Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

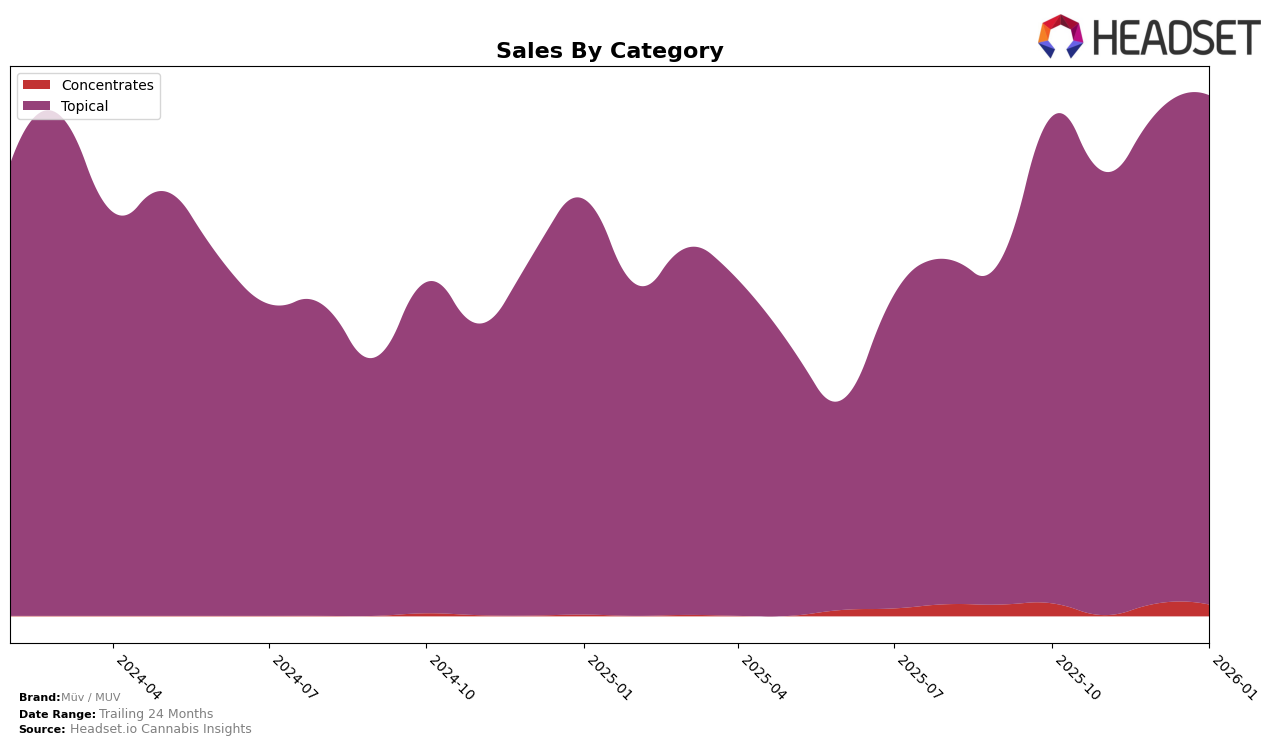

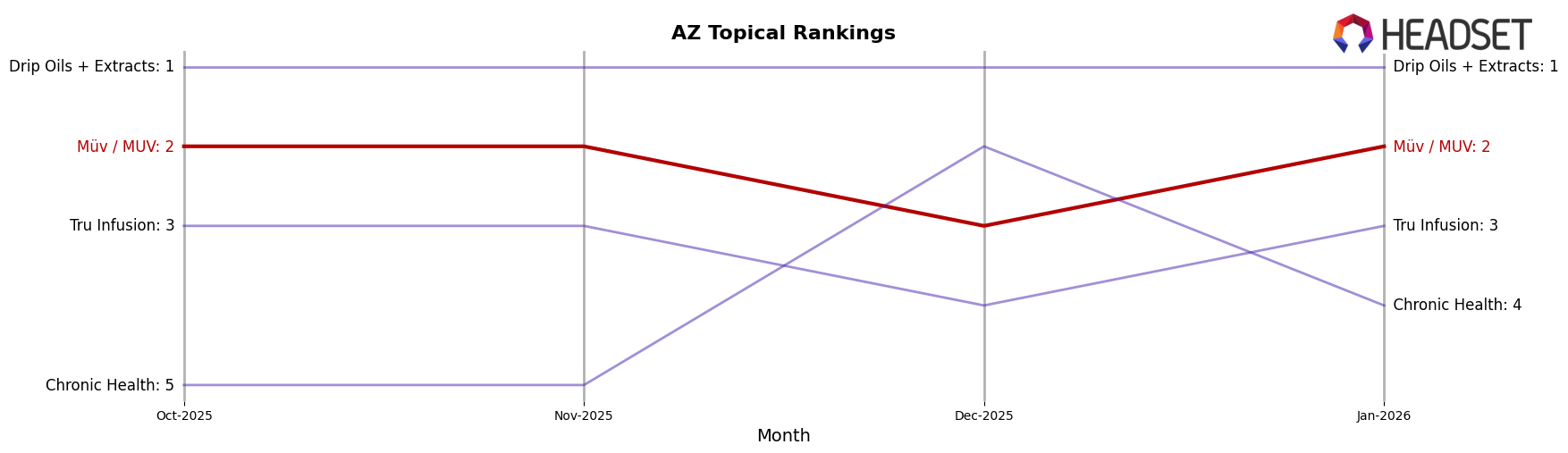

In the Arizona market, Müv / MUV has consistently shown strong performance in the Topical category. Throughout the last quarter of 2025 and into the start of 2026, the brand maintained a solid position, ranking consistently within the top three. Specifically, Müv / MUV held the 2nd position in October and November, briefly dropped to 3rd in December, and then regained the 2nd spot in January. This stability in ranking suggests a robust presence in the Arizona market, likely driven by a loyal customer base and consistent product quality. Notably, their sales figures in January 2026 reached an impressive $40,289, indicating a positive trend and potential growth in consumer demand.

While Müv / MUV has demonstrated strong performance in Arizona, it is worth noting that their presence in other states or categories might not be as prominent. For instance, if the brand does not appear in the top 30 rankings for certain states or categories, it could indicate areas where the brand has room for growth or faces stronger competition. This absence in top rankings can be seen as both a challenge and an opportunity for Müv / MUV to expand its market reach and diversify its product offerings. Understanding these dynamics can provide valuable insights for stakeholders looking to capitalize on emerging trends and optimize their market strategies.