Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

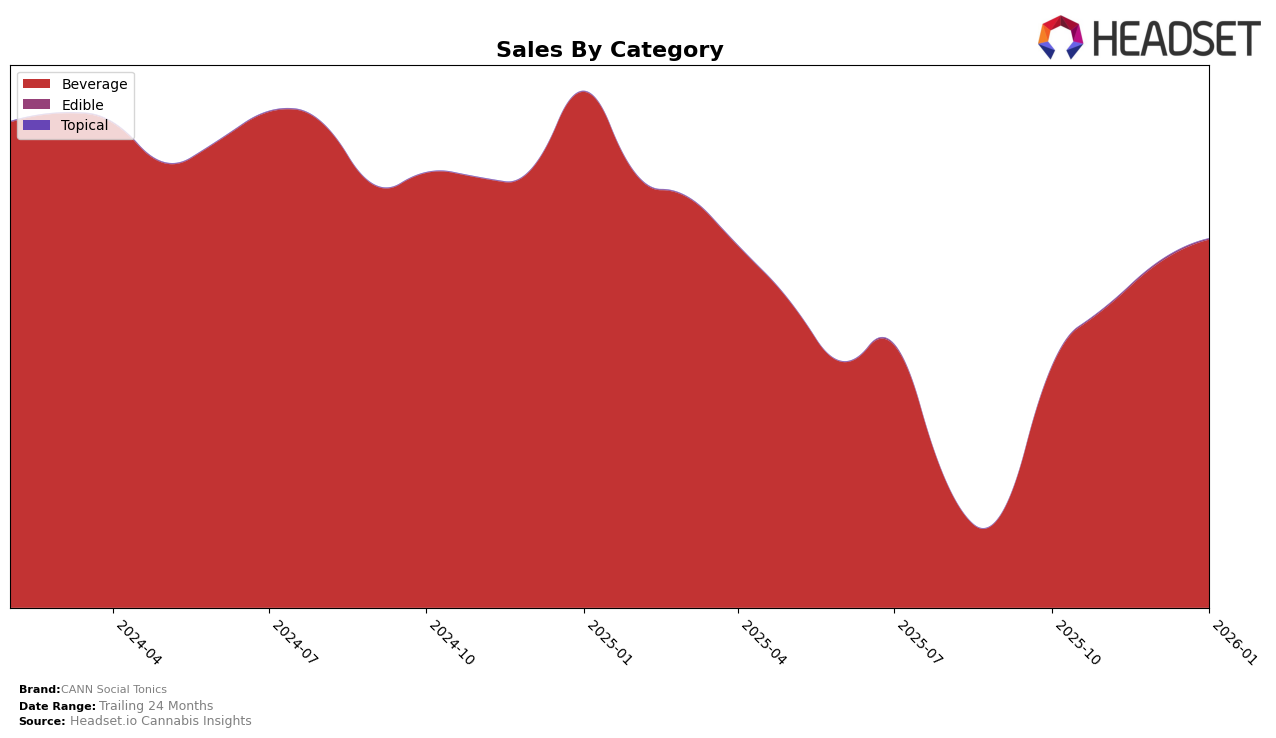

CANN Social Tonics has demonstrated notable performance in the beverage category across various states, with significant movement in rankings and sales figures. In California, the brand has shown consistent improvement, moving from the 7th position in October 2025 to the 5th position by January 2026. This upward trend is mirrored by a steady increase in sales, indicating a growing consumer preference in the state. Conversely, in Connecticut, CANN Social Tonics has experienced some fluctuations, maintaining a strong presence in the top three but alternating between the 2nd and 3rd positions over the same period. Such variability suggests a competitive market environment, yet the brand's ability to remain within the top ranks highlights its resilience and appeal.

It's important to note that CANN Social Tonics' consistent presence in the top rankings across these states is not universal across all regions, as there are markets where the brand does not appear within the top 30, which could be indicative of either emerging competition or different consumer preferences. Despite these challenges, the brand's performance in major markets like California and Connecticut underscores its potential for further expansion and dominance in the beverage category. As the brand continues to navigate these diverse market dynamics, observing its strategies and adaptations could provide valuable insights into its future trajectory and potential areas for growth.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, CANN Social Tonics has shown a notable upward trend in its ranking and sales over the past few months. Starting from a rank of 7th in October 2025, CANN Social Tonics improved its position to 5th by January 2026, indicating a positive reception and growing popularity among consumers. This upward movement places CANN Social Tonics ahead of Almora Farms, which slipped from 5th to 7th in the same period. Although Manzanita Naturals and Pabst Labs maintain higher sales figures, CANN Social Tonics' consistent growth trajectory suggests a strengthening brand presence. Meanwhile, Not Your Father's Root Beer remains a dominant force, consistently holding the 3rd rank with significantly higher sales. The data indicates that while CANN Social Tonics is gaining ground, there remains a competitive gap with the top-tier brands, highlighting potential opportunities for strategic marketing and product innovation.

Notable Products

In January 2026, the top-performing product from CANN Social Tonics was the CBD/THC 2:1 Blood Orange Cardamom Social Tonic 6-Pack, which climbed to the number one spot with sales of 3254 units. The Hi Boy - Blood Orange Cardamom Social Tonic 4-Pack maintained its consistent performance, holding steady at the second position. The CBD/THC 2:1 Lemon Lavender Social Tonic 6-Pack rose to third place, indicating a growing preference for this flavor. A notable shift was observed for the CBD/THC 2:1 Blood Orange Cardamom Social Tonic, which fell from first in December to fourth in January. Meanwhile, the Hi Boy - Lemon Lavender Social Tonic 4-Pack rounded out the top five, showing a slight decline from its previous third position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.