Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

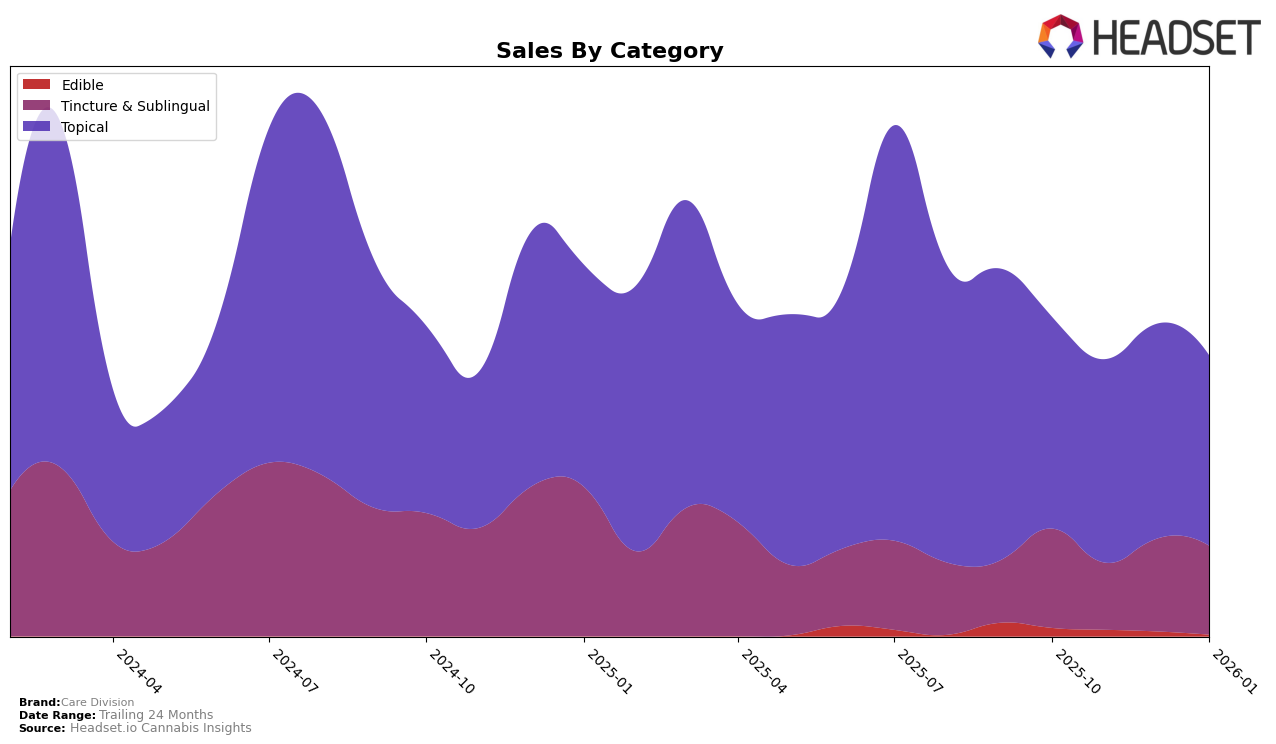

In the Colorado market, Care Division has shown notable fluctuations across different product categories. In the Tincture & Sublingual category, the brand maintained a strong presence, with rankings oscillating between 4th and 6th place from October 2025 to January 2026. This indicates a resilient performance despite a temporary dip in November. On the other hand, the Topical category exhibited more stability, with Care Division consistently securing a spot within the top 5. This consistency suggests that their topical products have a solid consumer base in Colorado, providing a reliable revenue stream for the brand.

Care Division's sales trends in Colorado reveal an interesting dynamic. For Tinctures & Sublinguals, sales peaked in December 2025, indicating a possible seasonal boost or successful marketing campaign during that period. However, sales dipped slightly in January 2026, which might warrant a closer examination of market conditions or competitive actions. Conversely, Topical sales showed a downward trend from October 2025 to January 2026, which could suggest increasing competition or changing consumer preferences in this category. Despite this, the brand's ability to stay within the top 5 rankings suggests that they are still a key player in the topical market. For a deeper analysis, one might explore how Care Division's strategies compare to their competitors in these categories.

Competitive Landscape

In the competitive landscape of the Topical category in Colorado, Care Division has demonstrated a consistent performance, maintaining a steady rank of 5th place from October 2025 to January 2026, except for a brief climb to 4th place in November 2025. This stability in rank is notable given the fluctuating performances of competitors like Highly Edible, which was absent from the top 20 in November 2025 but rebounded to 6th place by January 2026. Meanwhile, Nordic Goddess consistently held the 3rd position, showcasing a strong market presence with sales figures significantly higher than Care Division's. My Brother's Flower also posed a competitive challenge, closely aligning with Care Division's rank and sales, occasionally surpassing it, as seen in December 2025. Despite these challenges, Care Division's stable ranking suggests a loyal customer base and effective market strategies, although the brand may need to innovate or adjust its strategies to climb higher in the ranks and close the sales gap with top competitors.

Notable Products

In January 2026, the top-performing product for Care Division was the CBD/THC 1:1 The Truth Pain Relief Cream, maintaining its first-place ranking consistently since October 2025, with sales figures reaching 604 units. The CBD/THC 10:1 Chill Tincture held steady in the second position, showing consistent demand from December 2025. Carefree - CBD/THC 1:1 Pain Relief Cream improved its ranking from fifth in December to third in January, indicating a positive sales trend. New to the rankings in January, the CBD/THC 5:1 Dream Sleep Tincture debuted at fourth place, showing promising initial sales. The CBD Wellness Care Tincture entered the list at fifth, suggesting growing interest in CBD-focused products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.