Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

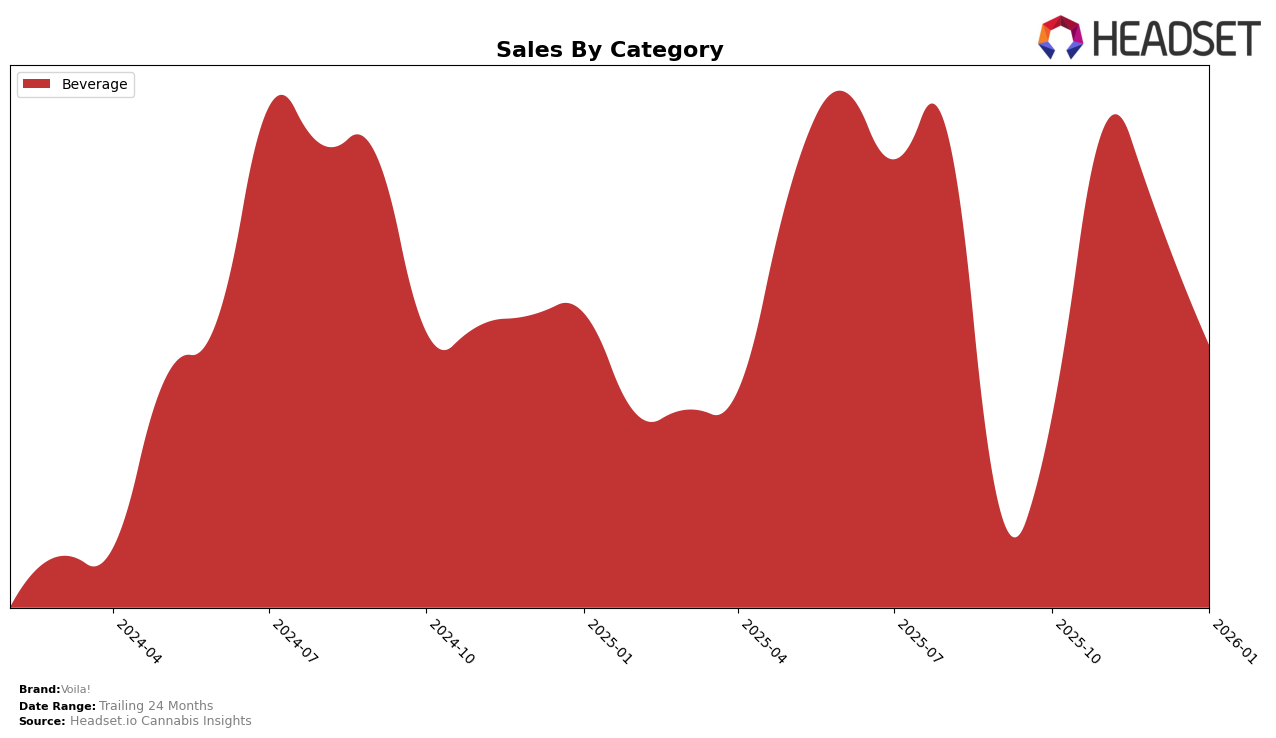

Voila! has shown a consistent presence in the California market within the beverage category, although their performance has seen a slight decline over the months. Starting in November 2025, Voila! entered the top 30 brands at rank 17 and experienced a gradual drop, landing at rank 19 by January 2026. This movement suggests a competitive landscape where maintaining or improving rank requires strategic efforts. The brand's sales figures also reflect this trend, with a notable decrease from November to January, indicating potential challenges in sustaining consumer interest or market share.

Notably, Voila! did not appear in the top 30 brands in October 2025, which could be seen as a missed opportunity to establish an early foothold in the market during that period. This absence highlights the importance of strategic entry timing and market penetration. Despite the decline in rankings and sales, Voila!'s ability to remain within the top 30 after entering suggests a level of resilience and potential for recovery with the right adjustments. Observing how they navigate the competitive pressures in California will be crucial for understanding their long-term viability in the beverage category.

Competitive Landscape

In the competitive California beverage category, Voila! experienced a fluctuating presence in the market rankings from October 2025 to January 2026. Initially absent from the top 20 in October, Voila! re-emerged in November at rank 17, before slipping to 18 in December and further to 19 in January. This downward trend in rank coincides with a notable decrease in sales, from a high in November to a significant drop by January. In contrast, Kan+Ade maintained a steady position at rank 16 from November to January, indicating a stable market presence despite a sales dip in January. Meanwhile, 5G (530 Grower) showed a positive trajectory, climbing from rank 21 in October to 17 by January, suggesting a strengthening market position. These dynamics highlight the competitive pressures Voila! faces, with brands like Kan+Ade and 5G (530 Grower) demonstrating resilience and growth, potentially impacting Voila!'s market share and necessitating strategic adjustments to regain momentum.

Notable Products

In January 2026, the top-performing product for Voila! was the CBD/THC 1:2 Cucumber Mint Sparking Water, which ascended to the number one rank with sales reaching 633 units. The CBD/THC 1:2 Lime Sparking Water and CBD/THC 1:2 Peach Pear Sparking Water tied for the second position, both experiencing a drop from their previous top ranks in December 2025. The CBD/THC 1:2 Pineapple Strawberry Sparking Water fell to third place, continuing its downward trend from the previous months. The CBD/THC 1:2 Watermelon Sparking Water maintained its fourth position, showing a significant decline in sales compared to December 2025. Overall, the Beverage category saw fluctuations, with the Cucumber Mint variant showing notable growth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.