Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

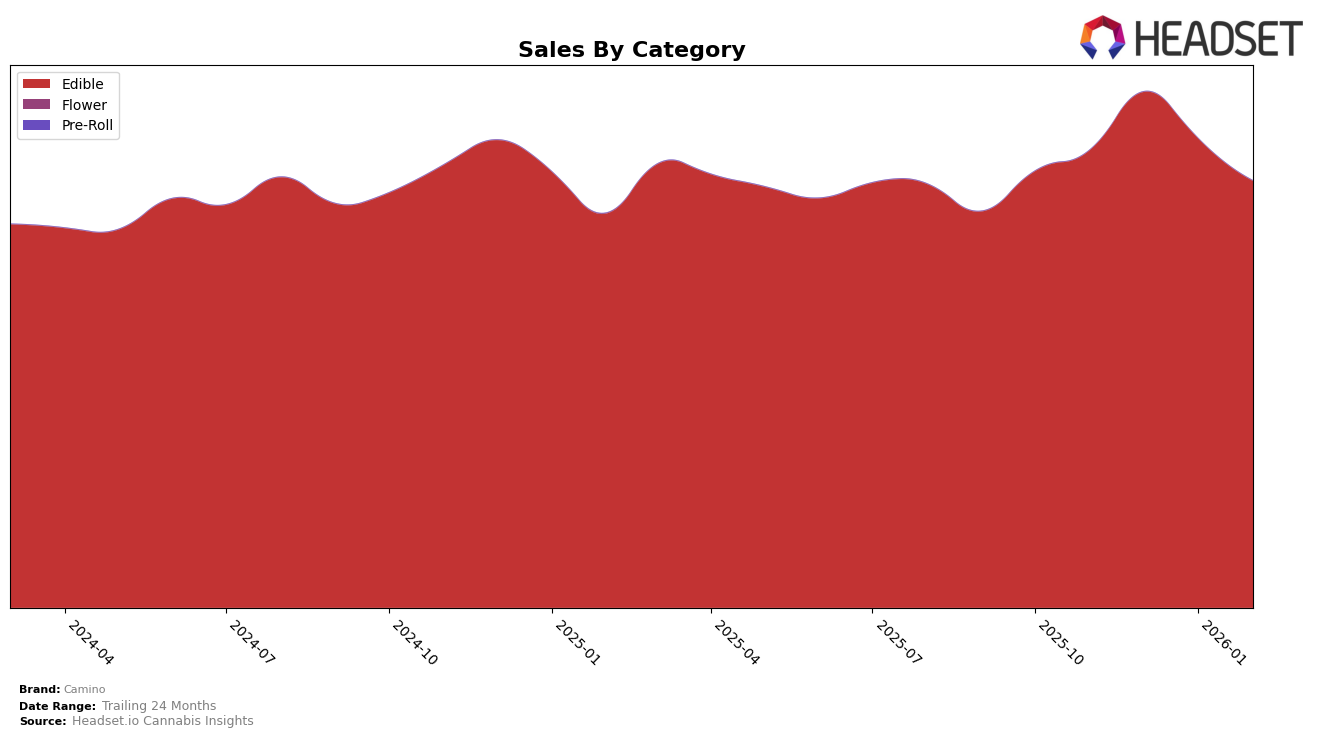

Camino has shown a consistent performance in the Edible category across various states, maintaining strong positions in some of the most competitive markets. In California, Camino has maintained a steady second place from November 2025 to February 2026, despite a noticeable dip in sales from December to February. This consistency is mirrored in New York, where Camino has held the top spot consistently, reflecting robust consumer loyalty in the region. Meanwhile, in Massachusetts, Camino experienced a slight drop in ranking from second to third place in February 2026, which could indicate increasing competition or shifting consumer preferences. Notably, in Ohio, the brand saw a peak at second place in January 2026, before settling back to fourth in February, suggesting a dynamic market environment.

In other states, Camino's performance has been more varied. In Illinois, the brand has shown a gradual climb from the 14th position in November 2025 to 11th in January 2026, before slightly dropping to 12th in February. This upward trend indicates potential growth opportunities, although the February slip suggests challenges remain. In Connecticut and New Jersey, Camino has consistently held the third position, reflecting a stable market presence. Interestingly, in Nevada, Camino appeared in the rankings for the first time in February 2026 at fourth place, marking a significant entry into the state's market. This suggests a positive reception but also highlights the need for sustained efforts to maintain and improve their standing in such competitive environments.

