Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

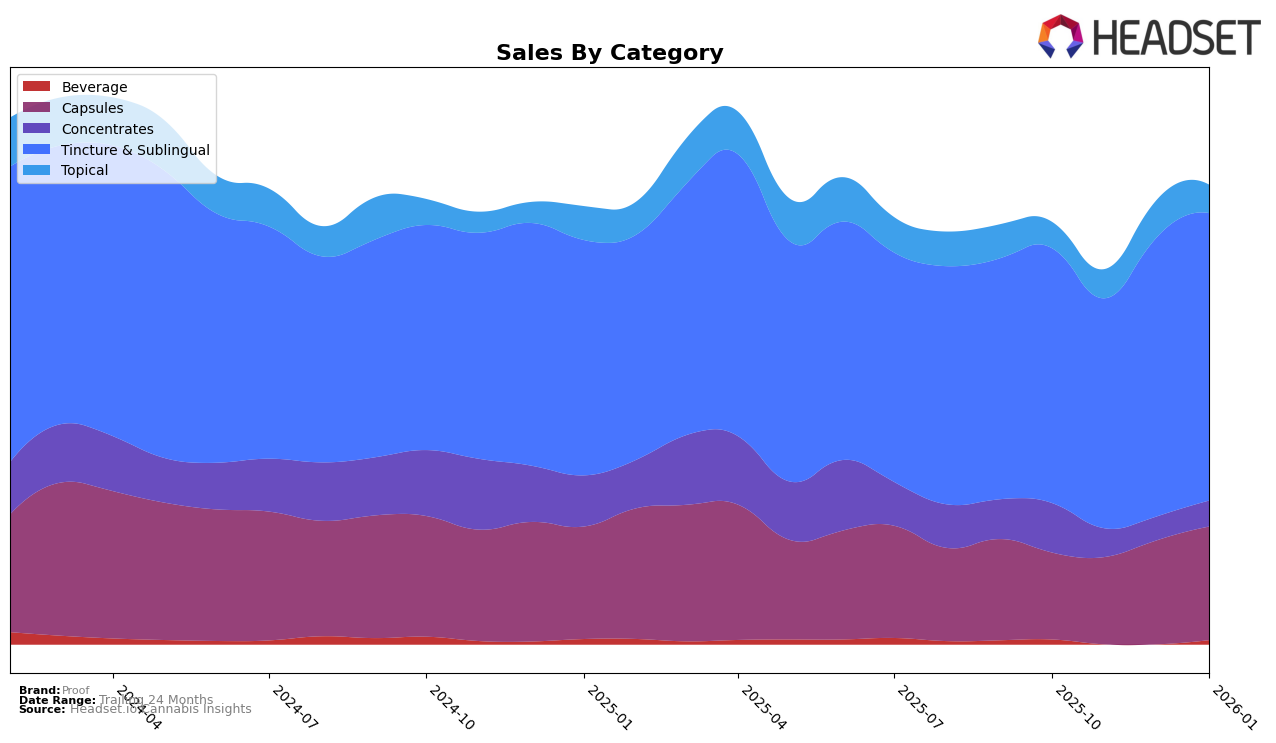

In California, Proof has showcased a stable performance in the Capsules category, maintaining a consistent presence in the top 11 for several months, with a slight improvement from 11th to 10th place between November 2025 and January 2026. This suggests a steady demand for their capsules, as indicated by a noticeable increase in sales over this period. Conversely, the brand's performance in the Concentrates category has been less impressive, as it failed to secure a spot in the top 30 rankings, indicating potential challenges or competitive pressures in this segment.

