Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

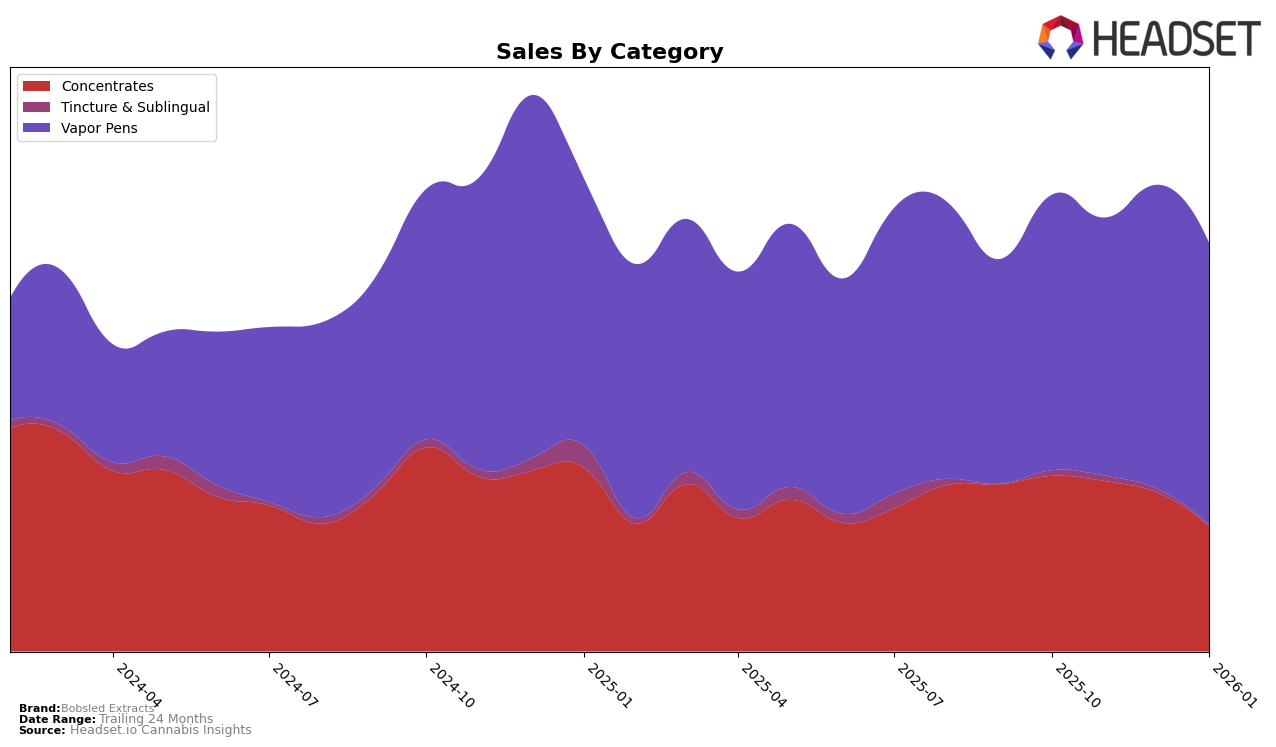

Bobsled Extracts has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand experienced a gradual decline in ranking from 4th place in October 2025 to 8th place by January 2026. This movement could be indicative of increasing competition or shifts in consumer preferences within the state. Despite the decline in rank, the brand maintained a consistent presence in the top 10, which suggests a strong foothold in the market. On the other hand, their performance in the Tincture & Sublingual category remained relatively stable, holding the 11th position from December 2025 to January 2026, after a slight drop from 8th place in October 2025. This stability in rankings might reflect a loyal customer base for their tincture products.

In the Vapor Pens category, Bobsled Extracts consistently held the 18th position across the four months, a sign of steady performance amidst a competitive landscape. This consistency might indicate a well-received product line that resonates with consumers in Oregon. However, the lack of movement in rank could also suggest challenges in breaking into the higher echelons of the market. Notably, Bobsled Extracts was absent from the top 30 brands in any other state or province, highlighting a potential area for growth and expansion beyond Oregon. This absence could be perceived as a limitation in their current market strategy or an opportunity for targeted marketing and distribution efforts in new regions.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Bobsled Extracts consistently held the 18th rank from October 2025 through January 2026, indicating a stable position but also highlighting potential areas for growth. Despite a slight dip in sales in November 2025, Bobsled Extracts rebounded in December, though it remained behind competitors like Altered Alchemy, which improved its rank from 17th to 16th and saw a consistent increase in sales over the same period. Meanwhile, Rogue Gold experienced a significant jump in December, moving from 25th to 15th, which could pose a future threat if their upward trend continues. Private Stash and Boujee Blendz (OR) also showed fluctuations in rank, with Boujee Blendz notably improving its position in January. These dynamics suggest that while Bobsled Extracts maintains a steady presence, there is an opportunity to strategize for increased market share against these agile competitors.

Notable Products

In January 2026, the top-performing product from Bobsled Extracts was the Frostbite Cured Resin Cartridge (1g) in the Vapor Pens category, achieving the highest sales with 1,020 units. Closely following were the Night Nurse Melted Diamonds + Cannabis Terpenes Cartridge (1g) and the White Bubblegum Cured Resin Cartridge (1g), ranked second and third respectively. The Grape Gas Live Resin Cartridge (1g) secured the fourth position, while the Diamond OG Cured Resin Cartridge (1g) rounded out the top five. Compared to previous months, these products have maintained strong sales momentum, with Frostbite Cured Resin Cartridge consistently leading the ranks. Overall, the rankings reflect a stable preference for Vapor Pens within the Bobsled Extracts lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.