Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

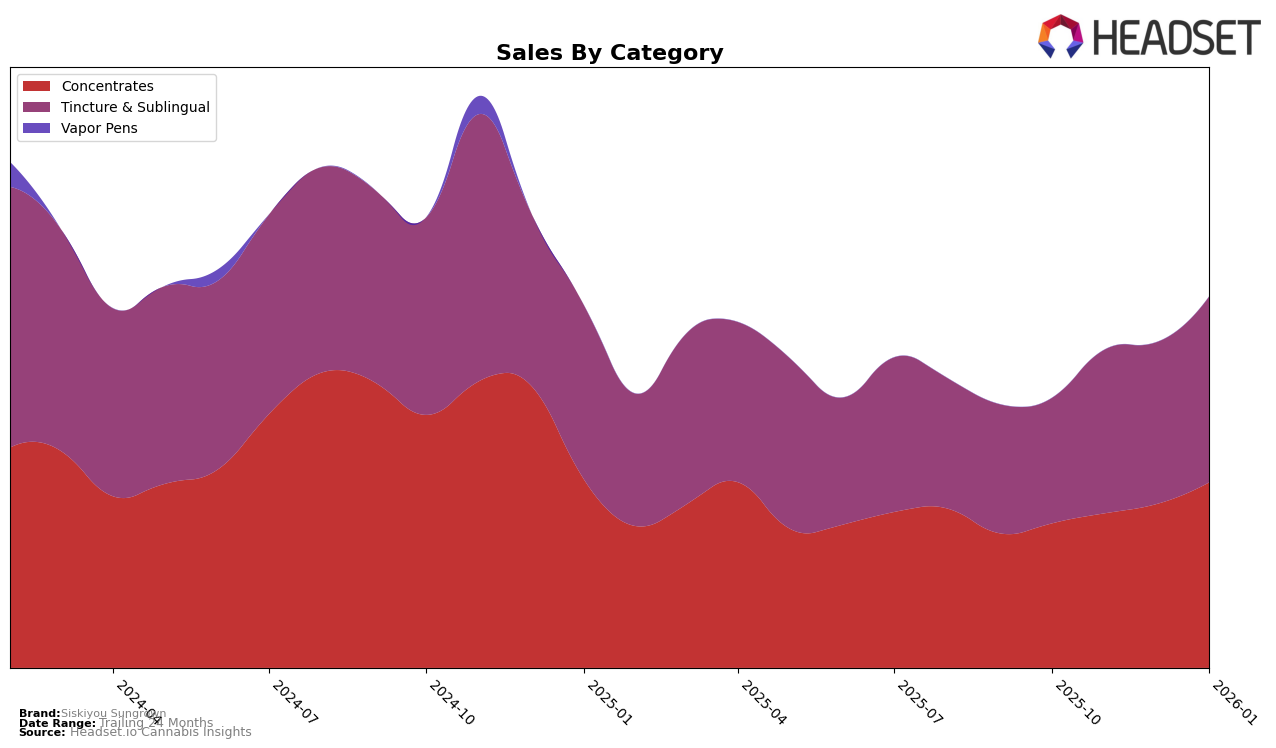

Siskiyou Sungrown has shown a steady presence in the Oregon market, particularly within the Tincture & Sublingual category. Over the four-month period from October 2025 to January 2026, the brand has maintained a strong position, improving its rank from 9th to 6th place. This upward trend signifies a positive reception and growing consumer preference for their products in this category. In contrast, the brand's performance in the Concentrates category has been less notable, as it remained outside the top 30, with rankings consistently around the 50th position. This suggests that while Siskiyou Sungrown is making significant strides in certain areas, there is potential for growth and increased market penetration in others.

Examining the sales trajectory, Siskiyou Sungrown's Tincture & Sublingual category experienced a notable increase in sales, with a jump from $19,809 in October 2025 to $29,412 by January 2026. This growth indicates a robust demand and potential for further expansion in this segment. However, in the Concentrates category, despite a slight increase in sales from $22,824 to $29,338 over the same period, the brand has not managed to break into the top rankings. This disparity in performance across categories highlights the need for strategic focus to bolster their presence in the Concentrates market, potentially through product innovation or enhanced marketing efforts.

Competitive Landscape

In the Oregon Tincture & Sublingual category, Siskiyou Sungrown has shown a notable upward trend in rankings from October 2025 to January 2026, improving from 9th to 6th position. This positive trajectory indicates a strengthening market presence, likely driven by consistent sales growth over the same period. Despite this progress, Siskiyou Sungrown faces stiff competition from established brands such as High Desert Pure, which maintained a steady 4th rank, and Crown B Alchemy, which consistently held the 5th position. Meanwhile, Medicine Farm experienced fluctuations, dropping to 8th in November and December before climbing back to 7th in January, while Fruit Lust made significant gains, moving from 14th in November to 8th by January. These dynamics suggest that while Siskiyou Sungrown is improving its competitive standing, the market remains highly competitive, with several brands vying for top positions.

Notable Products

In January 2026, the top-performing product from Siskiyou Sungrown was the CBD/THC 1:1 MCT Peppermint Tincture, which maintained its leading position from November 2025 with sales reaching 456 units. The THC Cannabis Oil RSO ranked second, showing a consistent climb from fourth place in October 2025. The CBD/THC 1:1 Full Spectrum RSO held steady in third place, demonstrating stable sales performance over the past few months. The THC RSO, while maintaining fourth place in January, has experienced a gradual decline in sales since October 2025. Notably, the CBD/THC 1:1 Alcohol Tincture reappeared in the rankings in January, securing the fifth position with improved sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.