Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

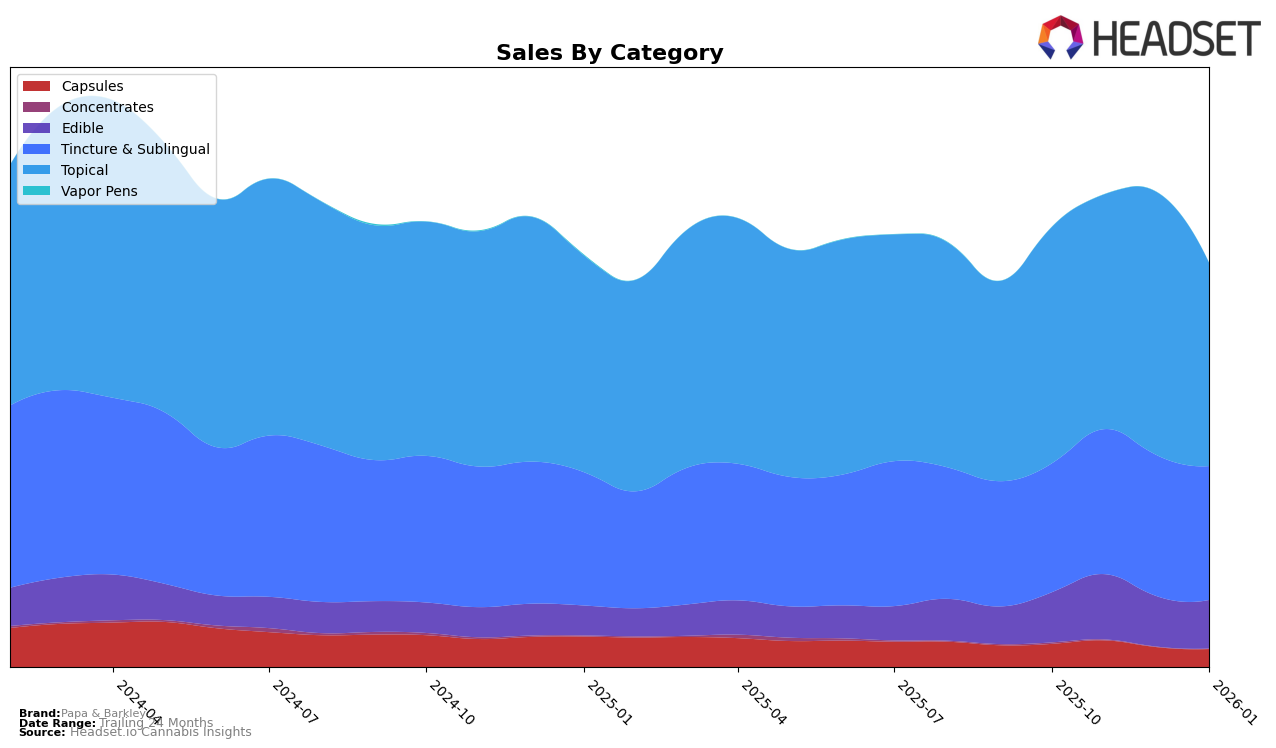

Papa & Barkley has shown a consistent performance in the California market, particularly excelling in the Tincture & Sublingual and Topical categories. The brand maintained the top position in both categories from October 2025 to January 2026, indicating a strong market presence and consumer preference. However, in the Capsules category, there was a slight decline in rank from 9th to 11th over the same period, suggesting a potential area for improvement. Interestingly, the Edible category saw Papa & Barkley fluctuating around the 29th position, briefly dropping out of the top 30 in December before regaining its rank in January. This fluctuation could hint at competitive pressures or changing consumer tastes in that segment.

In New York, Papa & Barkley made a notable entry into the Topical category, securing the 3rd position by January 2026. This marks a significant achievement, especially considering the absence of previous rankings in this category and state, highlighting a successful market entry strategy. Despite the strong performance in topicals, there is no available data for other categories in New York, which could imply either a strategic focus on topicals or a need to expand their product offerings in that market. The brand's ability to capture and maintain a leading position in new markets will be crucial for its continued growth and success.

Competitive Landscape

In the California topical cannabis market, Papa & Barkley has consistently maintained its position as the leading brand from October 2025 to January 2026. Despite a slight decrease in sales from December 2025 to January 2026, Papa & Barkley has remained unchallenged at the top rank, indicating strong brand loyalty and market presence. In contrast, Mary's Medicinals has held the second position throughout the same period, with sales figures significantly lower than Papa & Barkley's, yet showing a steady upward trend until a slight dip in January 2026. Meanwhile, Buddies consistently ranks third, with sales figures that are considerably lower than both Papa & Barkley and Mary's Medicinals, indicating a more niche market presence. This competitive landscape highlights Papa & Barkley's dominance and suggests that while competitors are stable, they have not significantly threatened Papa & Barkley's leadership in the California topical category.

Notable Products

In January 2026, Papa & Barkley's Sleep Releaf- CBD/CBN/THC 1:1:1 Berry Pomegranate Gummies 20-Pack maintained its top position as the leading product in the Edible category, with sales reaching 5892 units. The CBD/THC 1:3 THC Rich Releaf Balm consistently held the second rank in the Topical category, despite a decrease in sales compared to previous months. The CBD/THC 3:1 CBD Rich Releaf Balm in the 15ml size remained third, while the CBD/THC 1:3 THC Rich Releaf Body Oil improved its ranking to fourth. The 50ml version of the CBD/THC 3:1 CBD Rich Releaf Balm saw a drop to fifth place, indicating a shift in consumer preference within the Topical category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.