Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

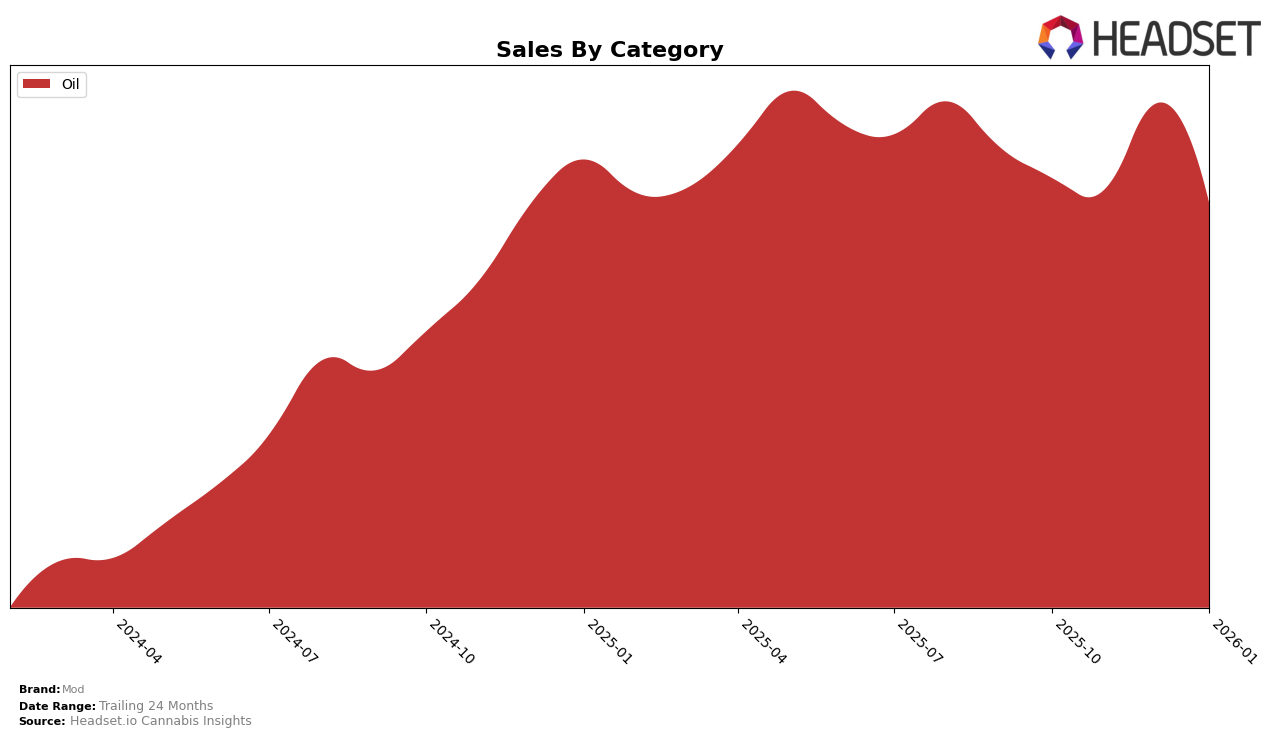

Mod has consistently maintained a strong presence in the Oil category within Ontario, holding the impressive position of second place from October 2025 through January 2026. This stability in ranking indicates a robust market strategy and consumer loyalty in the region. However, the sales figures reveal some fluctuations, with a notable peak in December 2025, where sales reached 452,856, before experiencing a decline in January 2026. This pattern suggests a possible seasonal demand or promotional activity that boosted sales during the holiday period, followed by a typical post-holiday dip.

Interestingly, Mod's absence from the top 30 in other states and categories suggests a concentrated focus or perhaps a strategic decision to prioritize certain markets. While their dominance in Ontario's Oil category is commendable, the lack of broader presence could be seen as a potential area for growth or a deliberate choice to strengthen their foothold in a specific niche. This selective ranking highlights both the challenges and opportunities for Mod as they navigate the competitive landscape of the cannabis industry.

Competitive Landscape

In the competitive landscape of the oil category in Ontario, Mod consistently holds the second rank from October 2025 to January 2026, indicating a stable market position. Despite not surpassing Redecan, which maintains the top rank with a steady increase in sales, Mod shows resilience with a notable sales peak in December 2025. This surge suggests a potential seasonal demand or successful marketing strategy during that period. Meanwhile, MediPharm Labs and NightNight consistently rank third and fourth, respectively, with MediPharm Labs showing a slight sales fluctuation and NightNight experiencing a decline in January 2026. Mod's stable ranking amidst these competitors highlights its strong brand presence and customer loyalty in the Ontario oil market.

Notable Products

In January 2026, the top-performing product for Mod was THC 1000 Unflavoured Oil Drops 10-Pack, maintaining its first-place ranking since October 2025, with sales reaching 4905 units. THC Variety Pack Oil Drops 4-Pack held steady in second place, despite a noticeable dip in sales compared to previous months. THC 300 Oil Drops climbed back to third place, having briefly dropped to fourth in November 2025. The THC Berry Drops remained in fourth place, with a consistent ranking since December 2025 but experienced a decline in sales. Lastly, THC Lime Drops consistently held the fifth position throughout the observed months, showing steady performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.