Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

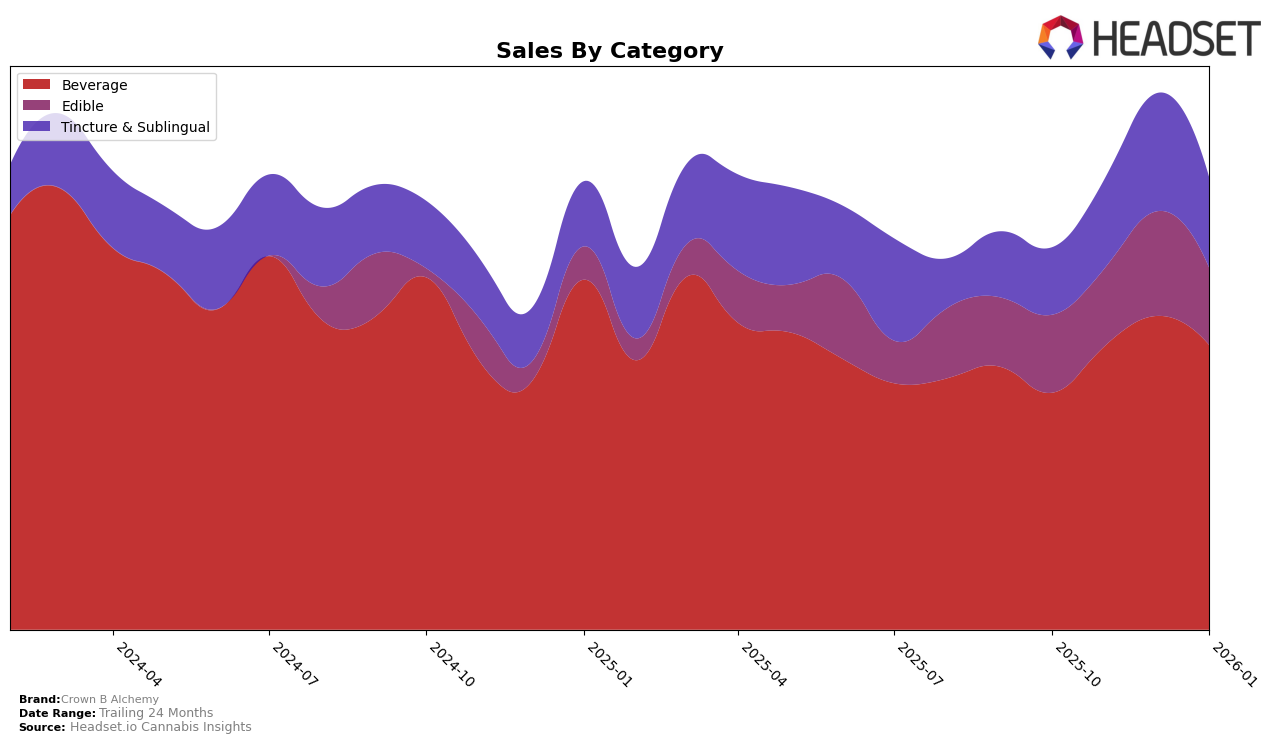

Crown B Alchemy has demonstrated consistent performance in the Oregon market, particularly in the Beverage and Tincture & Sublingual categories. In the Beverage category, the brand has maintained a steady 5th place ranking from October 2025 through January 2026, indicating a strong foothold in this segment. The Tincture & Sublingual category also shows a stable performance, with the brand climbing from 6th to 5th place in November 2025 and maintaining that position through January 2026. This consistency in ranking suggests a robust consumer base and possibly effective product offerings that resonate well with the market's preferences.

In contrast, Crown B Alchemy's performance in the Edible category in Oregon has been more variable. The brand's ranking fluctuated between 20th and 24th place from October 2025 to January 2026, with a noticeable drop in sales during January 2026 compared to the previous month. Although they managed to stay within the top 30, the inconsistency in rankings and sales could point to challenges in maintaining consumer interest or increased competition within this category. The absence of top 30 rankings in other states or provinces during this period could be seen as an opportunity for expansion or as a limitation in their current market reach.

Competitive Landscape

In the competitive landscape of the Oregon beverage category, Crown B Alchemy has maintained a consistent rank of 5th place from October 2025 to January 2026. This stability in ranking is noteworthy given the fluctuations observed in other brands. For instance, Fruit Lust experienced a dip in December 2025, falling to 7th place before recovering to 6th in January 2026. Meanwhile, Mule Extracts and Mary Jones have consistently held their 3rd and 4th positions, respectively, with Mary Jones showing a positive sales trend, closing the gap with Mule Extracts. Despite these competitors, Crown B Alchemy's sales trajectory is impressive, showing a peak in December 2025, which suggests effective market strategies and consumer engagement. However, maintaining this momentum is crucial as Hapy Kitchen remains a close contender, consistently ranked 7th but showing a downward sales trend, indicating potential opportunities for Crown B Alchemy to further solidify its position.

Notable Products

In January 2026, the top-performing product for Crown B Alchemy was the CBD/THC/CBG 1:1:1 Moonlight Serenade Gummies 2-Pack, maintaining its number one rank consistently since October 2025, with sales of 1201 units. The Pineapple Gummies 2-Pack climbed to the second rank, showing a consistent improvement from third place in October and December 2025. The Blackberry Gummies 2-Pack ranked third, a slight drop from its second-place position in December 2025. Cannabull Moonlight Serenade - CBD/THC/CBN 1:1:1 Marionberry Syrup made a notable entry at fourth place, up from fifth in November 2025. Lastly, the CBD/THC 1:1 Peach Mango Gummies 2-Pack held the fifth position, a slight drop from fourth in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.