Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

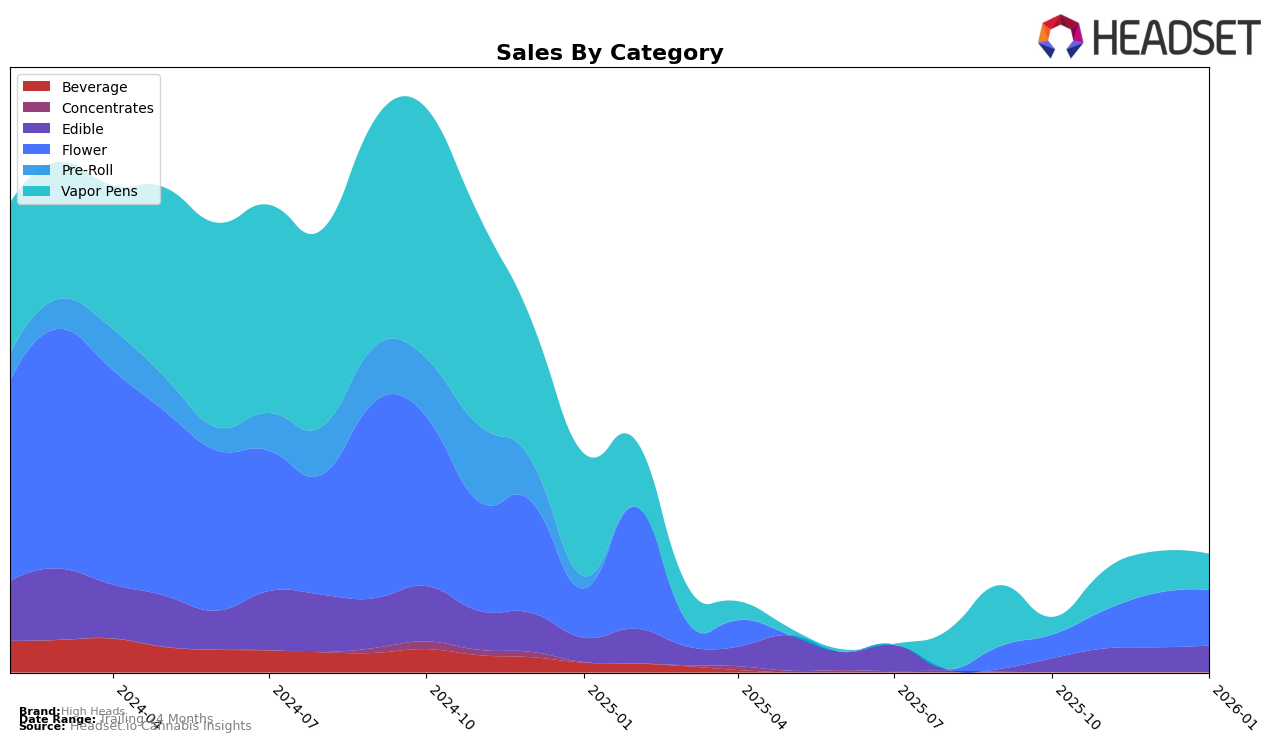

High Heads has demonstrated notable performance in the Nevada market across various product categories. In the Edible category, the brand has shown a consistent upward trajectory, moving from the 22nd position in October 2025 to 16th by January 2026. This steady climb is accompanied by a significant increase in sales, indicating a growing consumer preference for their products in this segment. Conversely, in the Vapor Pens category, High Heads experienced some fluctuations. While the brand improved its ranking from 37th to 21st between October and December 2025, it slipped back to 27th in January 2026, suggesting potential challenges in maintaining consistent growth in this segment.

In the Flower category, High Heads has made significant strides, moving from a 64th position in October 2025 to 36th by January 2026. This substantial improvement highlights the brand's strengthening foothold in the Nevada flower market, possibly driven by product innovations or strategic marketing efforts. However, it's important to note that despite the progress, the brand has not yet broken into the top 30, which could be a target for future growth. The absence of a ranking in the top 30 for certain months in some categories indicates areas where High Heads might focus on enhancing their market presence to achieve a more robust standing.

Competitive Landscape

In the competitive landscape of the Nevada flower category, High Heads has shown a promising upward trajectory in its rankings from October 2025 to January 2026. Initially ranked 64th in October, High Heads improved its position to 36th by January, indicating a significant gain in market presence. This upward movement is notable when compared to competitors like Matrix NV, which fluctuated in the lower ranks, and Hijinx, which also improved but remained behind High Heads. Reina consistently maintained a higher rank, entering the top 20 by December, suggesting a strong market hold. However, High Heads' consistent sales growth, especially from November to January, indicates a robust demand that could potentially close the gap with top-tier brands like Reina. This trend highlights High Heads' increasing consumer appeal and potential for further rank elevation in the Nevada flower market.

Notable Products

In January 2026, the top-performing product for High Heads was the Razzle Dazzle Gummies 10-Pack (100mg), which maintained its first-place ranking from the previous months, achieving sales of 1802 units. The London Jealousy Distillate Cartridge (0.9g) climbed to the second position from third in December, reflecting a positive trend with sales of 1100 units. Meanwhile, the Gelonade Distillate Cartridge (0.9g) re-entered the rankings at third place, while the Pink Rozay Distillate Cartridge (0.9g) slipped to fourth. Notably, the CBD/THC 1:1 Sour Cherry Blast Gummies 10-Pack made its debut in the rankings at fifth place. The rankings indicate a consistent preference for edibles and vapor pens among High Heads' customers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.