Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

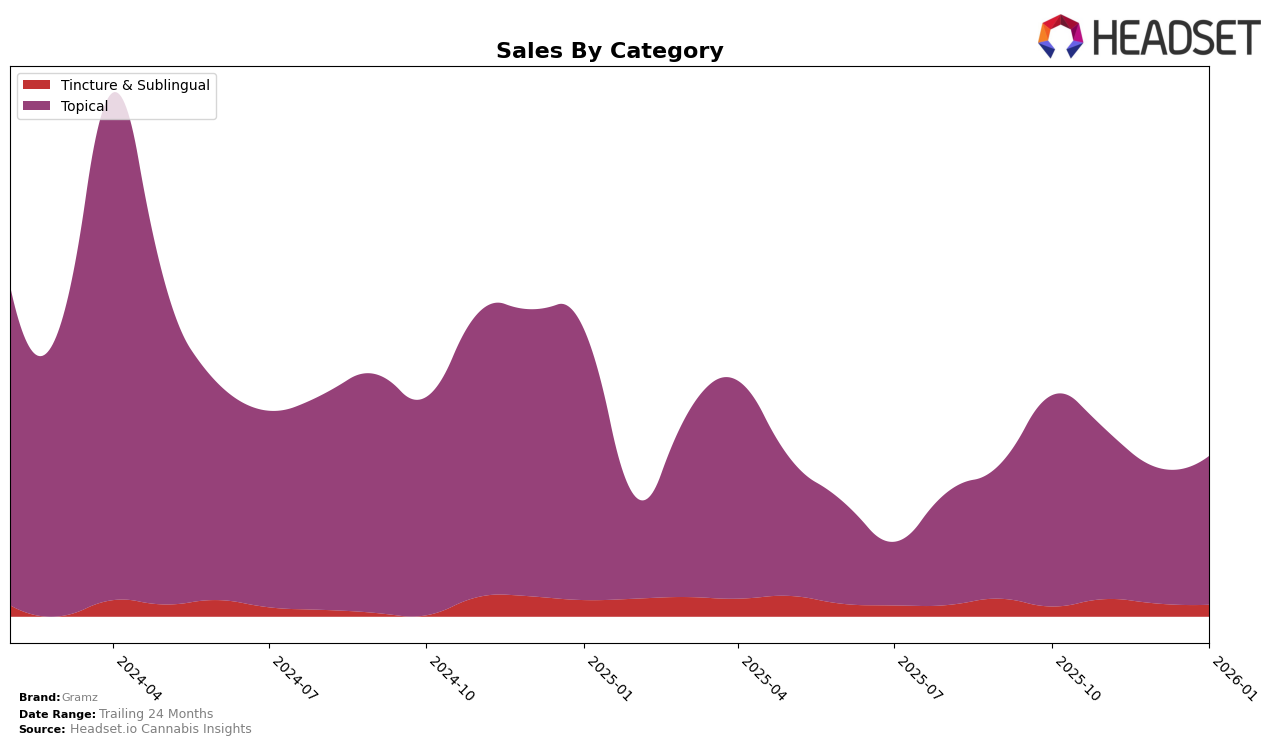

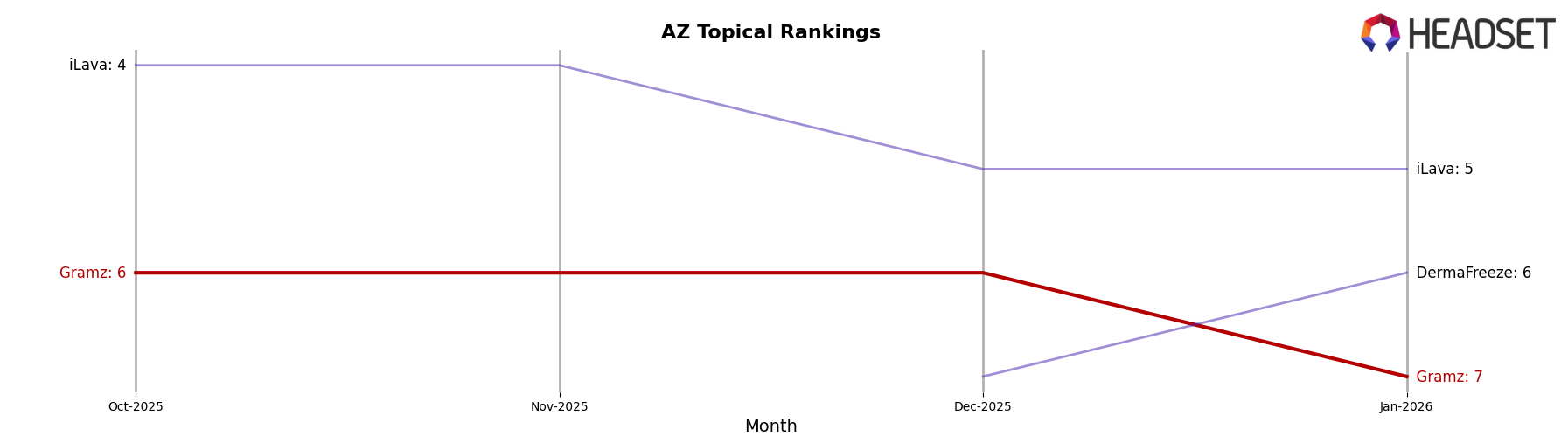

Gramz has demonstrated a consistent presence in the Topical category in Arizona, maintaining a steady rank of 6th place from October to December 2025, before slightly dropping to 7th in January 2026. This minor dip in ranking is accompanied by an interesting trend in sales figures, which show a decline from October through December, followed by a slight recovery in January. This suggests a potential seasonal fluctuation or market adjustment that may have impacted their standing. The consistent ranking in the top 10, however, indicates a strong foothold in the Arizona market for topicals, even amidst the competitive pressures.

Across other states and categories, Gramz's performance is less conspicuous, as they do not appear in the top 30 brands, indicating either a lack of market penetration or possibly a strategic focus on select markets like Arizona. This absence could point to opportunities for growth in other regions or categories where they are not currently visible. It will be crucial for Gramz to assess these markets to identify potential areas for expansion or to bolster their existing strategies to improve their rankings and sales figures in the coming months.

Competitive Landscape

