Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

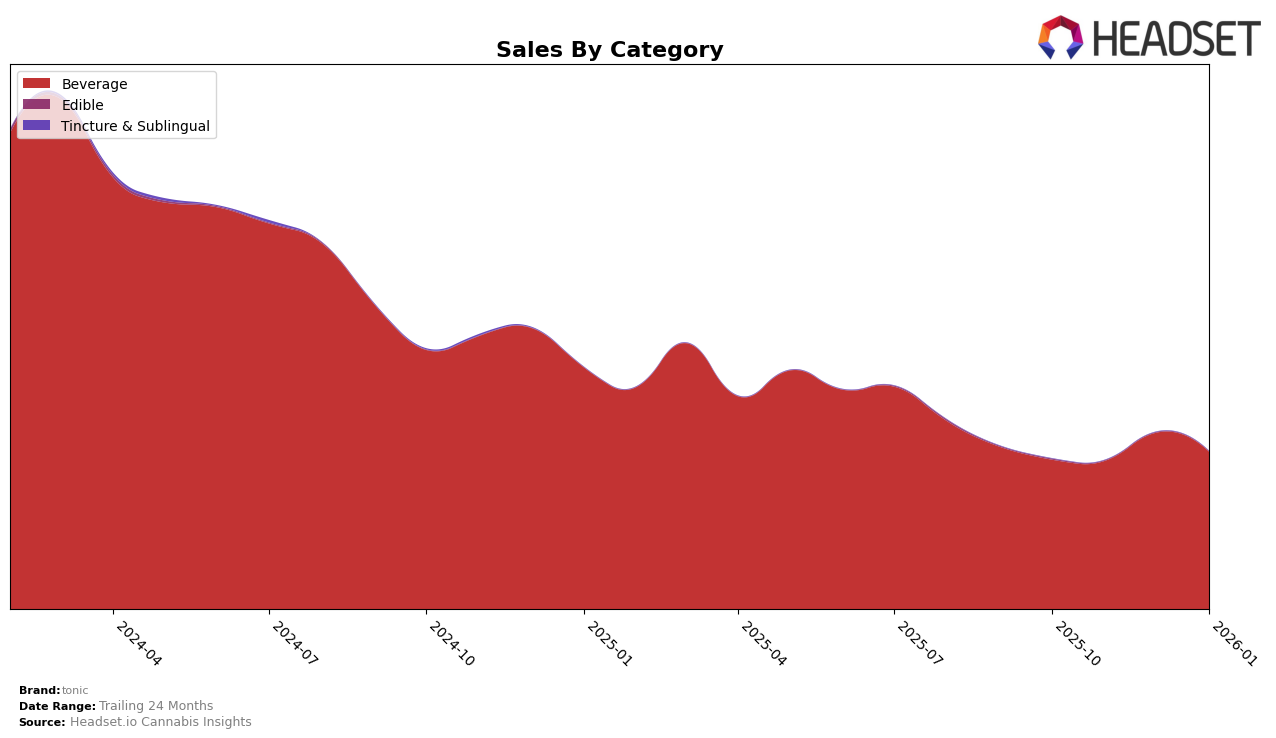

In the state of Illinois, the cannabis brand tonic has demonstrated consistent performance within the Beverage category. Over the span from October 2025 to January 2026, tonic maintained a strong position, consistently ranking 5th after an initial rank of 6th in October. This steady presence in the top 5 indicates a robust market acceptance and possibly a loyal customer base. The sales figures reflect this stability, with a noticeable upward trend from $88,973 in October to $141,866 in January, which suggests effective market strategies or growing consumer demand in this region.

Conversely, in Michigan, tonic's performance in the Beverage category has been more volatile. The brand experienced fluctuations in its rankings, starting at 4th in October and dropping to 7th by January. This variation could imply increased competition or shifting consumer preferences in Michigan. Despite these challenges, tonic's sales figures in Michigan show a notable decline from $120,088 in October to $78,521 in January. This downward trend might indicate areas for improvement in market strategy or product offerings to regain momentum in this competitive landscape.

Competitive Landscape

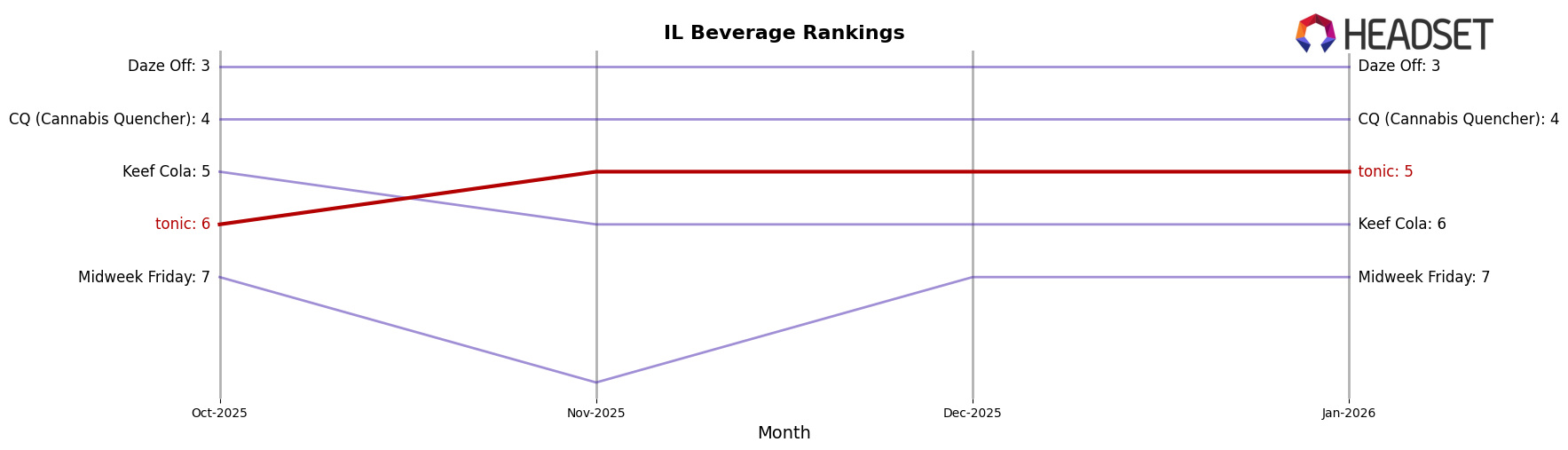

In the Illinois beverage category, tonic has shown a notable upward trajectory in its rankings and sales from October 2025 to January 2026. Initially ranked 6th in October, tonic climbed to 5th place by November and maintained this position through January 2026. This improvement in rank is accompanied by a consistent increase in sales, surpassing brands like Keef Cola, which saw a decline in both rank and sales over the same period. Despite tonic's positive trend, it still trails behind top competitors such as CQ (Cannabis Quencher) and Daze Off, which have maintained stable ranks at 4th and 3rd respectively, with significantly higher sales figures. This competitive landscape indicates that while tonic is gaining momentum, there remains a gap to close with the leading brands in the Illinois beverage market.

Notable Products

In January 2026, the top-performing product from tonic was the CBD/THC 1:1 Tropical Punch Tonic, which climbed to the number one spot from third place in December 2025, achieving sales of 3344. The Raspberry Lemonade Tonic ranked second, dropping from its first-place position in November 2025. Fizz Shortie - CBD/THC 5:1 Lemon Lime Mini Seltzer entered the rankings in January, securing the third position. Mango Pineapple Seltzer maintained a steady presence, moving up one spot to fourth place. The Mandarin Orange Tonic saw a significant drop to fifth place after leading in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.