Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

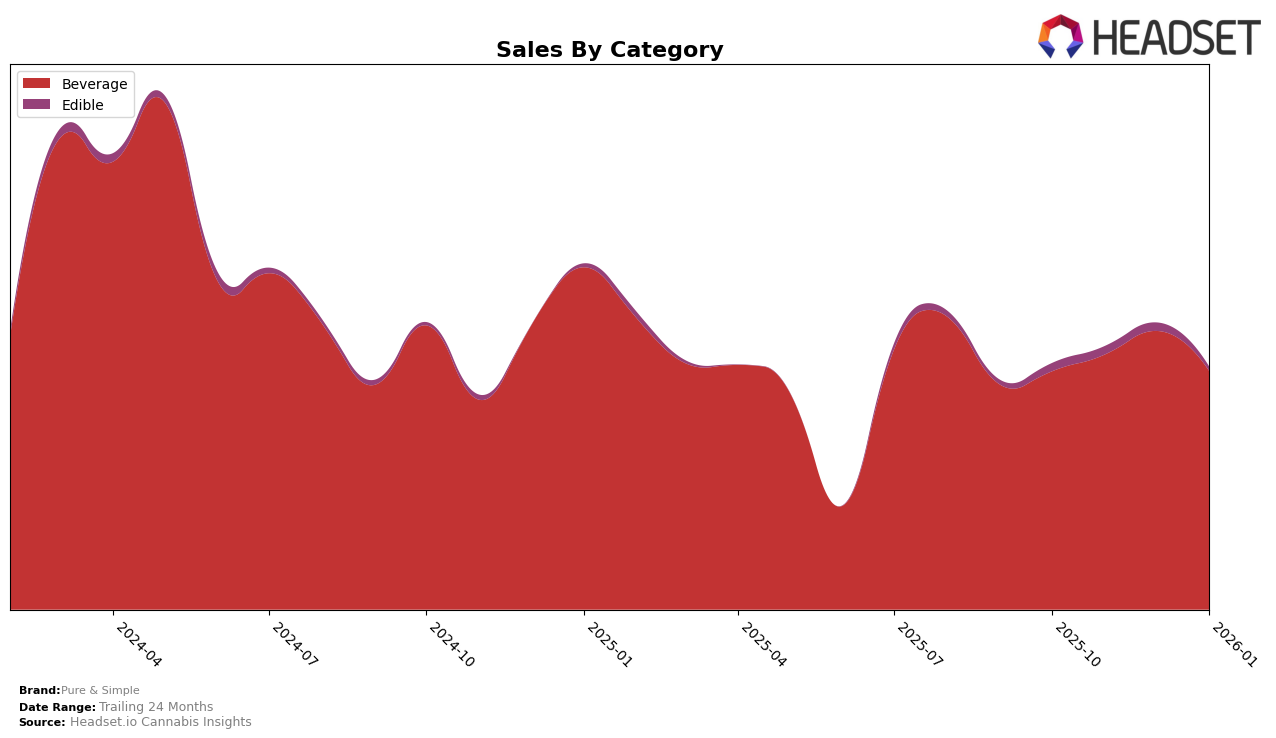

Pure & Simple has shown a consistent presence in the Arizona cannabis beverage market, maintaining a steady ranking within the top 10 over the recent months. Starting at 8th position in October 2025, the brand improved slightly to 7th in November, before settling back to 8th in December and then dropping to 9th in January 2026. This fluctuation suggests a competitive landscape in Arizona's beverage category, where Pure & Simple is holding its ground but faces challenges in climbing higher. The brand's sales figures reflect these movements, with a noticeable peak in December. However, the subsequent decline in January indicates a potential need for strategic adjustments to regain momentum.

In other states and categories, Pure & Simple's absence from the top 30 rankings reveals areas for growth and potential expansion opportunities. The lack of presence in these rankings could signify either a strategic focus on Arizona or challenges in penetrating other markets. Understanding these dynamics and the competitive pressures in different regions could be crucial for stakeholders looking to optimize Pure & Simple's market strategy. The data suggests that while the brand is performing well in Arizona, it might benefit from exploring new markets or enhancing its offerings to gain a foothold in other states and categories.

Competitive Landscape

In the competitive landscape of the Arizona cannabis beverage market, Pure & Simple has experienced fluctuations in its ranking, moving from 8th in October 2025 to 9th by January 2026. This shift is notable as it comes amidst varying performances by competitors. Nebula maintained a relatively stable position, consistently ranking higher than Pure & Simple, though its sales saw a decline from November to January. Meanwhile, Pot Shot re-entered the rankings in December 2025, overtaking Pure & Simple by January 2026, which suggests a resurgence in its market presence. These dynamics indicate that while Pure & Simple has managed to sustain its sales volume, the competitive pressure from brands like Nebula and Pot Shot could be influencing its rank, highlighting the need for strategic adjustments to regain and enhance its market position.

Notable Products

In January 2026, Orange Juice (100mg THC, 8oz) continued its reign as the top-selling product for Pure & Simple, maintaining its number one rank with sales of 337 units. Prickly Pear Lemonade (100mg THC, 8oz) moved up to the second spot, showing a notable increase in sales from previous months. Hibiscus Citrus Juice (100mg THC, 8oz) secured the third position, although its sales slightly decreased compared to December. Just Apple Juice (100mg THC, 8oz) experienced a drop in rank, descending from second place in December to fourth in January. Meanwhile, Apple Fruit Chews 10-Pack (100mg) remained steady at the fifth position, albeit with a significant dip in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.