Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

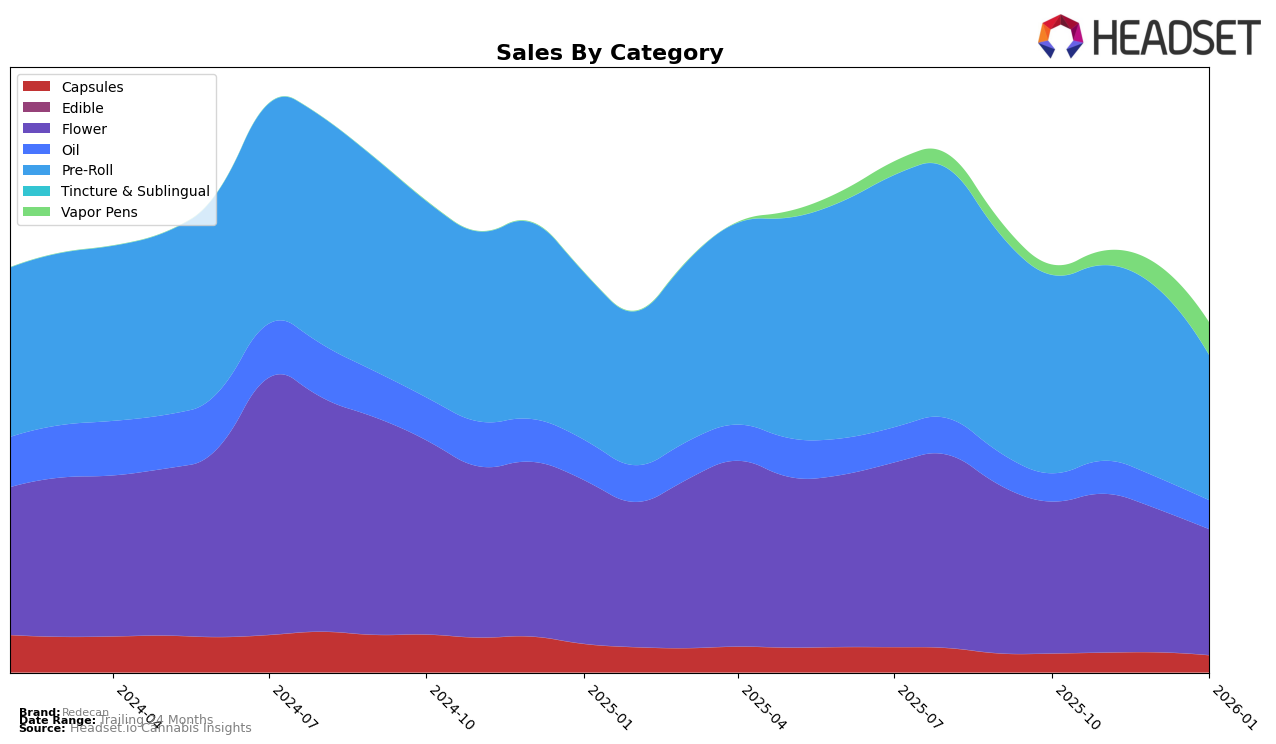

Redecan's performance across various Canadian provinces shows a nuanced picture of its market presence. In Alberta, Redecan's Flower category saw a slight decline from 6th to 8th position between October 2025 and January 2026, while Pre-Rolls also experienced a drop from 5th to 7th place in the same period. Interestingly, the Vapor Pens category showed a significant entry in December 2025, debuting at 23rd and moving to 24th by January 2026, indicating a growing presence in this segment. In British Columbia, Redecan's Flower category was notably absent from the top 30 in October and December 2025, only re-entering at 29th in January 2026. Meanwhile, Pre-Rolls maintained a steady presence, though slipping from 18th to 23rd over the same timeframe.

In Ontario, Redecan's Capsules consistently ranked 2nd across the months, showcasing a strong foothold in this category. The Oil category remained dominant, holding the top position throughout the period, underscoring Redecan's leadership in this segment. The Flower category experienced a gradual decline from 10th to 12th place, while Pre-Rolls saw a more significant drop from 5th to 7th place by January 2026. Notably, Vapor Pens made an appearance in January 2026, ranking 28th, indicating potential for growth in this area. In Saskatchewan, Redecan's Flower category improved from 9th to 7th place, and Pre-Rolls saw a positive movement, rising from 8th to 5th place, suggesting a strengthening market position in these categories.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Redecan has experienced a slight decline in its ranking and sales over the past few months. Starting from October 2025, Redecan held the 10th position, but by January 2026, it had slipped to 12th place. This downward trend in rank is mirrored by a decrease in sales, which dropped from over 1.87 million CAD in October 2025 to approximately 1.51 million CAD by January 2026. Meanwhile, Nugz (Canada) has shown resilience, improving its rank from 13th in October to 10th in January, surpassing Redecan. Similarly, Tenzo has made significant strides, climbing from 19th to 13th place, indicating a positive growth trajectory. On the other hand, Versus maintained a strong position in the top 10 for most of the period but saw a drop to 11th in January, aligning closely with Redecan's trajectory. These shifts highlight the dynamic nature of the Ontario Flower market, where Redecan faces increasing competition from brands like Nugz and Tenzo, which are gaining momentum and market share.

Notable Products

In January 2026, the top-performing product for Redecan was Redees- Hemp'd Animal Runtz Pre-Roll 10-Pack (4g), maintaining its first-place ranking from previous months despite a sales figure of 35,740. Redees - Purple Churro Pre-Roll 10-Pack (4g) climbed to second place, up from third in December 2025, indicating a strong upward trend. Redees - Cold Creek Kush Pre-Roll 10-Pack (4g) dropped to third place, reflecting a significant decrease in sales. Redees - Wappa Pre-Roll 10-Pack (4g) improved its position to fourth, showing a recovery from its absence in November 2025. Animal Rntz (3.5g) rounded out the top five, continuing its decline in ranking and sales over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.