Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

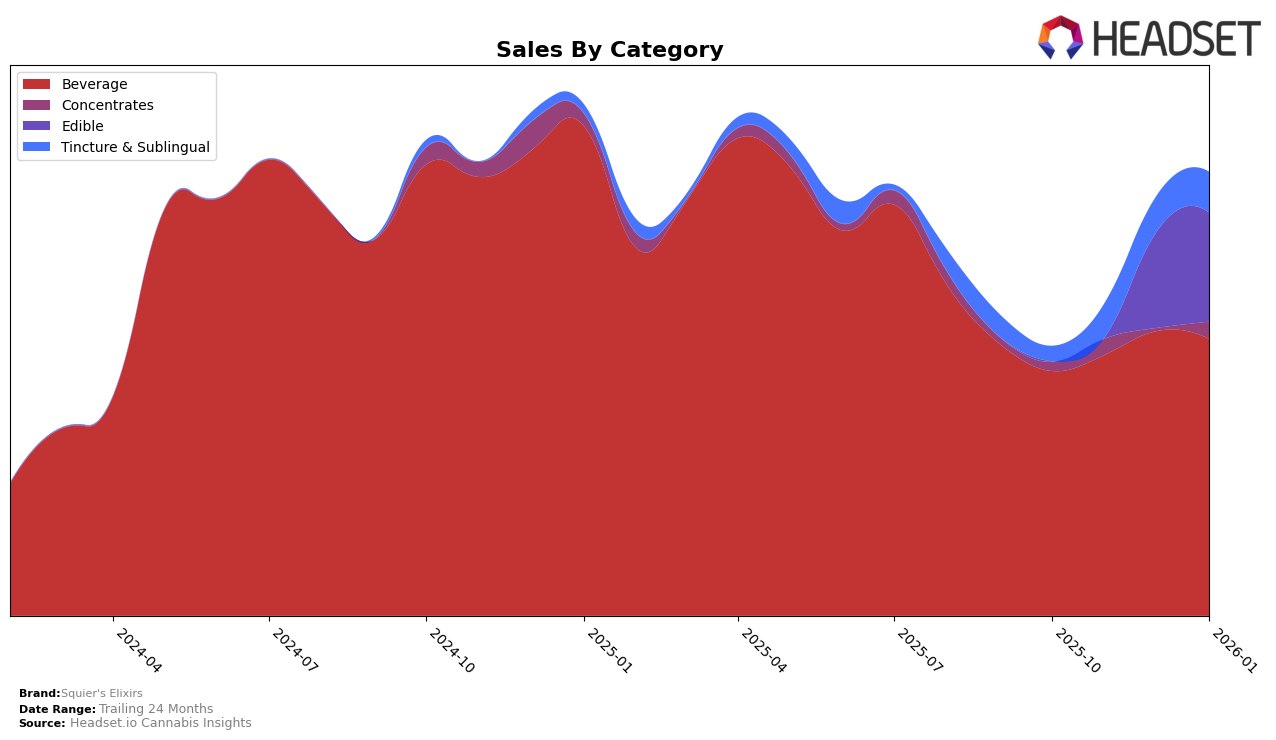

Squier's Elixirs has shown a consistent performance in the Massachusetts beverage category, maintaining a steady rank of 7th from November 2025 through January 2026. This stability suggests a strong market presence and consumer loyalty within the state. Their sales figures also reflect a positive trend, with a noticeable increase from October to December 2025, before a slight dip in January 2026. This could indicate a seasonal variation or a temporary market fluctuation. The brand's ability to hold a top 10 position consistently speaks to its competitive edge in the beverage segment.

In contrast, Squier's Elixirs has faced challenges in the edible category in Massachusetts, as they were not ranked in the top 30 until December 2025. By January 2026, they improved to 48th place, reflecting a positive movement but also highlighting the competitive nature of the edible market. The absence from the top 30 in previous months may have implications for their market strategy or product offerings in this category. The increase in sales from December 2025 to January 2026 suggests potential for growth if they can capitalize on this upward trend. However, maintaining and improving their position will be crucial for long-term success in the edibles space.

Competitive Landscape

In the competitive Massachusetts beverage category, Squier's Elixirs has shown a consistent performance, maintaining its rank at 7th place from November 2025 through January 2026, after an initial rise from 8th place in October 2025. This stability is notable given the fluctuating ranks of nearby competitors such as Sip, which improved from 10th to 8th place, and Vibations, which briefly dipped to 11th place in December 2025 before returning to 9th. Meanwhile, Chill Medicated and Pine + Star have been trading places in the top 5, indicating a more volatile competitive landscape at the higher ranks. Despite this, Squier's Elixirs has managed to increase its sales steadily over the months, suggesting a strong customer base and effective marketing strategies that could be leveraged further to climb the ranks. This consistent performance amidst a dynamic market highlights Squier's Elixirs' potential for growth and resilience in the Massachusetts beverage sector.

Notable Products

In January 2026, the top-performing product from Squier's Elixirs was the Pink Pineapple Hash Rosin Drink Elixir (500mg THC, 4oz) in the Beverage category, maintaining its number one rank from December 2025 with sales of 417 units. The Blueberry Lemonade Hash Rosin Elixir Mix (200mg THC, 8oz) climbed to the second position, up from fourth in December, indicating a significant rise in popularity. The Blueberry Lemon Hash Rosin Elixir Mix (500mg THC, 4oz) held steady at the third rank, showing consistent demand. Meanwhile, the Raspberry Lime Hash Rosin Elixir Mix (500mg THC, 4oz) dropped from second to fourth place. Notably, the Mandarin Mango Gummies 20-Pack (100mg) entered the rankings for the first time in fifth place, suggesting a growing interest in edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.