Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

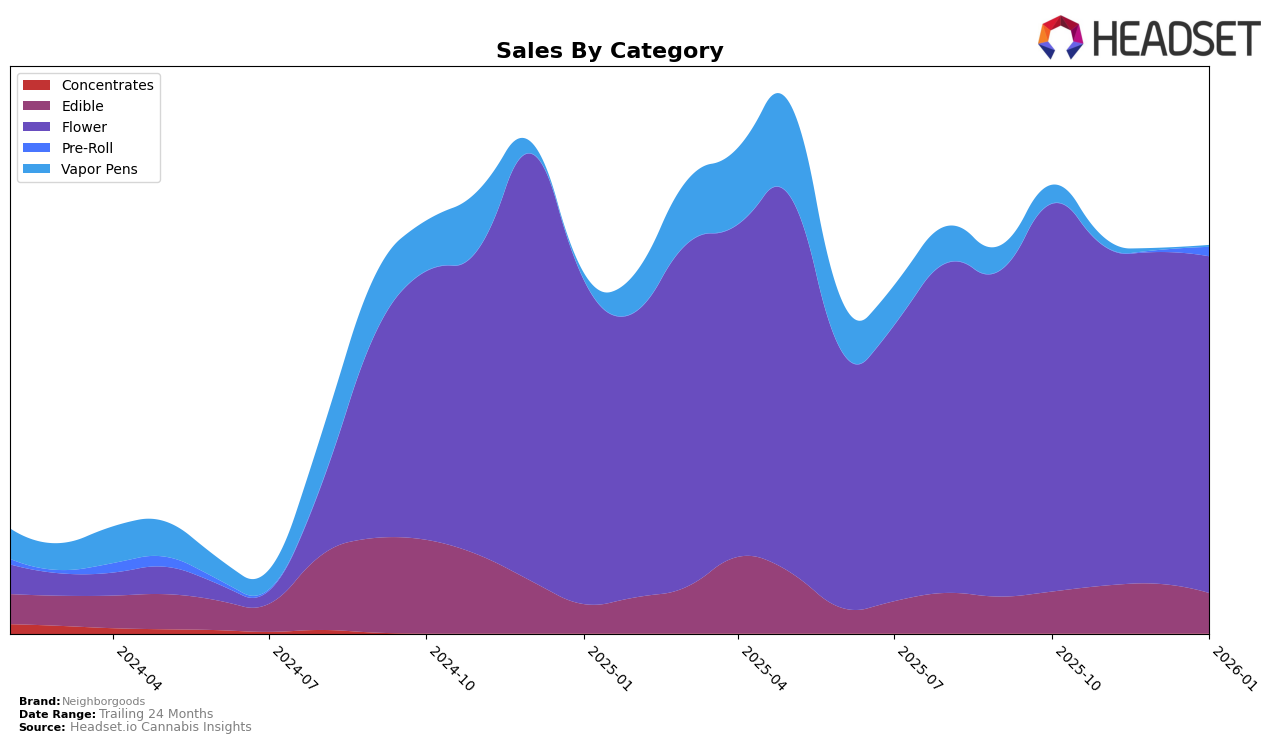

Neighborgoods has demonstrated a varied performance across different product categories in Ohio. In the Edible category, the brand maintained a stable position, ranking 11th in both November and December 2025, though it slipped slightly to 12th in January 2026. This consistency in the top 15 suggests a solid presence in the market. Meanwhile, in the Flower category, Neighborgoods experienced more volatility, dropping from 2nd place in October 2025 to 7th by December, before recovering to 5th in January 2026. This fluctuation might indicate competitive pressure or shifts in consumer preferences. The brand's absence from the top 30 in the Vapor Pens category after October 2025 could be viewed as a challenge, suggesting potential areas for strategic improvement or market reevaluation.

In the Pre-Roll category, Neighborgoods made an entry into the top 30 by January 2026, securing the 19th position, which marks a positive development for the brand in this segment. However, the lack of ranking in the Vapor Pens category post-October 2025 highlights a significant gap in their market presence, which could be a concern if not addressed. The overall sales trajectory across categories highlights a mixed performance, with some areas showing potential for growth and others indicating room for strategic adjustments. The brand's ability to navigate these dynamics will be crucial for its sustained success in Ohio.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Neighborgoods has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially holding a strong rank of 2nd in October 2025, Neighborgoods saw a decline to 6th and 7th in November and December, respectively, before recovering slightly to 5th in January 2026. This fluctuation in rank corresponds with a decrease in sales from October to December, followed by a modest recovery in January. Meanwhile, RYTHM consistently improved its position, climbing from 9th to 4th, indicating a robust sales growth trajectory that could pose a competitive threat. Similarly, Klutch Cannabis demonstrated a significant leap from 6th to 1st in November, although it settled at 3rd by January, suggesting strong but volatile performance. On the other hand, Grassroots experienced a decline in rank and sales, which may provide Neighborgoods an opportunity to capitalize on its competitor's downturn. Additionally, Eden's Trees surged impressively from 13th to 2nd by December, before dropping to 6th, indicating a potential for rapid market shifts. These dynamics highlight the competitive pressures Neighborgoods faces and the importance of strategic adjustments to maintain and improve its market standing in Ohio's flower category.

Notable Products

In January 2026, Melonade #8 (2.83g) maintained its top position as the leading product for Neighborgoods, achieving sales of 5,657 units. Hippie Crasher (2.83g) climbed to the second position from third in December 2025, indicating a positive trend in consumer preference. Spritzer Pre-Roll (1g) entered the rankings at third place, showing a significant debut in the Pre-Roll category. Cap J (2.83g) held steady at fourth place, reflecting consistent demand. Melonade #8 (14.15g) reappeared in the rankings at fifth place, suggesting a resurgence in popularity for this larger size offering.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.