Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

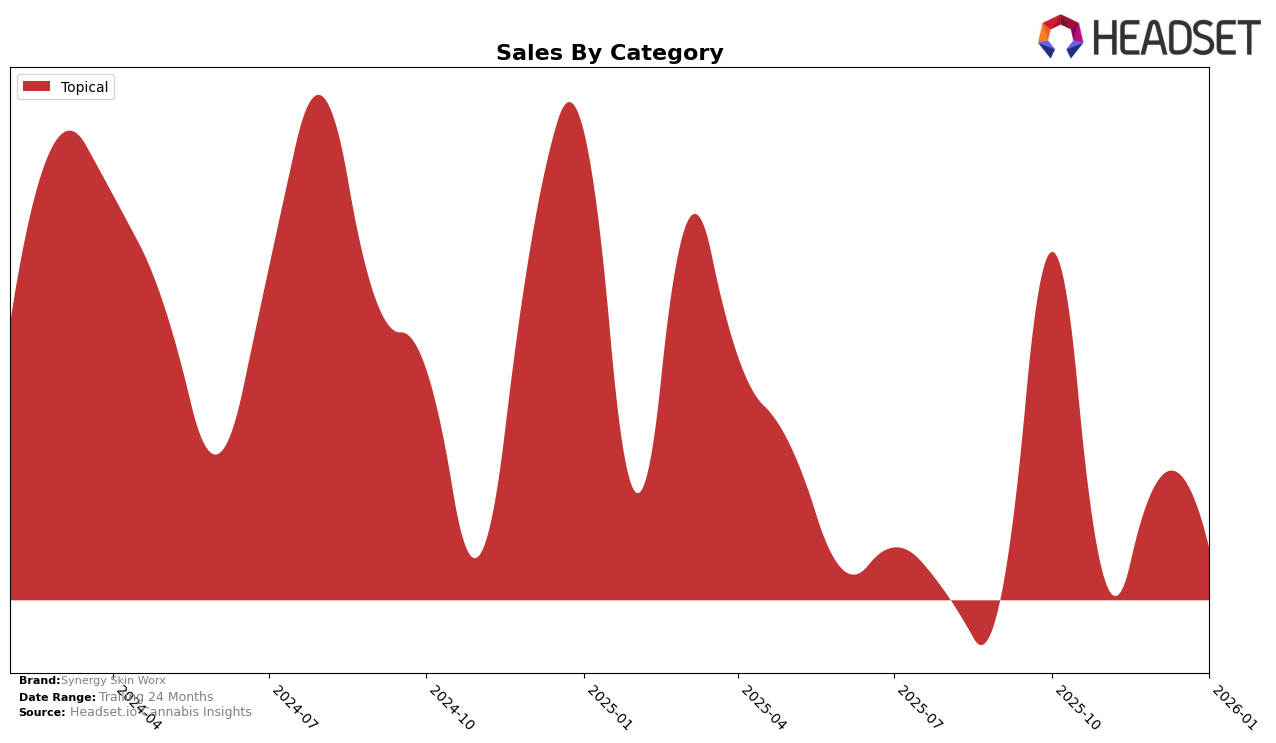

Synergy Skin Worx has shown a consistent presence in the Oregon market, particularly in the Topical category. Despite a slight dip in sales from October to November 2025, where sales decreased from $26,064 to $13,687, the brand maintained its position within the top five, ranking fourth in January 2026. This indicates a resilient market presence, as the brand managed to recover in December 2025 with an increase in sales to $17,331, before slightly dropping again in January 2026. The ability to stay within the top rankings suggests a strong customer base and effective market strategies in Oregon.

However, Synergy Skin Worx's absence in the top 30 brands for other states or categories could be a potential area of concern or opportunity for growth. The lack of presence in these rankings might indicate either limited distribution or competition that is more intense outside of Oregon. This highlights the importance for Synergy Skin Worx to potentially explore diversification strategies or enhance their marketing efforts in other regions to capture a larger market share. Understanding the dynamics of these markets could provide valuable insights into how the brand can expand its footprint beyond its current stronghold.

Competitive Landscape

In the Oregon topical cannabis market, Synergy Skin Worx has experienced fluctuations in its competitive standing from October 2025 to January 2026. Initially ranked 3rd in October 2025, the brand saw a decline to 4th in November and further to 5th in December, before recovering slightly to 4th in January 2026. This shift in rank reflects a competitive landscape dominated by High Desert Pure, which consistently held the top position, and Medicine Farm, maintaining a steady 2nd place. Notably, Physic Cannabis Therapy emerged in December 2025, securing the 4th position, which contributed to Synergy Skin Worx's temporary drop to 5th. The sales trajectory for Synergy Skin Worx shows a decline from October to November, followed by a modest recovery in December, but the brand's sales remained significantly lower than the leading competitors. This competitive pressure underscores the need for Synergy Skin Worx to innovate and differentiate to regain and sustain higher market positions.

Notable Products

In January 2026, the top-performing product for Synergy Skin Worx was the CBD/CBN/CBC/CBG/THC Entourage Patch, maintaining its number one rank from December 2025 with sales of 514 units. The THC Transdermal Patch held steady at the second position, although its sales decreased from the previous month. The High CBD Transdermal Patch improved its ranking to third place, up from fifth in December 2025, indicating a rising interest in high-CBD options. The CBD/CBC/CBN/CBG/THC : 2:1 Entourage Transdermal Patch slipped to fourth place, while the CBD/THC 1:1 Transdermal Patch entered the top five for the first time, securing the fifth position. This shift in rankings suggests a dynamic market with evolving consumer preferences for specific cannabinoid profiles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.