Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

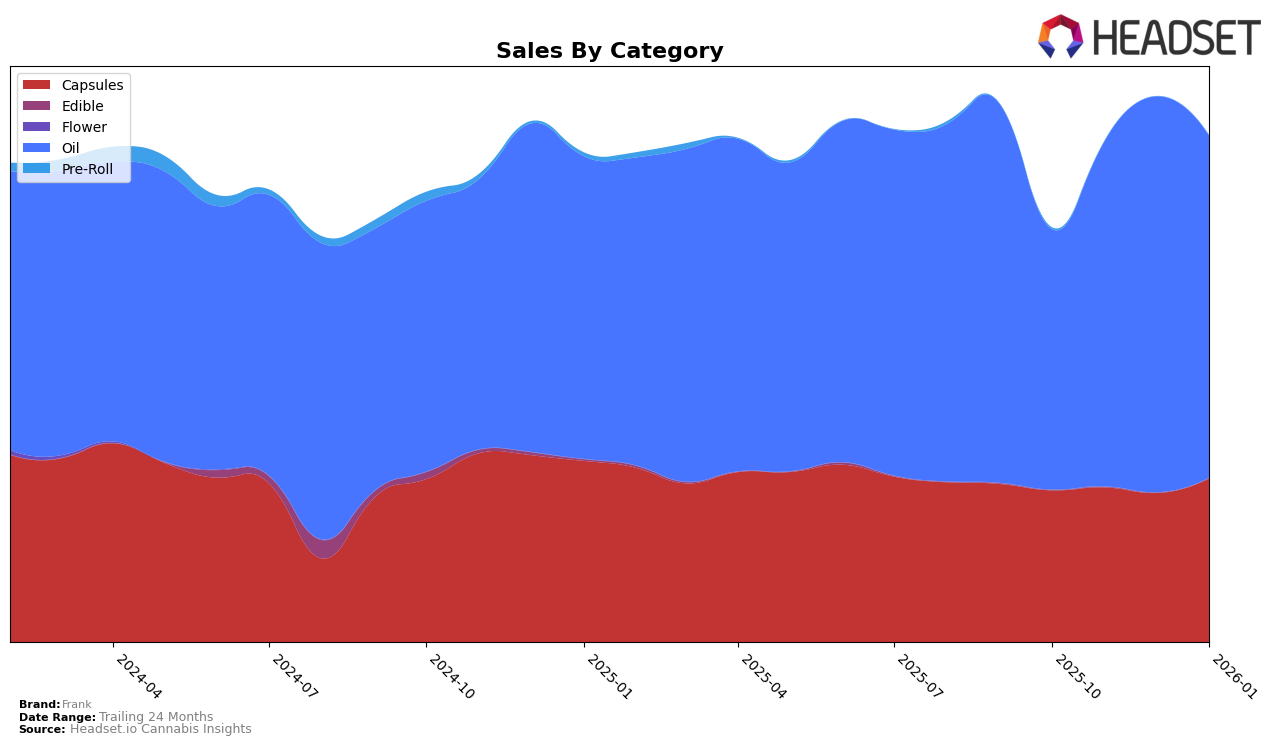

Frank has shown a consistent performance in the Alberta market, particularly in the Oil category, maintaining a steady 5th rank from October 2025 to January 2026. This stability indicates a strong foothold in the Oil category, despite a slight fluctuation in sales figures. In contrast, the Capsules category in Alberta saw Frank dip slightly in December 2025 to the 6th position before recovering to 5th in January 2026. Meanwhile, in British Columbia, Frank's performance in the Oil category is noteworthy, climbing from 7th place in November 2025 to 4th in December 2025, although it settled at 5th in January 2026. However, Frank's presence in the Capsules category in British Columbia wasn't as prominent until January 2026, when it entered the top 10, highlighting a potential area for growth.

In Ontario, Frank has been gradually improving its rankings in both Capsules and Oil categories. The Capsules category saw an improvement from 14th in October 2025 to 11th by December 2025, maintaining this position through January 2026. This upward trend suggests a growing acceptance and popularity of Frank's Capsules in Ontario. Similarly, in the Oil category, Frank moved from 10th in October 2025 to 8th by December 2025, sustaining this rank into January 2026. Meanwhile, in Saskatchewan, Frank's Capsules made a notable entry into the top 5 by January 2026, while its Oil category maintained a consistent presence within the top 5. The absence of Frank in the top 30 for some months in certain categories could be seen as an opportunity for the brand to strategize and enhance its market penetration in those areas.