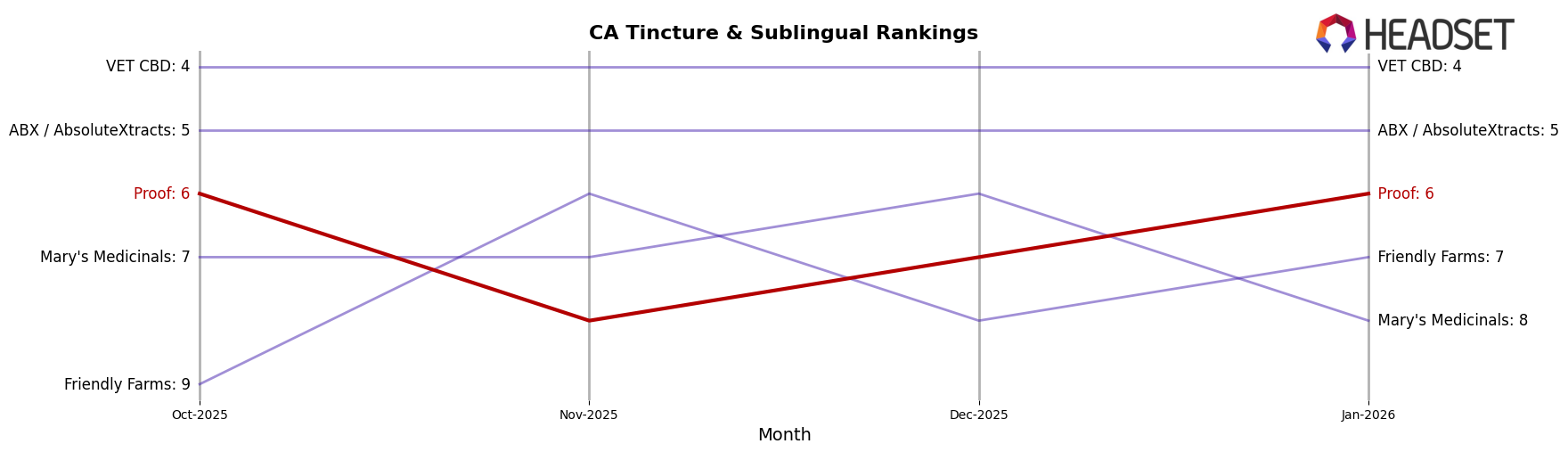

Proof's performance in the Tincture & Sublingual category in California remains robust, consistently ranking in the top 8 and peaking at 6th place in both October 2025 and January 2026. This highlights a strong foothold in this category, which could be attributed to their product offerings or brand loyalty. On the other hand, the Topical category shows some fluctuations, with Proof oscillating between 9th and 11th place over the months. Despite this variability, the brand managed to stay within the top 11, suggesting a resilient position amidst market dynamics. However, the absence of Proof in the top 30 in other categories or states might indicate areas for potential growth or strategic reevaluation.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Proof has demonstrated notable fluctuations in its rank, moving from 6th in October 2025 to 8th in November 2025, before climbing back to 6th by January 2026. This dynamic shift highlights the brand's resilience and adaptability in a competitive market. Despite these rank changes, Proof's sales figures show a positive trajectory, particularly from November to January, where sales increased significantly. In contrast, competitors such as VET CBD maintained a consistent 4th place rank throughout the same period, indicating stable market dominance. Meanwhile, Mary's Medicinals and Friendly Farms experienced rank fluctuations similar to Proof, suggesting a competitive and volatile market environment. These insights emphasize the importance for Proof to continue leveraging its strengths to maintain and potentially improve its market position amidst strong competitors.

Notable Products

In January 2026, Proof's top-performing product was the CBD/THC 1:1 Bazillion Tincture Drops (1000mg CBD, 1000mg THC, 15ml) from the Tincture & Sublingual category, maintaining its first-place rank for four consecutive months with sales reaching 969 units. The High THC Tincture (1000mg THC, 15ml) secured the second position, consistently holding this rank since November 2025. The CBD Extra Strength Tincture (1000mg CBD, 15ml) remained in third place, showing stable performance across the months. The CBD/THC 20:1 Tincture (300mg CBD, 15mg THC, 15ml) climbed back to fourth place, regaining its position from October 2025 after a temporary absence in December. Meanwhile, the CBD Rich Tincture Drops (1000mg CBD, 15ml) entered the top five in January 2026, following a similar ranking in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.