Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

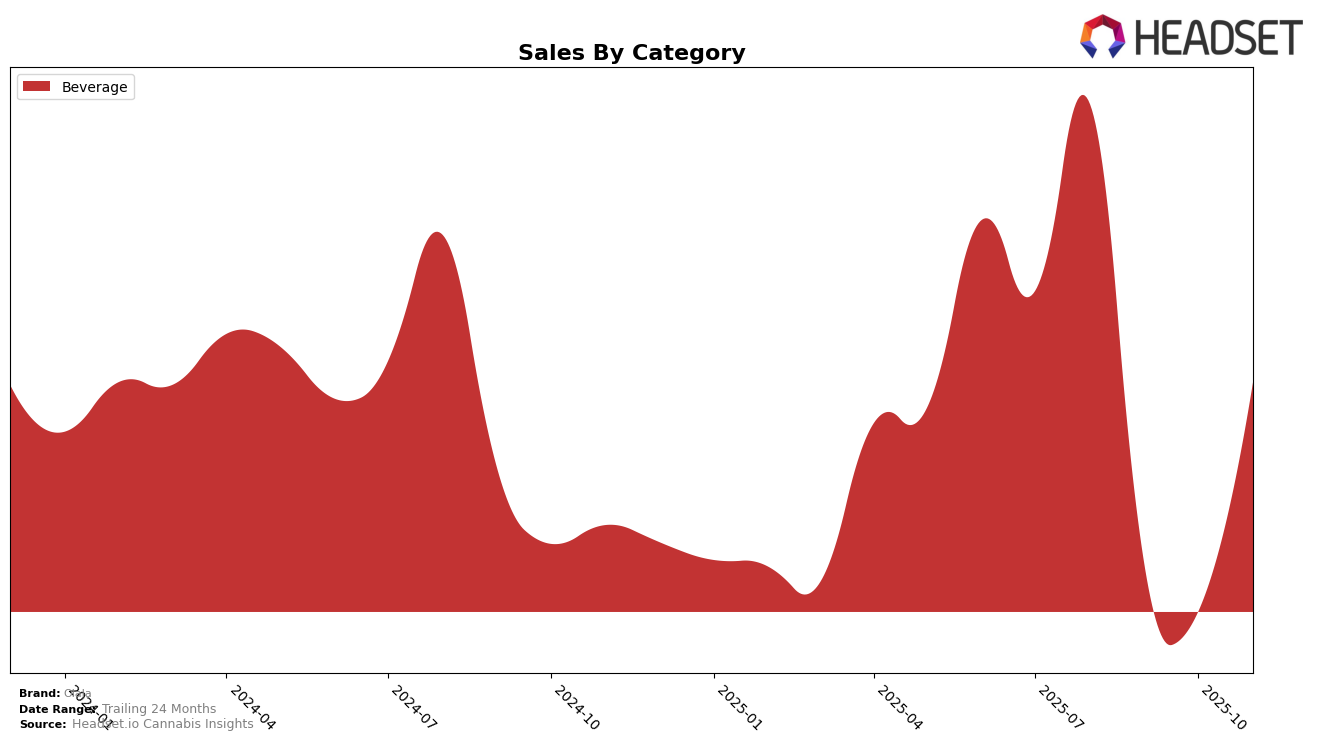

In the state of California, Olala's performance in the Beverage category showed a notable presence in August 2025, where it ranked 20th. However, the absence of rankings in the subsequent months of September, October, and November 2025 indicates that Olala did not maintain a position within the top 30 brands in this category. This downward movement suggests a potential decline in market competitiveness or consumer preference shifts that might have affected their standing significantly. It is crucial for Olala to analyze these trends and consider strategic adjustments to regain traction in the California beverage market.

While the specific sales figures for the months following August are not provided, the initial sales data in August 2025, where Olala achieved $19,633 in sales, offers a glimpse into their market potential. The absence of rankings in the later months could potentially signal a decrease in sales volume or market penetration, which might be a point of concern for stakeholders. Understanding the dynamics of consumer preferences and competitive actions in California's beverage category could be key for Olala to strategize effectively for future growth and re-entry into the top rankings.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Olala has shown a fluctuating presence, maintaining a rank of 20th in August 2025 but dropping out of the top 20 in subsequent months. This indicates a need for strategic adjustments to regain market traction. Notably, High Power has demonstrated a stronger performance, ranking higher than Olala in August and September 2025, despite also dropping out of the top 20 by November. Meanwhile, Kikoko experienced a temporary rise to 17th place in October before falling back to 21st in November, suggesting volatility in consumer preferences. Artet and Hundo have not consistently ranked in the top 20, indicating that Olala's competitive pressure may primarily come from brands like High Power and Kikoko. These dynamics highlight the importance for Olala to innovate and differentiate its offerings to capture a more stable market position.

Notable Products

In November 2025, Olala's top-performing product was the Orange Cream Infused Soda (100mg THC, 12oz) in the Beverage category, which reclaimed the number one spot after a dip in sales in September. Guava Soda (100mg THC, 12oz) climbed to the second position, showing a consistent upward trend from the fourth rank in September. Blue Raspberry Infused Soda (100mg THC, 12oz) ranked third, experiencing a drop from its peak position in September. The Root Beer Soda (100mg) maintained a steady position at fourth place, while Rootbeer Soda (10mg) also held the fourth rank, demonstrating stable sales figures with $37 in November. Overall, Olala's product rankings in November showed a resurgence in their infused sodas, particularly in the higher THC concentration products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.