Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

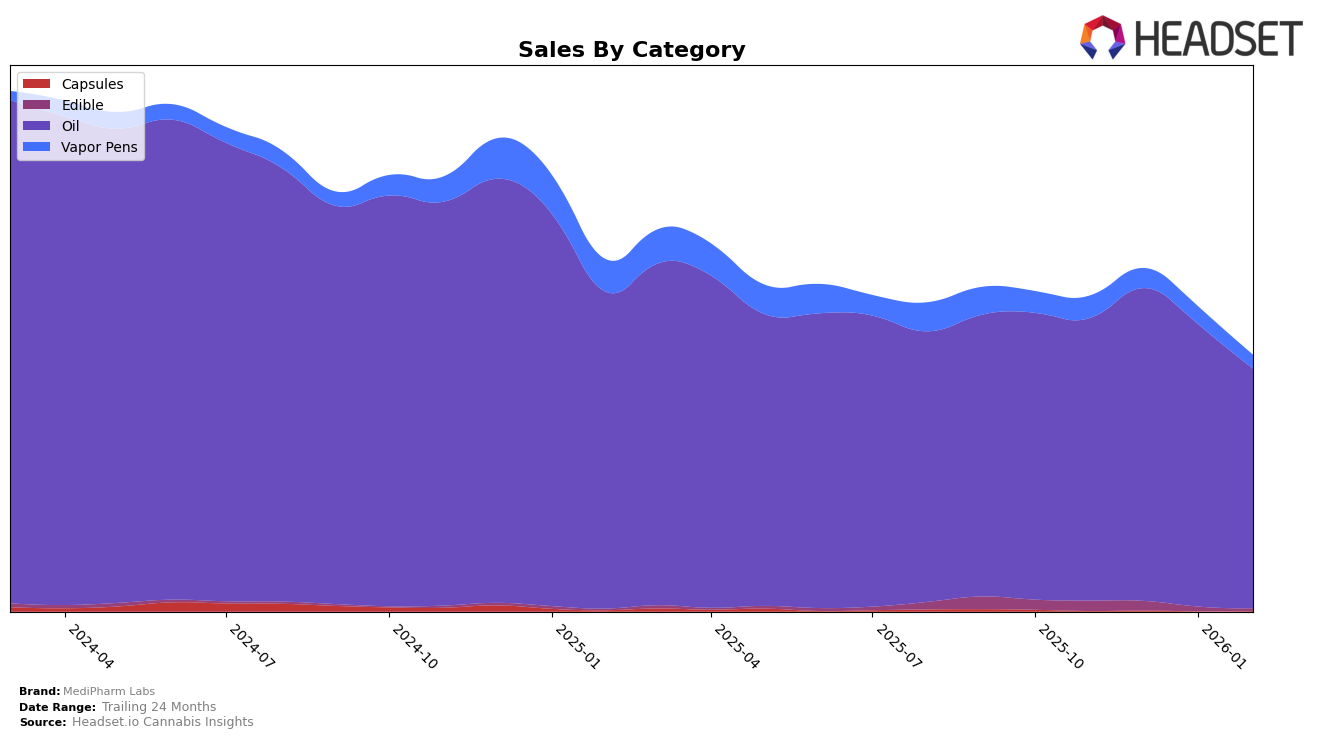

MediPharm Labs has maintained a strong presence in the Alberta market, particularly in the Oil category where it consistently holds the top rank. Despite a slight decrease in sales from January to February 2026, the brand's dominance in this category remains unchallenged. However, in the Edible category, MediPharm Labs saw a decline in rankings, dropping from 20th in November 2025 to falling out of the top 30 by January 2026. This indicates a potential area of concern or an opportunity for strategic realignment. The Vapor Pens category also saw a downward trend in Alberta, with rankings slipping from 58th to 71st over the same period, reflecting a need for the brand to possibly reassess its market strategies or product offerings in this segment.

In British Columbia, MediPharm Labs has shown commendable consistency in the Oil category, maintaining a position within the top 6 from November 2025 to February 2026. This stability suggests a strong brand loyalty or effective product performance in the region. On the other hand, the Ontario market reflects a similar pattern of stability in the Oil category, where MediPharm Labs has consistently ranked 3rd over the observed months. However, the Vapor Pens category in Ontario presents a challenge, with rankings dipping slightly from 97th in November 2025 to 95th in February 2026, after not making the top 30 in December. Such fluctuations indicate that while MediPharm Labs has a foothold in certain categories, there are areas that require attention to enhance overall market performance.

Competitive Landscape

In the Alberta oil category, MediPharm Labs has consistently maintained its top position from November 2025 through February 2026, showcasing its dominance in this market. Despite fluctuations in sales figures, with a noticeable dip in February 2026, MediPharm Labs remains ahead of competitors such as Viola and Tweed, which have consistently held the second and third ranks, respectively. Viola and Tweed have shown strong sales performance, yet their sales figures remain significantly lower than MediPharm Labs, indicating a robust market presence for MediPharm Labs. The consistent ranking of these competitors suggests a stable competitive landscape, but MediPharm Labs' ability to maintain its lead despite sales fluctuations highlights its strong brand loyalty and market strategy in Alberta's oil category.

Notable Products

In February 2026, the top-performing product from MediPharm Labs was CBN:THC 1:2 Nighttime Formula Oil (30ml) in the Oil category, maintaining its first-place ranking consistently since November 2025, with sales of 3972 units. THC 30 Regular Formula Oil (30ml) held steady at the second position, while CBN/CBD 1:2 Relax Formula Oil (30ml) remained third. CBD 50 Plus Olive Formula Oil (30ml) consistently ranked fourth, though sales figures showed a decline over the months. Notably, THC Dissolving Drops Oil (30ml) entered the rankings in January 2026 at fifth place and maintained that position in February. These rankings indicate a stable preference among consumers for these top four products, with the new entrant showing potential for growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.