in both rankings and sales by December 2025 signals potential challenges that the brand may need to address to regain its standing. The absence from the top 30 in January 2026 highlights a critical area for strategic focus, as maintaining a consistent presence in the rankings is crucial for sustaining brand visibility and consumer interest in a competitive market like Oregon.

Competitive Landscape

In the competitive landscape of the Oregon Tincture & Sublingual category, Luminous Botanicals has experienced fluctuating rankings, indicating a dynamic market presence. Despite a promising rise to 11th place in November 2025, Luminous Botanicals dropped to 14th by December and was absent from the top 20 in January 2026. This volatility contrasts with competitors like Peak Extracts, which maintained a relatively stable position, ranking between 7th and 11th over the same period. Meanwhile, East Fork Cultivars showed a notable spike in December, climbing to 7th place, before falling to 14th in January. Elysium Fields made a significant entry into the rankings in December at 13th place, suggesting emerging competition. These shifts highlight the competitive pressure on Luminous Botanicals to maintain and improve its market position amidst dynamic competitors.

Notable Products

In January 2026, the top-performing product from Luminous Botanicals was the CBD/THC 1:1 Meadow Blend Tincture (375mg CBD, 375mg THC, 30ml) in the Tincture & Sublingual category, maintaining its first-place rank from November 2025. It achieved notable sales of 84 units. The CBD:THC Sky Blend Tincture (75mg CBD, 675mg THC, 1oz, 30ml) secured the second position, consistent with its previous month's ranking. The CBD:THC Sky Blend Tincture (40mg CBD, 340mg THC, 15ml, 0.5oz) improved to third place from fourth in December 2025. Meanwhile, the CBD/THC 1:1 Meadow Blend Tincture (189mg CBD, 180mg THC, 15ml, 0.5oz) dropped to fourth place, and the CBD/THC 9:1 Earth Blend Tincture (675mg CBD, 75mg THC, 1oz) fell to fifth from the top rank in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.