Competitive Landscape

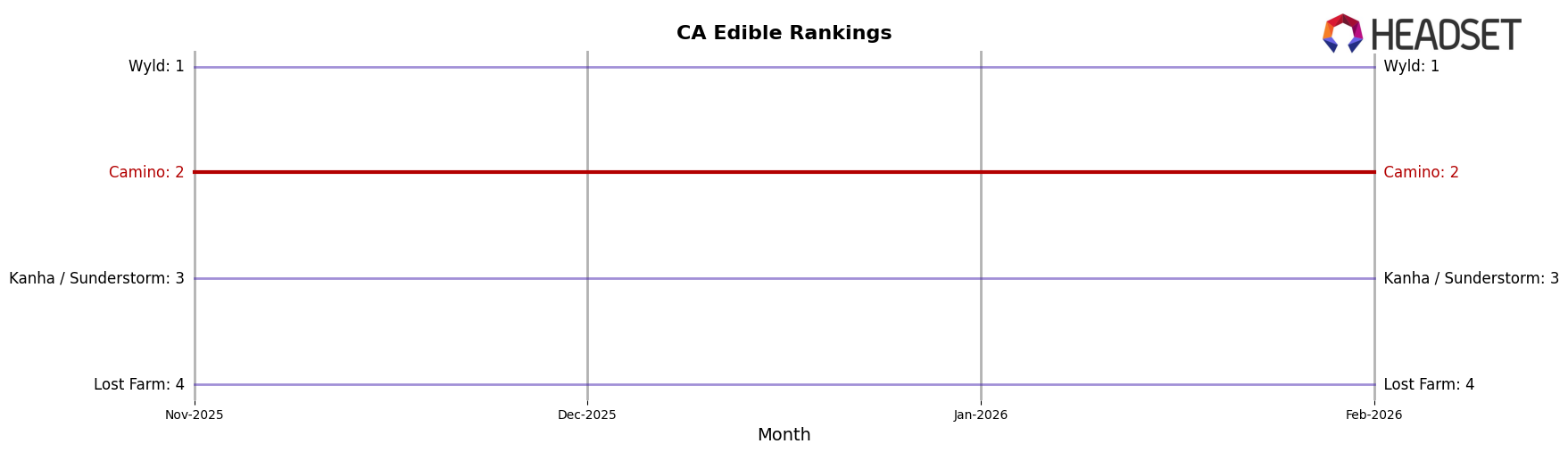

In the competitive landscape of the California edible market, Camino consistently holds the second rank from November 2025 through February 2026. Despite maintaining this position, Camino faces stiff competition from Wyld, which dominates the market as the top-ranked brand throughout the same period. The sales figures for Wyld are significantly higher than those of Camino, indicating a strong consumer preference or broader distribution network. Meanwhile, Kanha / Sunderstorm and Lost Farm consistently rank third and fourth, respectively, with sales figures that are notably lower than Camino's, suggesting that while they are competitive, they do not pose an immediate threat to Camino's position. However, Camino's sales show a downward trend from December 2025 to February 2026, which could indicate potential challenges in maintaining its market share if the trend continues. This analysis highlights the importance for Camino to strategize effectively to sustain its rank and potentially close the gap with Wyld.

Notable Products

In February 2026, the THC/CBN 5:1 Midnight Blueberry Sleep Gummies 20-Pack maintained its position as the top-performing product for Camino, consistently ranking first since November 2025, despite a decrease in sales to 88,510 units. The CBD/THC/CBN 1:1:1 Deep Sleep Sour Blackberry Dream Gummies 10-Pack also held steady at rank two, demonstrating stable consumer demand. Bliss - Sour Watermelon Lemonade Gummies 20-Pack regained its third-place ranking after a brief dip to fourth in January 2026. Wild Berry Chill Gummies 20-Pack, although dropping to fourth in February from its third-place position in January, remained a strong contender in the lineup. The THC/CBN 10:3 Sours Blackberry Dream Sleep Gummies 10-Pack consistently ranked fifth since its introduction in December 2025, showcasing its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.