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Arizona, Müv / MUV has maintained a strong presence, consistently ranking within the top three brands from October 2025 to January 2026. Despite a slight dip to the third position in December 2025, Müv / MUV quickly regained its second-place standing by January 2026. This resilience is noteworthy, especially in the face of stiff competition from brands like Drip Oils + Extracts, which has consistently held the top rank. Meanwhile, Tru Infusion and Chronic Health have also been formidable competitors, with Chronic Health notably surging to second place in December 2025 before dropping back to fourth. Müv / MUV's ability to maintain a strong rank amidst these shifts indicates a robust market position, although the brand might need to strategize further to close the gap with the leading Drip Oils + Extracts.

Notable Products

In January 2026, the top-performing product for Müv / MUV was the CBD/THC 1:1 Pain Relief Cream (100mg CBD, 100mg THC), which maintained its number one rank from previous months, achieving sales of 464 units. The CBD/THC 1:1 Soothing Sports Gel (100mg CBD, 100mg THC) climbed to the second position, showing a significant improvement from its consistent fourth-place ranking in prior months. The CBD/THC 1:1 Transdermal Patch Gen2 (10mg CBD, 10mg THC) held steady at third place, maintaining its position from December 2025. The Hybrid Gen2 THC Transdermal Patch (20mg) experienced a drop to fourth place after being second or third in earlier months. Lastly, the CBD/THC 1:1 Pain Relief Cream (200mg CBD, 200mg THC) remained in fifth place, consistent with its December 2025 ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.