Competitive Landscape

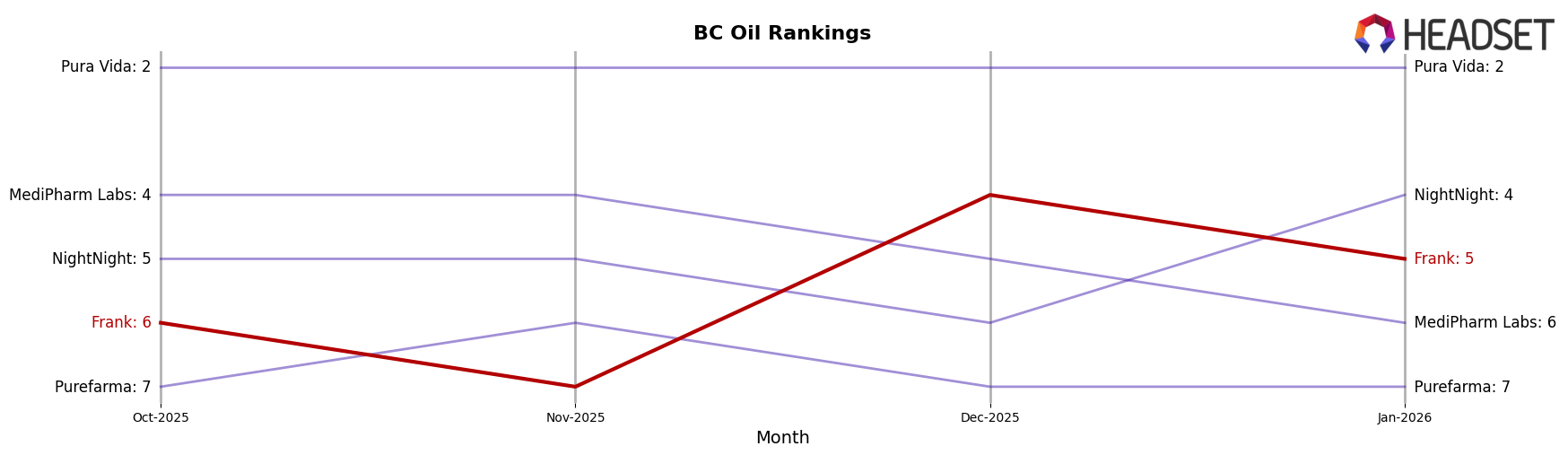

In the competitive landscape of the oil category in British Columbia, Frank has demonstrated a dynamic shift in its market position from October 2025 to January 2026. Initially ranked 6th in October 2025, Frank experienced a dip to 7th in November, before climbing to 4th in December, and settling at 5th in January 2026. This fluctuation in ranking reflects a competitive tussle with brands like NightNight, which saw a similar pattern but ended January in 4th place, and MediPharm Labs, which consistently stayed ahead, though it dropped from 4th to 6th by January. Notably, Pura Vida maintained a stronghold on the 2nd position throughout this period, indicating a significant lead in sales performance. Frank's ability to ascend to 4th place in December suggests a potential for growth, but the brand must strategize to maintain consistency and capitalize on its upward momentum to challenge the higher-ranked competitors.

Notable Products

In January 2026, Frank's top-performing product was CBD 100 Oil (30ml) in the Oil category, maintaining its first-place rank consistently from October 2025 with notable sales of 5721 units. Following closely, CBD Capsules 30-Pack (1500mg CBD) in the Capsules category also held steady in second place, showing a slight increase in sales compared to previous months. CBD Smokes Infused Pre-Roll 10-Pack (5g) in the Pre-Roll category made a comeback to the third position after dropping to fourth in November 2025, indicating a resurgence in popularity. Meanwhile, CBD Lemon Gummies 30-Pack (1500mg CBD) in the Edible category, which was ranked third in November, did not appear in the rankings for December and January, suggesting a decline or discontinuation. The consistent performance of the top two products highlights their strong market presence, while the fluctuating positions of the others suggest shifts in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.