Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

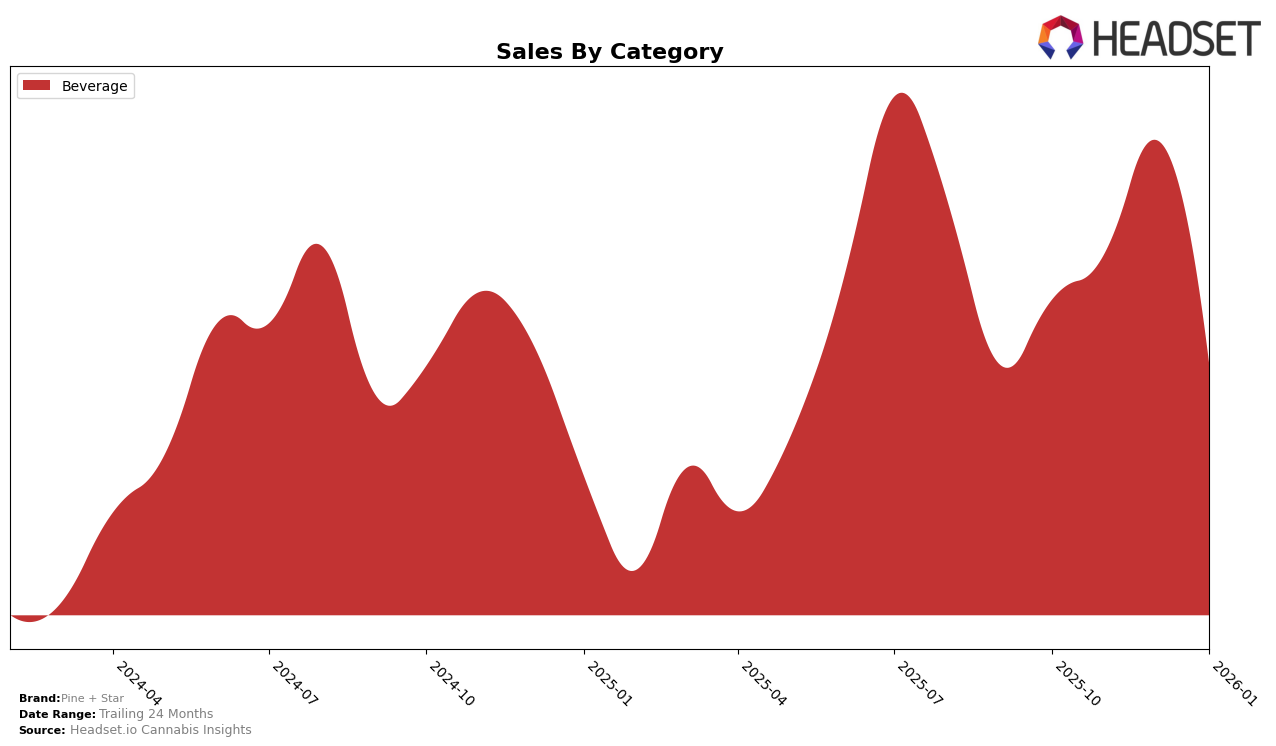

Pine + Star has shown a consistent performance in the Beverage category within the state of Massachusetts. The brand maintained a strong presence, consistently ranking in the top 10 over the four-month period from October 2025 to January 2026. Notably, Pine + Star held the 5th position in both November and December 2025, reflecting a solid market presence during these months. However, there was a slight dip in January 2026, where the brand slipped back to the 6th position. Despite this minor setback, the brand's sales trajectory over the months indicates a robust demand, with a peak in December 2025 before experiencing a decrease in January 2026.

While Pine + Star's performance in Massachusetts is commendable, it is important to note the absence of rankings in other states or provinces. This suggests that the brand might not be as competitive or widely available in other regions, which could be a point of concern or an opportunity for growth, depending on the strategic goals of the company. The consistent top 10 presence in Massachusetts, however, could serve as a strong foundation for potential expansion efforts. Understanding the factors behind their regional success could provide insights into scaling their operations in other markets.

Competitive Landscape

In the Massachusetts beverage category, Pine + Star has experienced fluctuating rankings over the past few months, indicating a competitive landscape. In October 2025, Pine + Star was ranked 6th, improving to 5th in November and December, before dropping back to 6th in January 2026. This fluctuation is notable as it highlights the brand's vulnerability to shifts in consumer preference and competitive actions. Buzzy consistently outperformed Pine + Star, maintaining a higher rank throughout this period, which suggests a stronger market presence and possibly a more loyal customer base. Meanwhile, Chill Medicated and Pine + Star have been closely competing, with Chill Medicated slightly edging out Pine + Star in January 2026. Other competitors like Sip and Squier's Elixirs have shown steady performance, but remain lower in rank compared to Pine + Star, indicating potential opportunities for Pine + Star to capitalize on its current standing and further solidify its position in the market.

Notable Products

In January 2026, the top-performing product for Pine + Star was the Blueberry Lemonade Sparkling Beverage, maintaining its leading position from December 2025 with sales reaching 3615 units. The Cape Code Cranberry Sparkling Beverage, which was previously ranked first in October and December 2025, fell to the second position in January. The Strawberry Lemonade Sparkling Beverage climbed to the third spot, showing a consistent rise from its previous fourth position in both October and December 2025. A new entry, Watermelon Limeade Sparkling Beverage, debuted at fourth place in January. Tea & Lemonade remained steady in the fifth position, experiencing a gradual decline in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.