Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

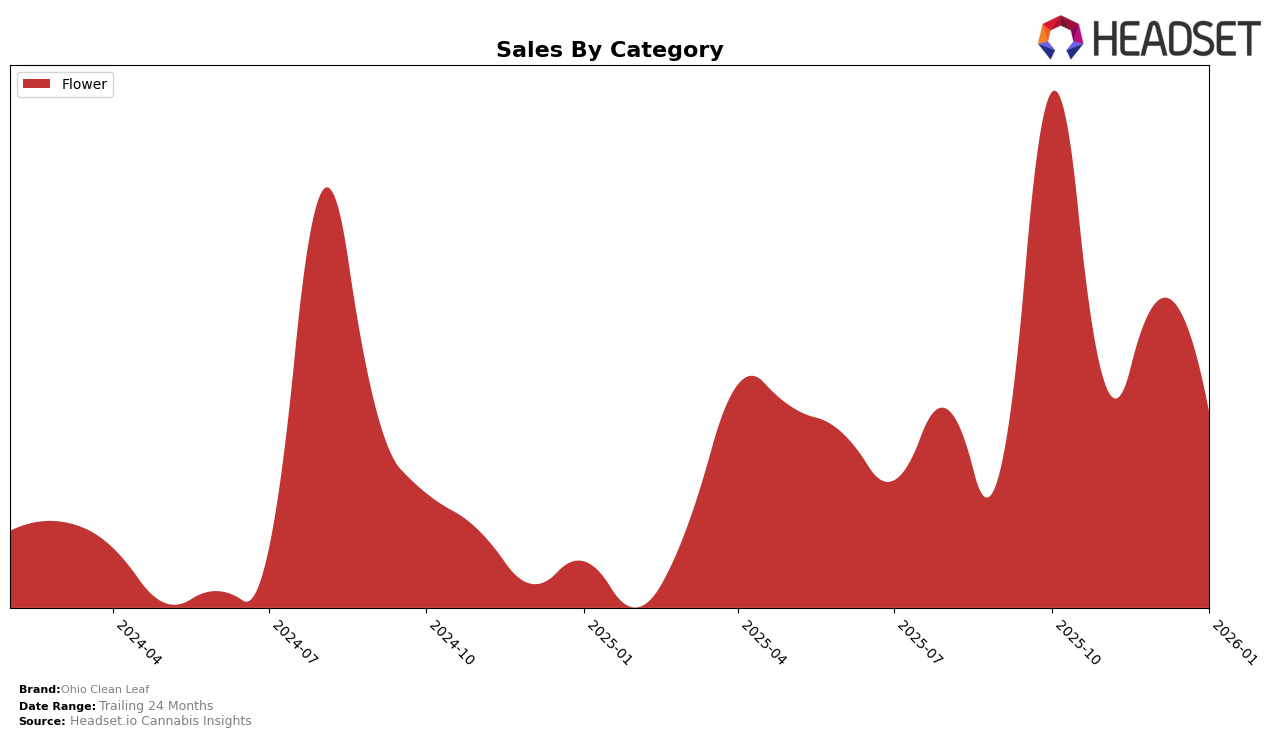

Ohio Clean Leaf has experienced fluctuating performance in the Flower category within the state of Ohio. In October 2025, the brand held the 18th position, which marked a relatively strong presence. However, subsequent months saw a decline, with rankings dropping to 29th in November, slightly recovering to 26th in December, and then falling back to 29th in January 2026. This movement indicates some volatility in their market position, which could be attributed to various factors such as competition, seasonal demand, or changes in consumer preferences. The notable drop in sales from October to November suggests that the brand faced challenges during that period, which may have impacted its ranking.

While Ohio Clean Leaf managed to stay within the top 30 brands in the Flower category in Ohio throughout the observed months, the fluctuation in their rankings highlights both opportunities and challenges in maintaining a steady market position. The brand's ability to recover slightly in December suggests potential resilience. However, the subsequent drop in January indicates that sustaining momentum remains a challenge. This performance pattern underscores the competitive nature of the cannabis market in Ohio and the need for brands like Ohio Clean Leaf to continually adapt and innovate to maintain or improve their standings.

Competitive Landscape

In the competitive landscape of the Ohio flower market, Ohio Clean Leaf has experienced notable fluctuations in rank and sales from October 2025 to January 2026. Starting at a strong position of 18th in October, Ohio Clean Leaf saw a decline to 29th by November, a slight recovery to 26th in December, and then a drop back to 29th in January. This volatility contrasts with competitors like The Standard, which maintained a relatively stable presence, fluctuating only slightly between 24th and 27th place. Meanwhile, Modern Flower experienced a significant drop from 25th in October to 50th in December, before improving to 31st in January, indicating a more volatile performance than Ohio Clean Leaf. The Botanist showed consistent performance, hovering around the 30th position, suggesting a steady market presence. Ohio Clean Leaf's sales trends reveal a peak in October, followed by a decline, which could be attributed to seasonal factors or increased competition. Understanding these dynamics is crucial for stakeholders looking to navigate the competitive Ohio flower market effectively.

Notable Products

In January 2026, Ohio Clean Leaf's top-performing product was Triple Burger (2.83g) in the Flower category, maintaining its number one rank from December 2025 despite a sales figure of 1353. Miracle Mints (2.83g) made a notable entry into the rankings at second place, showing strong performance without previous rankings. Sticky Buns (2.83g) held steady in third place, consistent with its December 2025 ranking. Triple Burger (14.15g) entered the rankings at fourth place, indicating growing popularity. Miracle Mints (14.15g) remained in fifth place, consistent with its December 2025 position, suggesting stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.