In the competitive landscape of the Arizona topical cannabis market, Gramz has experienced notable shifts in its ranking and sales performance from October 2025 to January 2026. Initially holding the 6th position, Gramz maintained this rank through December 2025 but saw a decline to 7th place in January 2026. This drop in rank coincides with a decrease in sales from $20,500 in October 2025 to $14,466 in January 2026, indicating a downward trend. In contrast, iLava consistently held the 4th position, with sales showing a steady increase, suggesting a strong market presence and consumer preference. Meanwhile, DermaFreeze emerged in the rankings in January 2026, securing the 6th spot, which may have contributed to Gramz's decline. This competitive pressure highlights the need for Gramz to innovate and strategize effectively to regain its market position and boost sales in the Arizona topical category.

Notable Products

In January 2026, the top-performing product from Gramz was the THC Herbal Lotion (300mg), which rose to the number one rank from its previous second-place position in December 2025, achieving a notable sales figure of 232 units. The CBD/THC 1:1 Herbal Lotion (300mg CBD, 300mg THC), previously holding the top spot for three consecutive months, dropped to second place. The CBG/THC 1:2 Essential Roll On Oil Cream (50mg CBG, 100mg THC) improved its rank significantly, moving up to third place from fifth in the previous months. Both the CBG/THC 1:2 G9 Aphrodisiac Libido Booster and the CBG/THC 1:2 G9 Herbal Aphrodisiac Libido Booster maintained a consistent presence in the top five, ranking fourth. Overall, the topical category showed strong performance, with three out of the top five products belonging to this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.