Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

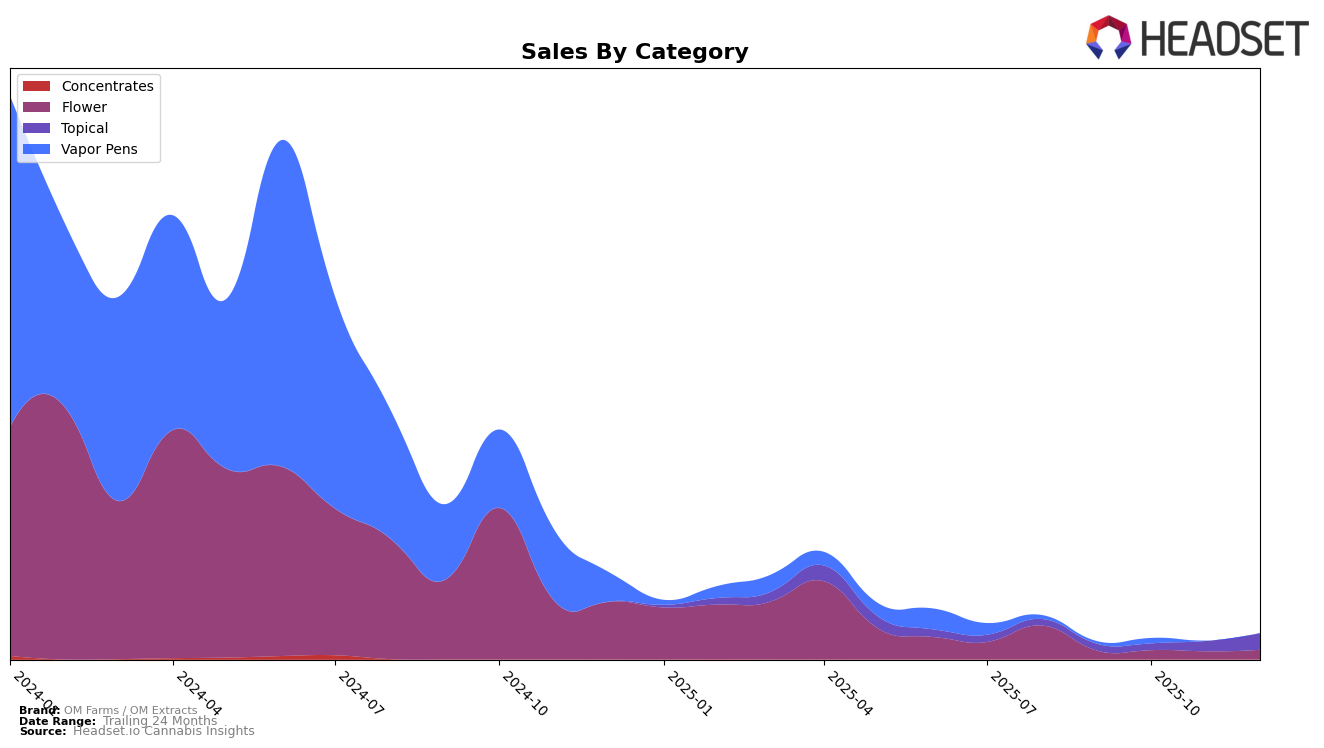

OM Farms / OM Extracts has shown a notable entrance into the topical category in Oregon towards the end of 2025. While the brand did not appear in the top 30 rankings from September to November, it made a significant leap in December, securing the 7th position. This suggests a strong finish to the year, indicating a potential rise in consumer interest or successful marketing strategies that captured the market's attention. Despite the absence in earlier months, the December ranking highlights a positive trajectory that could set the stage for continued success into the new year.

The rise of OM Farms / OM Extracts in Oregon is particularly interesting given the competitive nature of the topical category. The brand's ability to enter the top 10 in December, after not being ranked previously, may reflect strategic adjustments or new product introductions that resonated well with consumers. While specific sales figures for the months leading to December are not available, the sales data for December alone, totaling $10,795, underscores the brand's impactful presence. This movement suggests that OM Farms / OM Extracts is a brand to watch as it continues to navigate the dynamic cannabis market landscape.

Competitive Landscape

In the Oregon Topical category, OM Farms / OM Extracts has shown a notable presence by entering the top 20 rankings in December 2025, securing the 7th position. This marks a significant achievement, considering the brand was not ranked in the preceding months of September, October, and November 2025. This upward trajectory indicates a positive reception and growing market presence. In comparison, Angel (OR) maintained a consistent presence, ranking 5th in September and October, with a slight dip in December to 6th. Meanwhile, Synergy Skin Worx demonstrated strong performance, peaking at 3rd in October and maintaining a top 5 position throughout the period. The competitive landscape suggests that while OM Farms / OM Extracts is gaining traction, it faces stiff competition from established brands like Angel (OR) and Synergy Skin Worx, which have consistently higher sales figures, indicating a need for strategic marketing efforts to sustain and improve its rank and sales.

Notable Products

In December 2025, OM Farms / OM Extracts saw the CBD/THC 1:1 Arnica Relief Bath Salts (25mg CBD, 25mg THC) retain its top position in the Topical category, with sales reaching 222 units. The CBD/THC 1:1 Time To Relax Lavender Epsom Bath Salts (100mg CBD, 100mg THC, 6.5oz) maintained its rank at second place, showing consistent performance over the months. The CBD/THC 1:1 Balance Recovery Bath Salts (100mg CBD, 100mg THC, 6.5oz) climbed to third place from fourth in November, demonstrating a positive trend. Notably, the Blueberry Muffin Shake (7g) entered the rankings at fourth place in December, highlighting its emerging popularity. Meanwhile, the CBD/THC 1:1 Rose Geranium Balance Bath Salts (100mg CBD, 100mg THC, 6.5oz) dropped to fifth place from third, indicating a slight decline in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.