Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

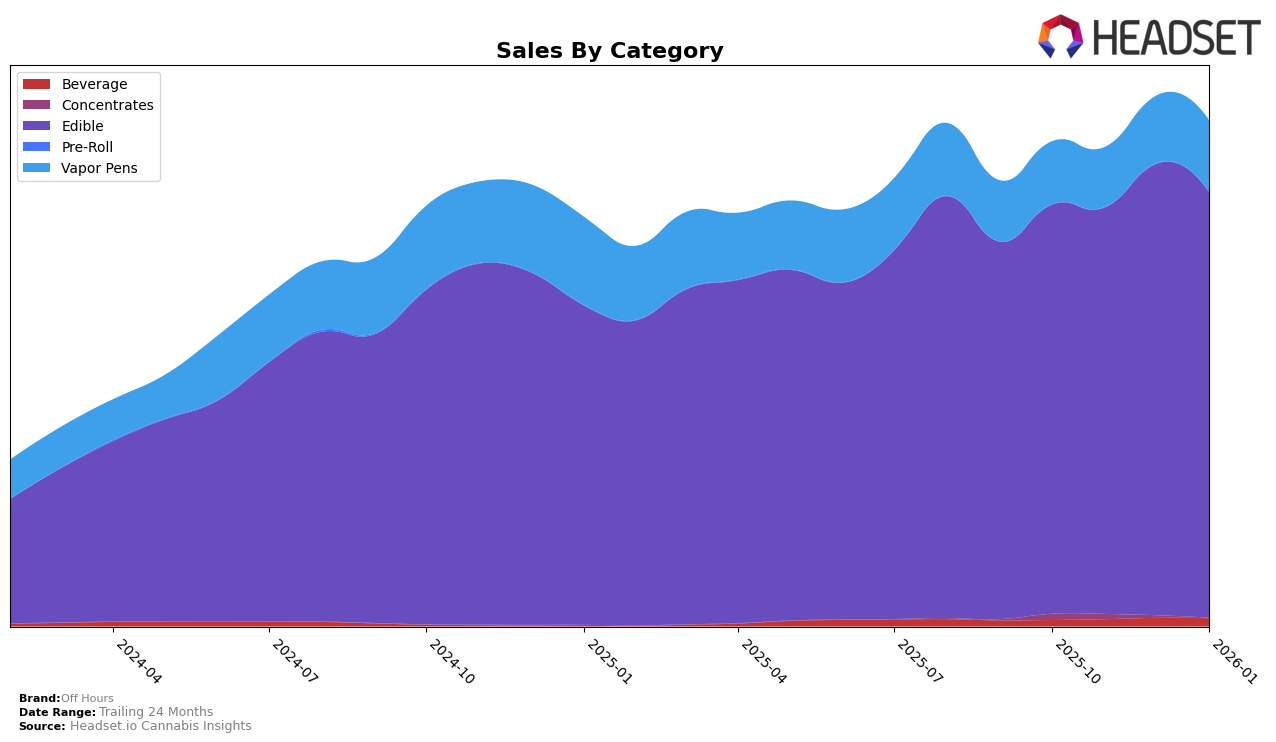

Off Hours has demonstrated a consistent performance in the New York market, particularly in the Edible category. The brand maintained a strong position, holding the top spot in October 2025 before moving to the second position from November 2025 through January 2026. This slight drop in ranking did not significantly impact sales, which showed a notable increase in December 2025, indicating a strong consumer preference and effective market strategies during the holiday season. In contrast, the Vapor Pens category presents a different picture, where Off Hours remained in the lower tier of the top 30, fluctuating between 26th and 27th positions. Despite this, there was a positive trend in sales from November 2025 to January 2026, suggesting a growing interest in their vapor pen products.

The absence of Off Hours in the top 30 rankings for other states or provinces in both the Edible and Vapor Pens categories could be interpreted as a missed opportunity for brand expansion or a reflection of competitive market dynamics in those regions. The brand's ability to maintain and slightly improve its position in the New York Vapor Pens category, despite being on the lower end of the rankings, indicates potential for growth if strategic adjustments are made. Observing these movements, it's clear that while Off Hours has a strong foothold in certain areas, there remains room for growth and increased market penetration across other states and categories.

Competitive Landscape

In the New York edible cannabis market, Off Hours has experienced notable shifts in its competitive positioning over recent months. Initially holding the top rank in October 2025, Off Hours was overtaken by Camino in November 2025, dropping to second place, where it remained through January 2026. Despite this change, Off Hours maintained strong sales figures, consistently outperforming Gron / Grön and Wyld, which fluctuated between third and fourth positions. The brand's ability to sustain high sales volume, even after losing the top rank, suggests a robust market presence and consumer loyalty. However, the consistent lead by Camino indicates a competitive challenge that Off Hours must address to reclaim its former top position.

Notable Products

In January 2026, the top-performing product from Off Hours was the Euphoric - THC/CBG 10:2 Watermelon Lemonade Sour Gummies 10-Pack, maintaining its first-place rank from previous months with sales reaching 18,784 units. Following closely, the CBD/THC/CBN 2:10:1 Mellow Blue Razzberry Sour Gummies 10-Pack remained in second place, consistently holding this position since October 2025. The Offline - CBD/THC/CBN 10:10:4 Cherry Berry Sour Gummies 10-Pack also retained its third-place position, showing a steady increase in sales. The Offline - CBD/THC/CBN 2:10:3 Grape Punch Gummies 10-Pack and Illuminate - THC/CBG 5:1 Peach Mango Gummies 10-Pack continued to occupy the fourth and fifth ranks, respectively, although both experienced slight fluctuations in sales figures. Overall, the rankings have remained stable from previous months, indicating consistent consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.