Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

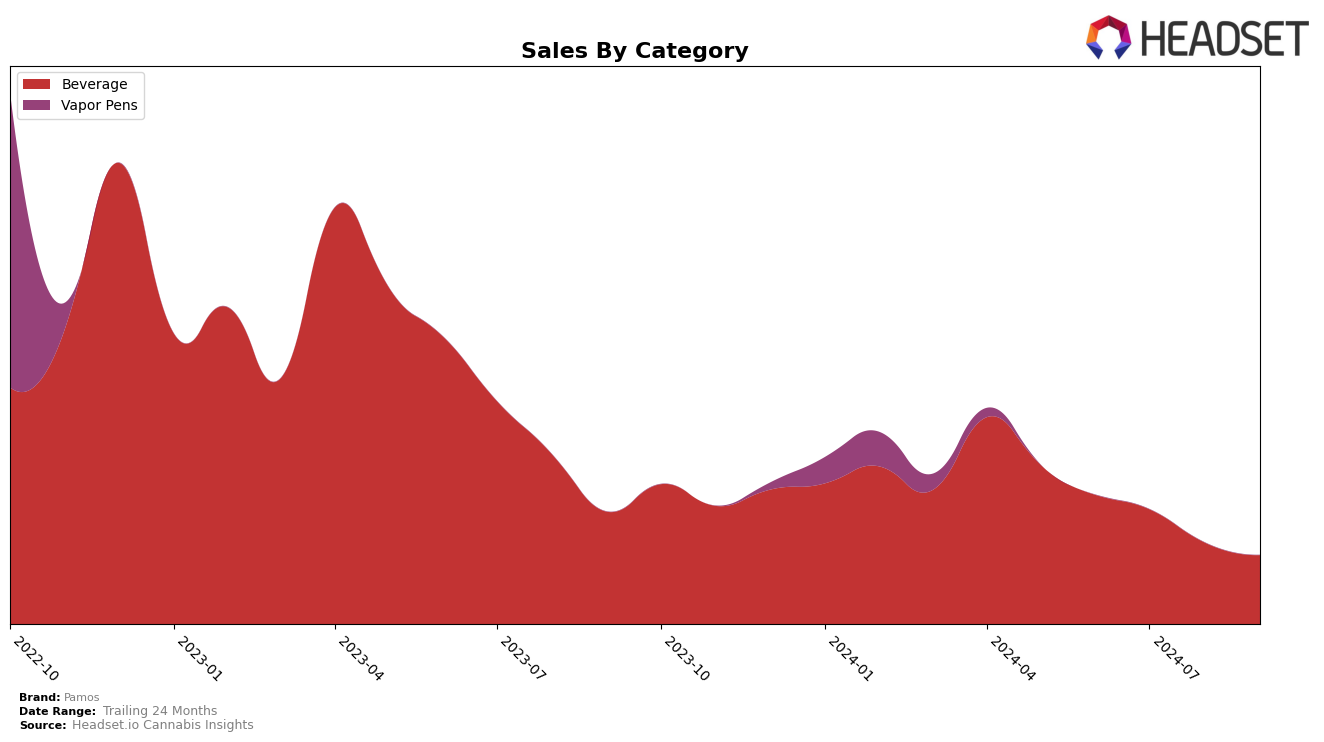

Pamos has shown a consistent presence in the Beverage category in Nevada, maintaining a strong position within the top 10 brands over the past few months. Despite a slight decline from 8th to 9th place in September 2024, the brand has demonstrated resilience in a competitive market. This movement suggests a potential challenge in sustaining its previous sales momentum, as evidenced by a gradual decrease in monthly sales figures from June to September. However, maintaining a top 10 position indicates a solid consumer base and brand recognition in the region.

In contrast, Pamos does not appear in the top 30 rankings for any other states or provinces, which could be seen as a limitation in its geographical reach or market penetration outside of Nevada. This absence might highlight opportunities for growth or expansion into new markets where the brand is currently underrepresented. Understanding the dynamics of these other markets could provide strategic insights for Pamos to broaden its footprint and improve its overall brand performance across different regions and categories.

Competitive Landscape

In the Nevada beverage category, Pamos has experienced a slight decline in its ranking from 8th place in June, July, and August 2024 to 9th place in September 2024. This shift comes as CannaPunch re-entered the top 10 in September, moving up to 8th place, which may have contributed to Pamos's drop. Despite this, Pamos has maintained a consistent presence in the top 10 throughout the summer months, indicating a stable market position. However, its sales have shown a downward trend over this period, which could be a concern for maintaining its competitive edge. In contrast, High Heads, which consistently ranks higher, has also seen a decline in sales, albeit from a much higher base, suggesting a broader market trend that Pamos should be aware of. This competitive landscape highlights the importance for Pamos to innovate and possibly re-strategize to regain its higher rank and boost sales in the Nevada beverage market.

Notable Products

In September 2024, Pamos's top-performing product was the Raspberry Long Island Iced Tea Cocktail (100mg) in the Beverage category, maintaining its number one rank for four consecutive months despite a sales decrease to 430 units. The Tropical Mai Tai High Dose Cocktail (100mg) also held its steady second position since June, with sales at 236 units. The CBD/THC 1:5 Tropical Mai Tai Spritz (2mg CBD, 10mg THC) saw an impressive rise to third place, up from fourth in August, with sales increasing to 115 units. Conversely, the CBD/THC 1:3 Peach & Guava Bellini Spritz (10mg THC, 2mg CBD, 12oz) dropped to fourth position, reflecting a slight sales decline to 101 units. Finally, the CBD/THC 1:3 Peach & Guava Bellini Cocktail (2mg CBD, 6mg THC) maintained its fifth position, despite lower sales figures compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.