Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

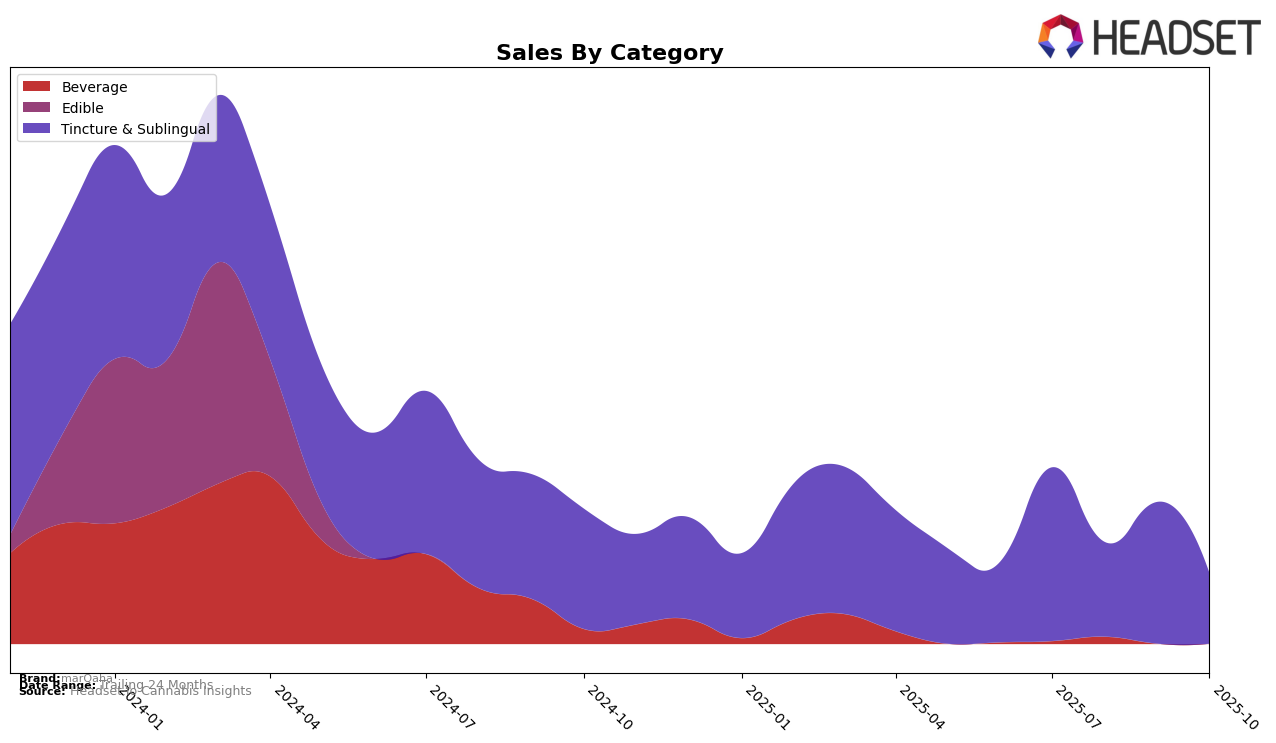

In the state of Colorado, marQaha has shown a noteworthy presence in the Tincture & Sublingual category. As of July 2025, the brand was ranked 8th in this category, indicating a strong positioning among competitors. However, it is important to note that marQaha did not maintain a top 30 ranking in the subsequent months of August, September, and October 2025. This drop out of the top 30 could be seen as a setback, suggesting increased competition or a shift in consumer preferences within the state. Despite this decline in ranking, marQaha's sales in July 2025 were recorded at $10,438, reflecting a solid performance during that month.

The absence of marQaha in the top 30 rankings from August to October 2025 in Colorado raises questions about the brand's strategic adjustments or market dynamics that may have contributed to this change. It is crucial to consider whether this trend is indicative of a broader challenge or a temporary fluctuation. The competitive landscape in the Tincture & Sublingual category is dynamic, and marQaha's ability to regain or improve its position in the coming months will be an area to watch. Understanding the factors that led to this ranking change could provide valuable insights into the evolving preferences of consumers and the competitive strategies of other brands in the market.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Colorado, marQaha has faced notable challenges in maintaining its rank and sales momentum. As of July 2025, marQaha was ranked 8th, but it did not appear in the top 20 rankings for the subsequent months, indicating a decline in its market presence. In contrast, Stratos consistently improved its position, moving from 7th in July to 6th in October, with relatively stable sales figures. Similarly, Care Division demonstrated resilience by climbing from 6th in July to 5th in October, despite fluctuations in sales. Meanwhile, Escape Artists maintained a strong position at 4th in July and August, though it did not appear in the rankings for September and October. These dynamics suggest that marQaha faces stiff competition from brands like Stratos and Care Division, which have shown greater stability and upward trends in both rank and sales, potentially impacting marQaha's market share and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In October 2025, the top-performing product from marQaha was the CBD/THC 30:1 Beef n' Bacon Tincture, which maintained its first-place ranking from August, despite a decrease in sales to 43 units. The CBD/THC 1:1 Equalize TinQture Entourage Oil held steady in the second position, showing a slight increase in sales compared to September. The CBD/THC 100:1 Entourage Oil Align Tincture rose to the third position, up from fifth in the previous two months, indicating a positive trend in consumer preference. The Indica Agave Tincture, however, dropped to fourth place after leading in September, with sales significantly declining. Lastly, the MarQaha x 14er - Blackberry Banana Kush Live Rosin Tincture slipped to fifth, showing a notable decrease in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.